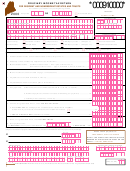

Instructions For Combined Wisconsin Individual And Fiduciary Income Tax Return For Nonresident Partners Form 1cnp 1998

ADVERTISEMENT

1998

Combined Wisconsin

Individual and Fiduciary Income Tax Return

For Nonresident Partners

Form 1CNP Instructions

New for 1998 . . .

For More Information . . .

The income tax rates have been reduced for individuals

• Visit the Department of Revenue’s Internet

and fiduciaries whose taxable years begin on or after

website at

January 1, 1998. For more information, see page 4.

At this site you may obtain additional information

about the Department of Revenue and answers to the

most frequently asked questions. You may also

Important . . .

download or request tax forms and publications.

• Extensions of time to file

• Subscribe to the Department of Revenue’s

The partnership may receive an extension of time to

publications

file Form 1CNP. See page 1 for more information.

The Wisconsin Tax Bulletin is a quarterly newsletter

• Composite Estimated Tax Vouchers

that provides information about new Wisconsin tax

Use the Wisconsin Composite Estimated Tax Vouch-

laws, court decisions, and interpretations of law.

ers, Forms CN-ES, included in this booklet to make

Subscriptions cost $7 per year.

estimated tax payments for nonresident partners who

will be participating in a combined return, Form

The Topical and Court Case Index gives references

1CNP, for 1999. See page 2.

to Wisconsin statutes, administrative rules, Wisconsin

Tax Bulletin tax releases and private letter rulings,

publications, and court decisions. The index is pub-

lished in December, with an addendum provided in

May. The annual cost is $18, plus sales tax.

To order the bulletin or index, send a check made

payable to “Document Sales” to the Wisconsin

Department of Administration, P.O. Box 7840, Madi-

son, WI 53707-7840.

Printed on

IP-031

Recycled Paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7