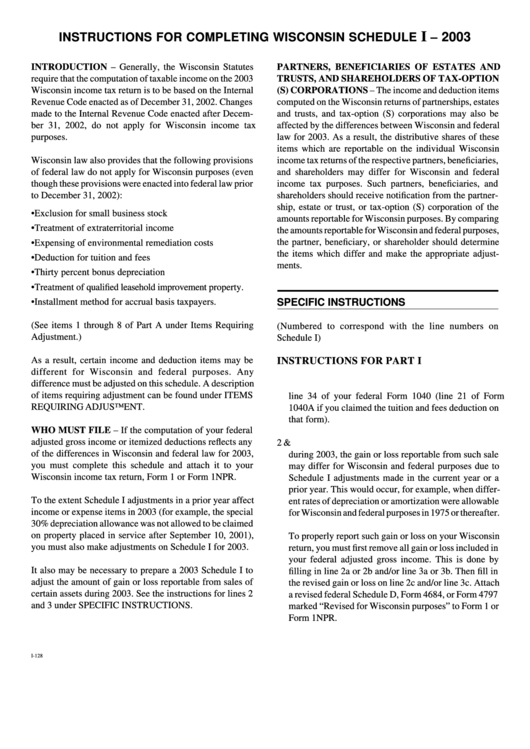

Instructions For Completing Wisconsin Shedule I-2003 - Income Tax Return

ADVERTISEMENT

I

2003

INSTRUCTIONS FOR COMPLETING WISCONSIN SCHEDULE

–

INTRODUCTION – Generally, the Wisconsin Statutes

PARTNERS, BENEFICIARIES OF ESTATES AND

require that the computation of taxable income on the 2003

TRUSTS, AND SHAREHOLDERS OF TAX-OPTION

Wisconsin income tax return is to be based on the Internal

(S) CORPORATIONS – The income and deduction items

Revenue Code enacted as of December 31, 2002. Changes

computed on the Wisconsin returns of partnerships, estates

made to the Internal Revenue Code enacted after Decem-

and trusts, and tax-option (S) corporations may also be

ber 31, 2002, do not apply for Wisconsin income tax

affected by the differences between Wisconsin and federal

purposes.

law for 2003. As a result, the distributive shares of these

items which are reportable on the individual Wisconsin

Wisconsin law also provides that the following provisions

income tax returns of the respective partners, beneficiaries,

of federal law do not apply for Wisconsin purposes (even

and shareholders may differ for Wisconsin and federal

though these provisions were enacted into federal law prior

income tax purposes. Such partners, beneficiaries, and

to December 31, 2002):

shareholders should receive notification from the partner-

ship, estate or trust, or tax-option (S) corporation of the

• Exclusion for small business stock

amounts reportable for Wisconsin purposes. By comparing

• Treatment of extraterritorial income

the amounts reportable for Wisconsin and federal purposes,

the partner, beneficiary, or shareholder should determine

• Expensing of environmental remediation costs

the items which differ and make the appropriate adjust-

• Deduction for tuition and fees

ments.

• Thirty percent bonus depreciation

• Treatment of qualified leasehold improvement property.

• Installment method for accrual basis taxpayers.

SPECIFIC INSTRUCTIONS

(See items 1 through 8 of Part A under Items Requiring

(Numbered to correspond with the line numbers on

Adjustment.)

Schedule I)

As a result, certain income and deduction items may be

INSTRUCTIONS FOR PART I

different for Wisconsin and federal purposes. Any

difference must be adjusted on this schedule. A description

1. Fill in your 2003 federal adjusted gross income from

of items requiring adjustment can be found under ITEMS

line 34 of your federal Form 1040 (line 21 of Form

REQUIRING ADJUSTMENT.

1040A if you claimed the tuition and fees deduction on

that form).

WHO MUST FILE – If the computation of your federal

adjusted gross income or itemized deductions reflects any

2 & 3. If you sold or otherwise disposed of certain property

of the differences in Wisconsin and federal law for 2003,

during 2003, the gain or loss reportable from such sale

you must complete this schedule and attach it to your

may differ for Wisconsin and federal purposes due to

Wisconsin income tax return, Form 1 or Form 1NPR.

Schedule I adjustments made in the current year or a

prior year. This would occur, for example, when differ-

To the extent Schedule I adjustments in a prior year affect

ent rates of depreciation or amortization were allowable

income or expense items in 2003 (for example, the special

for Wisconsin and federal purposes in 1975 or thereafter.

30% depreciation allowance was not allowed to be claimed

on property placed in service after September 10, 2001),

To properly report such gain or loss on your Wisconsin

you must also make adjustments on Schedule I for 2003.

return, you must first remove all gain or loss included in

your federal adjusted gross income. This is done by

It also may be necessary to prepare a 2003 Schedule I to

filling in line 2a or 2b and/or line 3a or 3b. Then fill in

adjust the amount of gain or loss reportable from sales of

the revised gain or loss on line 2c and/or line 3c. Attach

certain assets during 2003. See the instructions for lines 2

a revised federal Schedule D, Form 4684, or Form 4797

and 3 under SPECIFIC INSTRUCTIONS.

marked “Revised for Wisconsin purposes” to Form 1 or

Form 1NPR.

I-128

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4