Instructions For Schedule K (Form 990) - Supplemental Information On Tax-Exempt Bonds - 2016 Page 5

ADVERTISEMENT

12-month period used to report on the

Regulations section 1.148-4(h). If the

bond issue during the 12-month period are

bond issue.

answer to line 4a is “Yes”:

used to report on the bond issue.

Enter the name of the provider of the

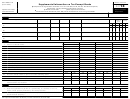

Part IV. Arbitrage

Part V. Procedures To

hedge on line 4b;

Undertake Corrective

Enter the term of the hedge rounded to

Complete for each bond issue listed in

the nearest tenth of a year (for example,

rows A through D of Part I. Complete

Action

2.4 years) on line 4c;

multiple schedules if necessary to account

Regulations section 1.141-12 and other

Enter “Yes” or “No” on line 4d to

for all outstanding tax-exempt bond

available remedies for noncompliance

indicate if, as a result of the hedge,

issues.

may not cover all violations of the

variable yield bonds will be treated as

Line 1. Under section 148(f), interest on a

requirements of section 145 and other

fixed yield bonds (superintegration of the

state or local bond isn't tax exempt unless

applicable requirements for tax-exempt

hedge). See Regulations section

the issuer of the bond rebates to the

bonds benefiting the organization. Certain

1.148-4(h)(4); and

United States arbitrage profits earned

remedial provisions also require that the

Enter “Yes” or “No” on line 4e to

from investing proceeds of the bond in

noncompliance be identified and remedial

indicate if the hedge was terminated prior

higher yielding nonpurpose investments.

action taken within a limited time after the

to its scheduled termination date.

Issuers of tax-exempt bonds and any

deliberate action or other cause of the

Lines 5a through 5d. Check “Yes” or

other bonds subject to the provisions of

violation. In instances where applicable

“No” on line 5a to indicate if any gross

section 148 must use Form 8038-T,

remedial provisions aren't available under

proceeds of the bond issue were

Arbitrage Rebate, Yield Reduction and

the regulations, an issuer of bonds may

invested in a guaranteed investment

Penalty in Lieu of Arbitrage Rebate, to

request a voluntary closing agreement to

contract (GIC). A GIC includes any

make arbitrage rebate and related

address the violation under the Tax

nonpurpose investment that has

payments. Generally, rebate payments

Exempt Bonds Voluntary Closing

specifically negotiated withdrawal or

are due no later than 60 days after every

Agreement Program described under

reinvestment provisions and a specifically

fifth anniversary of the issue date and the

Notice 2008-31, 2008-11 I.R.B. 592.

negotiated interest rate, including

final payment of the bonds. Check “Yes”

Check “Yes” or “No” to indicate whether

“negotiations” through requests for bids. It

or “No” to indicate whether the issuer has

the organization has established written

also includes any agreement to supply

filed the Form 8038-T that would have

procedures to ensure timely identification

investments on two or more dates (for

been most recently due.

of violations of federal tax requirements

example, a forward supply contract). If the

and timely correction of any identified

Lines 2a through 2c. If the issuer hasn't

answer on line 5a is “Yes”:

violation(s) through use of the voluntary

filed Form 8038-T for the most recent

Enter the name of the provider of the

closing agreement program if

computation date for which filing would be

GIC on line 5b,

self-remediation isn't available under

required if rebate were due, check “Yes”

Enter the term of the GIC rounded to the

applicable regulations. Answer “Yes” only

or “No” to indicate whether any of the

nearest tenth of a year on line 5c, and

if the procedures applied during the

explanations in lines 2a through 2c apply.

Enter “Yes” or “No” on line 5d to

12-month period are used to report on the

If line 2c is checked “Yes,” use Part VI to

indicate if the regulatory safe harbor for

bond issue.

provide the date of the rebate computation

establishing fair market value provided in

showing that no rebate was due for the

Part VI. Supplemental

Regulations section 1.148-5(d)(6)(iii) was

applicable computation date.

satisfied.

Information

Line 3. Check “Yes” or “No” to indicate if

Line 6. Check “Yes” or “No” to indicate if

the bond issue is a variable rate issue. A

Use Part VI to provide the narrative

any gross proceeds were invested

variable rate issue is an issue containing a

explanations required, if applicable, to

beyond a temporary period (for example,

bond with a yield not fixed and

supplement Part I, columns (e) and (f); to

the 3-year temporary period applicable to

determinable on the issue date.

provide additional information or

proceeds spent on expenditures for

comments relating to the reporting of

Lines 4a through 4e. In general,

capital projects, or the 13-month

liabilities by related organizations; and to

payments made or received by a

temporary period applicable to proceeds

describe certain assumptions which are

governmental issuer or borrower of

spent on working capital expenditures), or

used to complete Schedule K (Form 990)

bond proceeds under a qualified hedge

if any gross proceeds were invested in a

when the information provided isn't fully

are taken into account to determine the

reserve or replacement fund in an amount

supported by existing records. Also use

yield on the bond issue. A qualified

exceeding applicable limits. See

Part VI to supplement responses to

hedge can be entered into before, at the

Regulations sections 1.148-2(e) and (f).

questions on Schedule K (Form 990).

same time as, or after the date of issue.

Line 7. Check “Yes” or “No” to indicate if

Identify the specific part and line number

Check “Yes” or “No” on line 4a to indicate

the organization has established written

that the response supports, in the order in

if the organization or the governmental

which the responses appear on

procedures to monitor compliance with the

issuer has entered into a qualified hedge

arbitrage, yield restriction, and rebate

Schedule K (Form 990). Part VI can be

and identified it on the governmental

requirements of section 148. Answer

duplicated if more space is needed.

issuer's books and records. See

“Yes” only if the procedures applied to the

2016 Instructions for Schedule K (Form 990)

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5