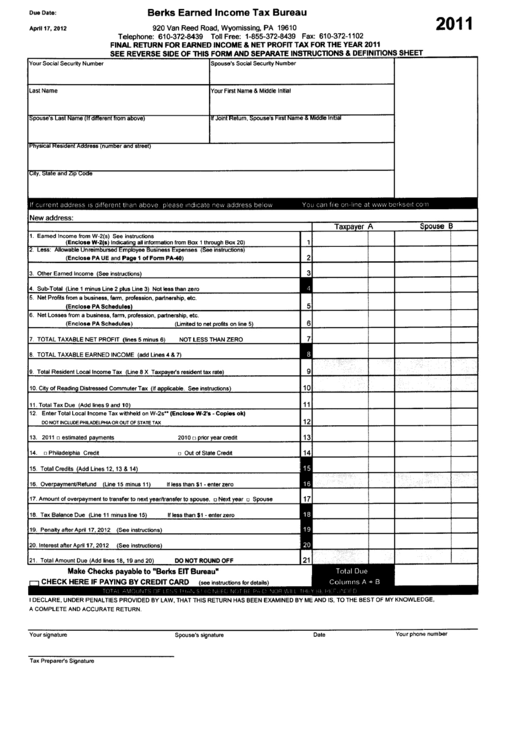

Final Return For Earned Income & Net Profit Tax For The Year 2011 - Berks Earned Income Tax Bureau

ADVERTISEMENT

Due Date:

Berks Earned Income Tax Bureau

April

17, 2012

920 Van Reed Road, Wyomissing, PA 19610

Telephone: 610-372-8439 Toll Free: 1-855-372-8439 Fax: 610-372-1102

FINAL RETURN FOR EARNED INCOME & NET PROFIT TAX FOR THE YEAR 2011

SEE REVERSE SIDE OF THIS FORM AND SEPARATE INSTRUCTIONS & DEFINITONS SHEET

2011

Your Social Securi Number

Spouse's Social Securi Number

Last Name

Your First Name & Middle In~ial

i::pouse s Last Name (II amerent from aDOVe)

II Joint Ketum, ::pouse s i-irst Name & Miaaie iniiiai

i

Physicai Resiaem Aaaress inumoer ana street)

Il;rty, ::tate ana Lip voae

If current address is different Uian above please indicate new address below

You can file on-line at www berkseit CO'll

New

address:

Tax a er A

Souse El

1. Eamed Income frm W-2(s) See instructions

(Enclose W-2(s) Indicating all information from Box 1 through Box 20)

2. Less: Allowable Unrembursed Employee Business Expenses ( instructions)

(Enclose PA UE and Page 1 of Form PA-4)

2

3

3. Other Eamed Income (See instructions

7. TOTAL TAXABLE NET PROFIT (lines 5 minus 6)

NOT LESS THAN ZERO

4. Sub-Total (line 1 minus line 2 plus line 3) Not less than zero

5. Net Profrts from a business, farm, proession, partnership, etc.

Enclose PA Schedules

6. Net Losses from a business, farm, profession, partnership, etc.

(Enclose PA Schedules) (lim~ed to net profrts on line 5)

8. TOTAL TAXABLE EARNED INCOME (add lines 4 & 7)

9. Total Resident Locl

Income Tax (line 8 X Tax a ets resident tax rate)

9

Distressed Commuter Tax (If a licable. See instructions)

10

11. Total Tax Due Add lines 9 and 10

12. Enter Total Local

Income Tax w~hheld on W-2s- (Enclose W-2's - Copies ok)

DO NOT INCLUDE PHILADELPHIA OR OUT OF STATE TAX

11

12

13. 2011 0 estimated payments

201 0 0 prior year cred~

13

14. 0 Philadelphia Cred~

o Out of State Cred~

14

18. Tax Balance Due line 11 minus line 15)

If less than $1 - enter zero

15. Total Cred~s Add lines 12, 13 & 14

16. Overpayment/Refund (line 15 minus 11)

If less than $1 - enter zero

17. Amount of overpaymem to transfer to next yearltransfer to spouse. 0 Next year 0 Spouse

21. Total Amount Due Add lines 18, 19 and 20 DO NOT ROUND OFF

Make Checks payable to "Berks EIT Bureau"

CHECK HERE IF PAYING BY CREDIT CARD (see instructions for details)

I DECLARE, UNDER PENAL TIES PROVIDED BY LAW, THAT THIS RETURN HAS BEEN EXAMINED BY ME AND IS, TO THE BEST OF MY KNOWLEDGE,

A COMPLETE AND ACCURATE RETURN.

Your signature

Spouse's signature

Date

Your phono number

Tax Preparets Signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2