Form 40x - Oregon Amended Individual Income Tax Return Page 2

ADVERTISEMENT

Page 2—Form 40X

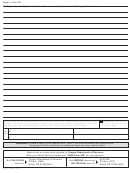

30. Explanation of adjustments made — Show the computations in detail. Attach applicable schedules.

Under penalties for false swearing, I declare that I have examined this return, including accompanying schedules and

I authorize the Department of

statements. To the best of my knowledge and belief it is true, correct, and complete. If prepared by a person other

Revenue to discuss this return

than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

with this preparer.

Your signature

Date

License No.

Signature of preparer other than taxpayer

X

X

SIGN

HERE

Telephone No.

Address

Spouse’s signature

(if filing jointly, BOTH must sign)

Date

X

Important: Attach a copy of your federal Form 1040X if you also amended your federal return.

See page 4 of the instructions for additional items you may need to attach.

Make check or money order payable to: Oregon Department of Revenue.

Write your Social Security number and “2003 Form 40X” on your payment.

Oregon Department of Revenue

REFUND

Mail TAX-TO-PAY

Mail REFUND returns and

PO Box 14555

PO Box 14700

returns to

NO-TAX-DUE returns to

Salem OR 97309-0940

Salem OR 97309-0930

150-101-046 (Rev. 10-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2