Instructions For Connecticut Individual Use Tax Form Op-186 - 1998

ADVERTISEMENT

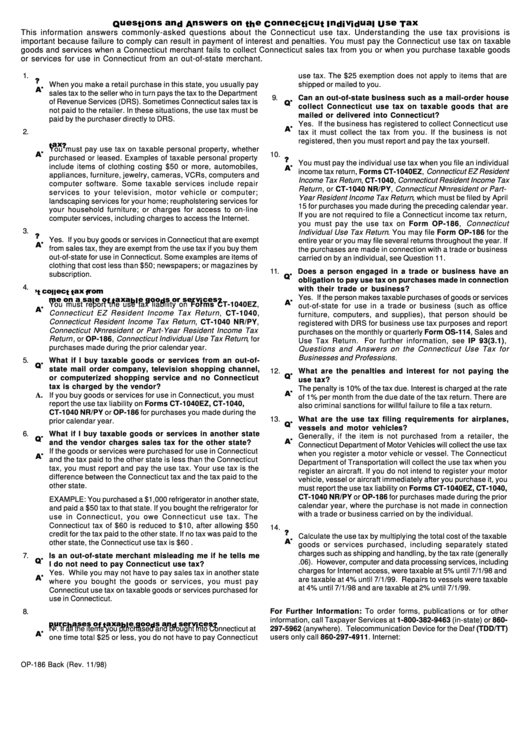

This information answers commonly-asked questions about the Connecticut use tax. Understanding the use tax provisions is

important because failure to comply can result in payment of interest and penalties. You must pay the Connecticut use tax on taxable

goods and services when a Connecticut merchant fails to collect Connecticut sales tax from you or when you purchase taxable goods

or services for use in Connecticut from an out-of-state merchant.

1.

use tax. The $25 exemption does not apply to items that are

When you make a retail purchase in this state, you usually pay

shipped or mailed to you.

sales tax to the seller who in turn pays the tax to the Department

9.

Can an out-of-state business such as a mail-order house

of Revenue Services (DRS). Sometimes Connecticut sales tax is

collect Connecticut use tax on taxable goods that are

not paid to the retailer. In these situations, the use tax must be

mailed or delivered into Connecticut?

paid by the purchaser directly to DRS.

Yes. If the business has registered to collect Connecticut use

2.

tax it must collect the tax from you. If the business is not

registered, then you must report and pay the tax yourself.

You must pay use tax on taxable personal property, whether

10.

purchased or leased. Examples of taxable personal property

You must pay the individual use tax when you file an individual

include items of clothing costing $50 or more, automobiles,

income tax return, Forms CT-1040EZ, Connecticut EZ Resident

appliances, furniture, jewelry, cameras, VCRs, computers and

Income Tax Return , CT-1040, Connecticut Resident Income Tax

computer software. Some taxable services include repair

Return , or CT-1040 NR/PY, Connecticut Nonresident or Part-

services to your television, motor vehicle or computer;

Year Resident Income Tax Return , which must be filed by April

landscaping services for your home; reupholstering services for

15 for purchases you made during the preceding calendar year.

your household furniture; or charges for access to on-line

If you are not required to file a Connecticut income tax return,

computer services, including charges to access the Internet.

you must pay the use tax on Form OP-186, Connecticut

3.

Individual Use Tax Return . You may file Form OP-186 for the

Yes. If you buy goods or services in Connecticut that are exempt

entire year or you may file several returns throughout the year. If

from sales tax, they are exempt from the use tax if you buy them

the purchases are made in connection with a trade or business

out-of-state for use in Connecticut. Some examples are items of

carried on by an individual, see Question 11.

clothing that cost less than $50; newspapers; or magazines by

11.

Does a person engaged in a trade or business have an

subscription.

obligation to pay use tax on purchases made in connection

4.

with their trade or business?

Yes. If the person makes taxable purchases of goods or services

You must report the use tax liability on Forms CT-1040EZ,

out-of-state for use in a trade or business (such as office

Connecticut EZ Resident Income Tax Return , CT-1040,

furniture, computers, and supplies), that person should be

Connecticut Resident Income Tax Return , CT-1040 NR/PY,

registered with DRS for business use tax purposes and report

Connecticut Nonresident or Part-Year Resident Income Tax

purchases on the monthly or quarterly Form OS-114, Sales and

Return , or OP-186, Connecticut Individual Use Tax Return , for

Use Tax Return. For further information, see IP 93(3.1),

purchases made during the prior calendar year.

Questions and Answers on the Connecticut Use Tax for

Businesses and Professions .

5.

What if I buy taxable goods or services from an out-of-

state mail order company, television shopping channel,

12.

What are the penalties and interest for not paying the

or computerized shopping service and no Connecticut

use tax?

tax is charged by the vendor?

The penalty is 10% of the tax due. Interest is charged at the rate

A. If you buy goods or services for use in Connecticut, you must

of 1% per month from the due date of the tax return. There are

report the use tax liability on Forms CT-1040EZ, CT-1040,

also criminal sanctions for willful failure to file a tax return.

CT-1040 NR/PY or OP-186 for purchases you made during the

13.

What are the use tax filing requirements for airplanes,

prior calendar year.

vessels and motor vehicles?

6.

What if I buy taxable goods or services in another state

Generally, if the item is not purchased from a retailer, the

and the vendor charges sales tax for the other state?

Connecticut Department of Motor Vehicles will collect the use tax

If the goods or services were purchased for use in Connecticut

when you register a motor vehicle or vessel. The Connecticut

and the tax paid to the other state is less than the Connecticut

Department of Transportation will collect the use tax when you

tax, you must report and pay the use tax. Your use tax is the

register an aircraft. If you do not intend to register your motor

difference between the Connecticut tax and the tax paid to the

vehicle, vessel or aircraft immediately after you purchase it, you

other state.

must report the use tax liability on Forms CT-1040EZ, CT-1040,

CT-1040 NR/PY or OP-186 for purchases made during the prior

EXAMPLE: You purchased a $1,000 refrigerator in another state,

calendar year, where the purchase is not made in connection

and paid a $50 tax to that state. If you bought the refrigerator for

with a trade or business carried on by the individual.

use in Connecticut, you owe Connecticut use tax. The

Connecticut tax of $60 is reduced to $10, after allowing $50

14.

credit for the tax paid to the other state. If no tax was paid to the

Calculate the use tax by multiplying the total cost of the taxable

other state, the Connecticut use tax is $60 .

goods or services purchased, including separately stated

charges such as shipping and handling, by the tax rate (generally

7.

Is an out-of-state merchant misleading me if he tells me

.06). However, computer and data processing services, including

I do not need to pay Connecticut use tax?

charges for Internet access, were taxable at 5% until 7/1/98 and

Yes. While you may not have to pay sales tax in another state

are taxable at 4% until 7/1/99. Repairs to vessels were taxable

where you bought the goods or services, you must pay

at 4% until 7/1/98 and are taxable at 2% until 7/1/99.

Connecticut use tax on taxable goods or services purchased for

use in Connecticut.

For Further Information: To order forms, publications or for other

8.

information, call Taxpayer Services at 1-800-382-9463 (in-state) or 860-

No. If all the items you purchased and brought into Connecticut at

297-5962 (anywhere). Telecommunication Device for the Deaf (TDD/TT)

users only call 860-297-4911. Internet:

one time total $25 or less, you do not have to pay Connecticut

OP-186 Back (Rev. 11/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1