Form Rpd-41294 - Liquor Excise Tax Alcoholic Beverage Inventory And Deduction Report Page 2

ADVERTISEMENT

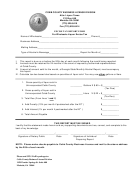

STATE OF NEW MEXICO

RPD-41294

Rev. 07/2008

TAXATION AND REVENUE DEPARTMENT

Page 1 of 2

ALCOHOLIC BEVERAGE INVENTORY AND DEDUCTION REPORT INSTRUCTIONS

INVENTORY: Complete the inventory information on lines 1 through 9. Ensure

Effective July 1, 2008, new legislation reorganizes the definition section

that the beginning inventory during a month reconciles with the ending inventory

of the Liquor Excise Tax Act and adds a definition of “winegrower”. It also

of the prior month report.

increases, from fewer than 560,000 liters to fewer than 950,000 liters, the

amount of production that qualifies a winegrower as a “small winegrower”.

Transfers in and transfers out refer to:

The reduction in the excise tax rate on wine from $.45 per liter to $.10 per

•

inventory that is moved between locations or between businesses in non-

liter is retained for the first 80,000 liters sold in New Mexico by a small

sale transactions, and

winegrower, but the limit on such sales over 80,000 liters that qualify for

•

wine that is transferred to a winegrower from another winegrower for process-

the reduced rate of $.20 per liter is increased from 560,000 liters to 950,000

ing, bottling or storage and subsequent return to the transferrer.

liters. The law also adds new rules related to the tax liability on wine trans-

Example 1. Wholesaler A transfers inventory from its warehouse to the warehouse

fers between winegrowers and between winegrowers and wholesalers.

of wholesaler B in a non-sale transaction. By agreement, the inventory will be

turned over to wholesaler B for re-sale, and wholesaler B assumes the responsibil-

WHO MUST FILE: Wholesalers who sell alcoholic beverages must file Form

ity to pay the liquor excise tax. Wholesaler A reports the non-sale "transfer out" of

RPD-41129, Liquor Excise Tax Return, and pay liquor excise tax on alcoholic

inventory, and wholesaler B reports the non-sale "transfer in" to inventory.

beverages sold. The liquor excise tax and return are due on or before the 25th

Example 2. In the transfer in and transfer out rows, winegrower A, who is also a

day of the month following the close of the calendar month in which alcoholic

wholesaler, may report the liters of wine transferred to the winegrower from another

beverages were sold. When filing and paying liquor excise tax, the wholesaler

winegrower (winegrower B) for processing, bottling or storage and subsequent

must also complete and attach Form RPD-41294, Alcoholic Beverage Inventory

return to winegrower B. When winegrower A receives the wine, a "transfer in" is

and Deduction Report.

recorded. When the wine is returned to the initial winegrower (winegrower B),

winegrower A records a "transfer out".

Note: Retailers located in McKinley County must also file Form RPD-41277,

Local Liquor Excise Tax Return, and pay the local liquor excise tax.

DEDUCTIONS/EXEMPTIONS: Certain sales of alcoholic beverages subject to

the liquor excise tax are deductible, exempt, or a credit is allowed. On lines 10

HOW TO FILE: Complete this form and attach it to Form RPD-41129, Liquor

through 14, report the gallons or liters included in sales (Line 5) that qualify for

Excise Tax Return. Make the check or money order payable to New Mexico

a deduction, exemption or a credit. The allowable deductions, exemptions and

Taxation and Revenue Department. Mail the payment and all required docu-

credits are subtracted from total sales in Column B on Form RPD-41129, Liquor

mentation to Taxation and Revenue Department, P. O. Box 25123, Santa Fe,

Excise Tax Return.

NM 87504-5123.

Line 10 For each type of alcoholic beverage, enter the gallons or liters sold during

HOW TO COMPLETE THIS FORM: Enter the name of the reporting whole-

the report period to or by an instrumentality of the Armed Forces of the

saler, the wholesaler's federal employer identification number (FEIN), and the

United States engaged in resale activities.

11-digit CRS identification number (CRS). Enter the report period (calendar

Line 11 For each type of alcoholic beverage, enter the gallons or liters sold and

month) beginning with the first day of the month and ending on the last day of

shipped to a person in another state.

the month. Use the following instructions to complete the report. Sign and date

Line 12 For each type of alcoholic beverage, enter the gallons or liters to which

the report.

the liquor excise tax was previously paid.

Line 13 For each type of alcoholic beverage, enter the gallons or liters included

INSTRUCTIONS: For each type of alcoholic beverage listed, complete the

in line 5 that were destroyed in shipment, spoiled, or otherwise damaged

columns according to the instructions below. You must enter the numbers in

and made unfit for sale or consumption. Note: If the liquor excise tax

terms of gallons or liters according to the unit of measure indicated for each

was paid in a prior period on the destroyed, spoiled or damaged product,

type of alcoholic beverage.

you may claim a refund of the tax paid by submitting Form RPD-41071,

Application for Tax Refund, and attaching proof that the product was

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3