Instructions For Schedule K (Form 990) - Supplemental Information On Tax-Exempt Bonds - 2016 Page 4

ADVERTISEMENT

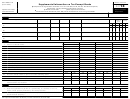

Part III. Private Business

contract provides for compensation for

organization has determined meets the

services rendered with compensation

safe harbor under Rev. Proc. 97-13, or

Use

based, in whole or in part, on a share of

otherwise doesn't result in private

Complete for bond issues listed in rows A

net profits from the operation of the facility.

business use. Similarly, don't include any

through D of Part I, other than listed bond

See Regulations section 1.141-3(b)(4).

use relating to a research agreement

issues that are post-December 31, 2002,

identified on line 3c that the organization

Line 3b. If line 3a was checked “Yes,”

refunding issues which refund

has determined meets the safe harbor

check “Yes” or “No” to indicate if, during

pre-January 1, 2003, bond issues directly

under Rev. Proc. 2007-47, or otherwise

the 12-month period used to report on the

or through a series of refundings. For this

doesn't result in private business use.

bond issue, the organization routinely

purpose, a refunding bond issue also

engaged bond counsel or other outside

Line 5. Enter the average percentage

includes allocation and treatment of bonds

counsel to review any management or

during the year of the property financed by

of a multipurpose issue as a separate

service contracts relating to the financed

the bond issue that was used in an

refunding issue under Regulations section

property.

unrelated trade or business activity (a

1.141-13(d). Complete multiple schedules

private business use) by the

if necessary to account for all outstanding

Line 3c. Check “Yes” or “No” to indicate if

organization, another section 501(c)(3)

tax-exempt bond issues.

any research agreement that may result in

organization, or a state or local

private business use was effective at any

governmental unit. See Regulations

The organization may omit from Part III

time during the year for property financed

section 1.141-3(g)(4). Enter the yearly

information with respect to any bond issue

by the bond issue. For this purpose,

average percentage rounded to the

reported in Part I that is a qualified private

answer “Yes” even if the organization has

nearest tenth of a percentage point (for

activity bond other than a qualified 501(c)

determined that the research agreement

example, 8.9%).

(3) bond. For any other qualified private

meets the safe harbor under Rev. Proc.

activity bonds, in Part VI the organization

2007-47, 2007-29 I.R.B. 108, available at

Line 7. Check “Yes” or “No” to indicate

must identify the issue by reference to

,

whether, as of the end of the 12-month

rows A through D of Part I, as applicable,

and will not result in actual private

period used to report on the bond issue,

and identify the type of qualified private

business use. An agreement by a

the bond issue met the private security or

activity bond.

nongovernmental person to sponsor

payment test of section 141(b)(2), as

research performed by the organization

modified by section 145 to apply to

Line 1. Check “Yes” or “No” to indicate if

can result in private business use of the

qualified 501(c)(3) bonds. Generally, a

the organization was at any time during

property used for the research, based on

qualified 501(c)(3) bond issue will meet

the reporting period a partner in a

all the facts and circumstances. A

the private security or payment test if more

partnership or a member of a limited

research agreement for the financed

than 5% of the payment of principal or

liability company which both owned

property will generally result in private

interest on the bond issue is either made

property that was financed by the bond

business use of that property if the

or secured (directly or indirectly) by

issue and included as partner(s) or

sponsor is treated as the lessee or owner

payments or property used or to be used

member(s) entities other than a section

of financed property for federal income tax

for a private business use. See

501(c)(3) organization.

purposes. See Regulations section

Regulations sections 1.141-4 and 1.145-2.

Line 2. Check “Yes” or “No” to indicate if

1.141-3(b)(6).

Line 8a. Check "Yes" or "No" to indicate

any lease arrangements that may result in

Line 3d. If line 3c was checked “Yes,”

whether the owner of any of the financed

private business use were effective at

check “Yes” or “No” to indicate if, during

property sold or transferred the property to

any time during the year with respect to

the 12-month period used to report on the

an entity other than a state or local

property financed by the bond issue. The

bond issue, the organization routinely

governmental unit or another section

lease of financed property to a

engaged bond counsel or other outside

501(c)(3) organization. For this purpose,

nongovernmental person other than a

counsel to review any research

report sales and transfers on a cumulative

section 501(c)(3) organization is generally

agreements relating to the financed

basis since the issuance of the bonds.

private business use. Lease arrangements

property.

that constitute unrelated trade or business

Line 8b. If line 8a was checked "Yes,"

of the lessor, or that are for an unrelated

Line 4. Enter the average percentage

report the percentage of property sold or

trade or business of a section 501(c)(3)

during the year of the property financed by

transferred, including prior transfers on a

organization lessee, may also result in

the bond issue that was used in a private

cumulative basis, since the issuance of

private business use. See Regulations

business use by a nongovernmental

the bonds.

sections 1.141-3(b)(3) and 1.145-2(b)(1).

person other than a section 501(c)(3)

Line 8c. If line 8a was checked "Yes,"

organization. See Regulations section

Line 3a. Check “Yes” or “No” to indicate if

state whether the organization took any

1.141-3(g)(4). The average percentage is

any management or service contract that

remedial actions under the applicable

determined by comparing (i) the amount of

may result in private business use was

regulations with respect to any

private business use (see Definitions,

effective at any time during the year with

nonqualified bonds that may have resulted

earlier) during the year to (ii) the total

respect to property financed by the bond

from the transfer.

amount of private business use and use

issue. For this purpose, answer “Yes”

that isn't private business use during that

Line 9. Check "Yes" or "No" to indicate

even if the organization has determined

whether the organization has established

year. Don't include costs of issuance

that the management or service contract

reported in Part II in the amount of

written procedures to ensure timely

meets the safe harbor under Rev. Proc.

property used in a private business use

remedial action with respect to all

97-13, 1997-1 C.B. 632, and will not result

(clause (i) of the preceding sentence), but

nonqualified bonds in accordance with

in actual private business use. A

do include such costs in the total amount

Regulations sections 1.141-12 and

management or service contract for the

1.145-2 or other additional remedial

of use (clause (ii)). Enter the yearly

financed property can result in private

average percentage to the nearest tenth of

actions authorized by the Commissioner

business use of the property, based on all

a percentage point (for example, 8.9%).

under Regulations section 1.141-12(h).

facts and circumstances. A management

For this purpose, don't include any use

Answer "Yes" only if the procedures

or service contract for the financed

applied to the bond issue during the

relating to either a management or service

property generally results in private

contract identified on line 3a that the

business use of that property if the

2016 Instructions for Schedule K (Form 990)

-4-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5