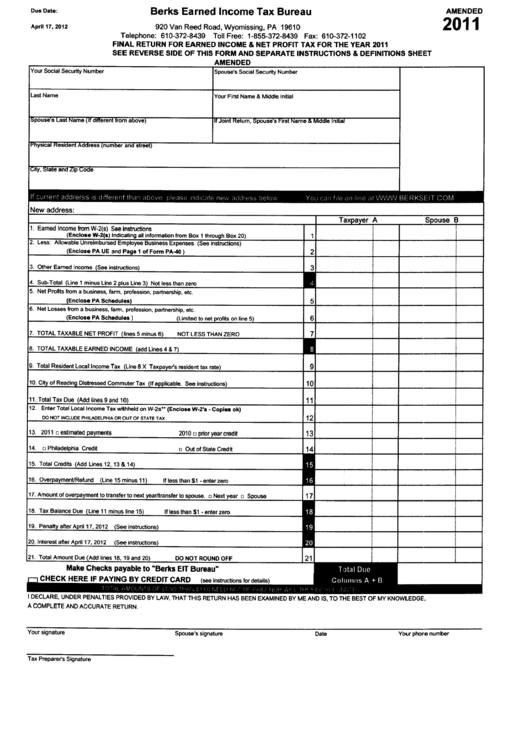

Final Return For Earned Income And Net Profit Tax For The Year 2011 - Berks Earned Income Tax Bureau

ADVERTISEMENT

Due Date:

Berks Earned Income Tax Bureau

AMENDED

2011

April

17, 2012

920 Van Reed Road, Wyomissing, PA 19610

Telephone: 610-372-8439 Toll Free: 1-855-372-8439 Fax: 610-372-1102

FINAL RETURN FOR EARNED INCOME & NET PROFIT TAX FOR THE YEAR 2011

SEE REVERSE SIDE OF THIS FORM AND SEPARATE INSTRUCTIONS & DEFINITIONS SHEET

AMENDED

Your Social Security Number

Spouse's Social Securi Number

Last

Name

Your First Name & Middle Initial

I

Spouse s Last Name (II allerent irom aoove)

f Joint Return, Spouse s First Name & Middle Initial

IPhyslcal Resident Aaaress (numoer ana stree)

I City, Stale ana Lip i;ooe

If CUi rent addrerss IS different tlian above pleas", indicite neii cliUlt:SS below

You caii file all Iiiie cit WWW BERKSLIT COM

New address:

Tax a er A

Souse e

1. Earned Income frm W-2(s) See instructions

(Enclose W-2(s) Indicating all information from Box 1 through Box 20)

2. Less: Allowable Unreimbursed Employee Business Expenses (See instructions)

(Enclose PA UE and Page 1 of Form PA-4)

2

3

3. Other Earned Income See instructions)

4. Sub-Total (Line 1 minus Line 2 plus Line 3) Not less than zero

5. Net Profits frm a business, farm, profession, partnership, etc.

(Enclose PA Schedules)

6. Net Losss frm a business, farm, profession, partnership, etc.

(Enclose PA Schedules) Limited to net profits on line 5)

5

7. TOTAL TAXBLE NET PROFIT (lines 5 minus 6)

NOT LESS THAN ZERO

6

7

8. TOTAL TAXBLE EARNED INCOME add Lines 4 & 7)

9. Total Resident Local

Income Tax (Line 8 X Taxpa ets residerr tax rate)

9

If applicable. See instructions

10

11. Total Tax Due (Add lines 9 and 10

12. Enter Total Locl

Income Tax withheld on W-2s" (Enclose W.2's - Copies ok)

DO NOT INCLUDE PHILAELPHIA OR OUT OF STATE TAX

11

13. 2011 0 estimated payments

2010 0 prior year credit

12

13

14

14. 0 Philadelphia Credit

o Out of State Creit

21. Total Amount Due (Add lines 18,19 and 20) DO NOT ROUND OFF

Make Checks payable to "Berks EIT Bureau"

CHECK HERE IF PAYING BY CREDIT CARD (see instructions for details)

15. Total Creits (Add Lines 12,13 & 14)

16. Overpayment/Refund Line 15 minus 11)

If less than $1 - errer zero

17. Amount of overpaymerr to transfer to next year/transfer to spouse. 0 Next year 0 Spouse

18. Tax Balance Due (Line 11 minus line 15)

If less than $1 - errer zero

19. Pena after April

17, 2012 (See instructions)

20. Interest after April

17, 2012 (See instructions)

I DECLARE, UNDER PENALTIES PROVIDED BY LAW, THAT

THIS RETURN HAS BEEN EXAMINED BY

ME AND IS, TO

THE BEST

OF MY KNOWLEDGE,

A COMPLETE AND ACCURATE RETURN.

Your signature

Spouse's signature

Date

Your phone number

Tax Preparets Signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2