Final Earned Income And Net Profits Tax Return - Southwest Regional Tax Bureau

ADVERTISEMENT

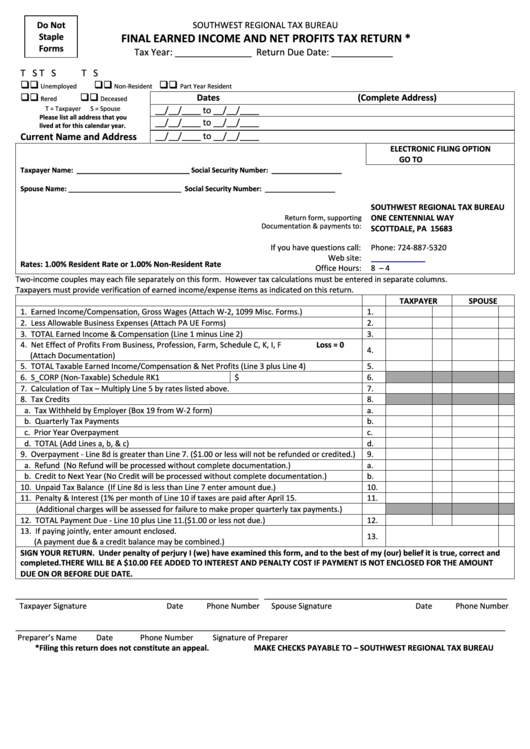

Do Not

SOUTHWEST REGIONAL TAX BUREAU

Staple

FINAL EARNED INCOME AND NET PROFITS TAX RETURN *

Forms

Tax Year: _______________ Return Due Date: ____________

T S

T S

T S

Unemployed

Non-Resident

Part Year Resident

Dates

(Complete Address)

Retired

Deceased

T = Taxpayer

S = Spouse

__/__/____ to __/__/____

Please list all address that you

__/__/____ to __/__/____

lived at for this calendar year.

Current Name and Address

__/__/____ to __/__/____

ELECTRONIC FILING OPTION

GO TO

Taxpayer Name: _____________________________

Social Security Number: __________________

Spouse Name:

_____________________________

Social Security Number: __________________

SOUTHWEST REGIONAL TAX BUREAU

Return form, supporting

ONE CENTENNIAL WAY

Documentation & payments to:

SCOTTDALE, PA 15683

If you have questions call:

Phone: 724-887-5320

Web site:

Rates: 1.00% Resident Rate or 1.00% Non-Resident Rate

Office Hours:

8 a.m. – 4 p.m.

Two-income couples may each file separately on this form. However tax calculations must be entered in separate columns.

Taxpayers must provide verification of earned income/expense items as indicated on this return.

TAXPAYER

SPOUSE

1. Earned Income/Compensation, Gross Wages (Attach W-2, 1099 Misc. Forms.)

1.

2. Less Allowable Business Expenses (Attach PA UE Forms)

2.

3. TOTAL Earned Income & Compensation (Line 1 minus Line 2)

3.

4. Net Effect of Profits From Business, Profession, Farm, Schedule C, K, I, F

Loss = 0

4.

(Attach Documentation)

5. TOTAL Taxable Earned Income/Compensation & Net Profits (Line 3 plus Line 4)

5.

6. S_CORP (Non-Taxable) Schedule RK1

$

6.

7. Calculation of Tax – Multiply Line 5 by rates listed above.

7.

8. Tax Credits

8.

a. Tax Withheld by Employer (Box 19 from W-2 form)

a.

b. Quarterly Tax Payments

b.

c. Prior Year Overpayment

c.

d. TOTAL (Add Lines a, b, & c)

d.

9. Overpayment - Line 8d is greater than Line 7. ($1.00 or less will not be refunded or credited.)

9.

a. Refund (No Refund will be processed without complete documentation.)

a.

b. Credit to Next Year (No Credit will be processed without complete documentation.)

b.

10. Unpaid Tax Balance (If Line 8d is less than Line 7 enter amount due.)

10.

11. Penalty & Interest (1% per month of Line 10 if taxes are paid after April 15.

11.

(Additional charges will be assessed for failure to make proper quarterly tax payments.)

12. TOTAL Payment Due - Line 10 plus Line 11. ($1.00 or less not due.)

12.

13. If paying jointly, enter amount enclosed.

13.

(A payment due & a credit balance may be combined.)

SIGN YOUR RETURN. Under penalty of perjury I (we) have examined this form, and to the best of my (our) belief it is true, correct and

completed. THERE WILL BE A $10.00 FEE ADDED TO INTEREST AND PENALTY COST IF PAYMENT IS NOT ENCLOSED FOR THE AMOUNT

DUE ON OR BEFORE DUE DATE.

_________________________________________________________ _________________________________________________________

Taxpayer Signature

Date

Phone Number

Spouse Signature

Date

Phone Number

___________________________________________________________________________________________________________________

Preparer’s Name

Date

Phone Number

Signature of Preparer

*Filing this return does not constitute an appeal.

MAKE CHECKS PAYABLE TO – SOUTHWEST REGIONAL TAX BUREAU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1