Form Rpd-41294 - Liquor Excise Tax Alcoholic Beverage Inventory And Deduction Report Page 3

ADVERTISEMENT

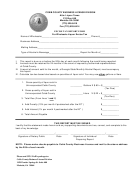

STATE OF NEW MEXICO

RPD-41294

Rev. 07/2008

TAXATION AND REVENUE DEPARTMENT

Page 2 of 2

ALCOHOLIC BEVERAGE INVENTORY AND DEDUCTION REPORT INSTRUCTIONS

spoiled, broken or damaged and returned.

•

“Fortified wine” means wine containing more than fourteen percent alcohol

Line 14 Enter the sum of lines 10 through 13.

by volume when bottled or packaged by the manufacturer, but "fortified wine" does

not include:

Wine Transfers Between Winegrowers and Between Winegrowers and

1) wine that is sealed or capped by cork closure and aged two years or

Wholesalers. Effective July 1, 2008.

more;

•

A winegrower may deduct the liters of wine transferred to a winegrower from

2) wine that contains more than fourteen percent alcohol by volume solely

another winegrower for processing, bottling or storage and subsequent return

as a result of the natural fermentation process and that has not been produced

to the transferrer from the units of wine subject to the liquor excise tax on the

with the addition of wine spirits, brandy or alcohol, or

licensed premises of the winegrower. The volume of wine transferred from

3) vermouth and sherry.

the initial winegrower to the second winegrower remains a tax liability of the

initial winegrower unless the second winegrower uses or resells the wine

•

“Microbrewer” means any person who produces fewer than five thou-

transferred. Then the second winegrower assumes the liability for the liquor

sand barrels of beer in a calendar year.

excise tax due.

•

A transfer of wine from a winegrower to a wholesaler for distribution of the

•

wine, transfers the liability for payment of the liquor excise tax to the wholesaler

"Person" includes, to the extent permitted by law, a federal, state or other

upon the sale of the wine by the wholesaler.

governmental unit or subdivision or an agency, department, institution or instru-

mentality thereof.

Important Definitions as used in the Liquor Excise Tax Act (Sections 7-17-1

through 7-17-12 NMSA 1978):

•

"Winegrower" means a person licensed pursuant to Section 60-6A-11

•

"Alcoholic beverages" means distilled or rectified spirits, potable alcohol,

NMSA 1978.

brandy, whiskey, rum, gin, aromatic bitters or any similar beverage, including

blended or fermented beverages, dilutions or mixtures of one or more of the

•

“Small winegrower” means a winegrower who produces fewer than nine

foregoing containing more than one-half of one percent alcohol by volume, but

hundred fifty thousand liters of wine in a year.

"alcoholic beverages" does not include medicinal bitters.

•

“Spirituous liquors” means alcoholic beverages, except fermented bever-

•

“Beer” means an alcoholic beverage obtained by the fermentation of

ages such as wine, beer, cider and ale.

any infusion or decoction of barley, malt and hops or other cereals in water and

includes porter, beer, ale and stout.

•

"Wholesaler" means a person holding a license issued under Section

60-6A-1 NMSA 1978 or a person selling alcoholic beverages that were not pur-

•

chased from a person holding a license issued under Section 60-6A-11 NMSA

“Cider” means an alcoholic beverage made from the normal alcoholic

1978.

fermentation of the juice of sound, ripe apples that contains not less than one-half

of one percent of alcohol by volume and not more than seven percent of alcohol

•

by volume.

“Wine” means an alcoholic beverage other than cider that is obtained by

the fermentation of the natural sugar contained in fruit or other agricultural products,

with or without the addition of sugar or other products, and that does not contain

more than twenty-one percent alcohol by volume.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3