Authorization Agreement For Electronic Tax Filing And Payment

ADVERTISEMENT

QUEST

Authorization Agreement For

Quick Easy Secure Tax Filing

Instructions and Terms on Back

Electronic Tax Filing And Payment

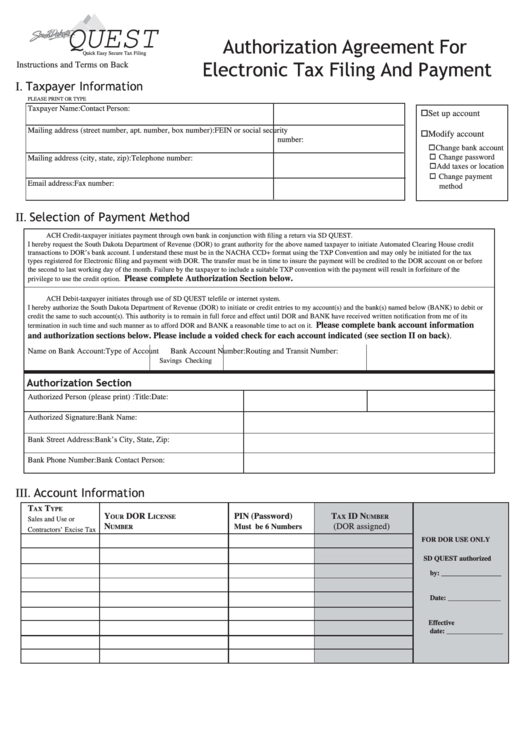

I. Taxpayer Information

PLEASE PRINT OR TYPE

Taxpayer Name:

Contact Person:

Set up account

Mailing address (street number, apt. number, box number):

FEIN or social security

Modify account

number:

Change bank account

Change password

Mailing address (city, state, zip):

Telephone number:

Add taxes or location

Change payment

Email address:

Fax number:

method

II. Selection of Payment Method

ACH Credit-taxpayer initiates payment through own bank in conjunction with filing a return via SD QUEST.

I hereby request the South Dakota Department of Revenue (DOR) to grant authority for the above named taxpayer to initiate Automated Clearing House credit

transactions to DOR’s bank account. I understand these must be in the NACHA CCD+ format using the TXP Convention and may only be initiated for the tax

types registered for Electronic filing and payment with DOR. The transfer must be in time to insure the payment will be credited to the DOR account on or before

the second to last working day of the month. Failure by the taxpayer to include a suitable TXP convention with the payment will result in forfeiture of the

Please complete Authorization Section below.

privilege to use the credit option.

ACH Debit-taxpayer initiates through use of SD QUEST telefile or internet system.

I hereby authorize the South Dakota Department of Revenue (DOR) to initiate or credit entries to my account(s) and the bank(s) named below (BANK) to debit or

credit the same to such account(s). This authority is to remain in full force and effect until DOR and BANK have received written notification from me of its

Please complete bank account information

termination in such time and such manner as to afford DOR and BANK a reasonable time to act on it.

and authorization sections below. Please include a voided check for each account indicated (see section II on back).

Name on Bank Account:

Type of Account

Bank Account Number:

Routing and Transit Number:

Savings

Checking

Authorization Section

Authorized Person (please print) :

Title:

Date:

Authorized Signature:

Bank Name:

Bank Street Address:

Bank’s City, State, Zip:

Bank Phone Number:

Bank Contact Person:

III. Account Information

T

T

AX

YPE

Y

DOR L

PIN (Password)

T

ID N

OUR

ICENSE

AX

UMBER

Sales and Use or

N

(DOR assigned)

Must be 6 Numbers

UMBER

Contractors’ Excise Tax

FOR DOR USE ONLY

SD QUEST authorized

by: _________________

Date: _______________

Effective

date: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1