Form Npt - City Of Philadelphia Net Profits Tax - 2016

ADVERTISEMENT

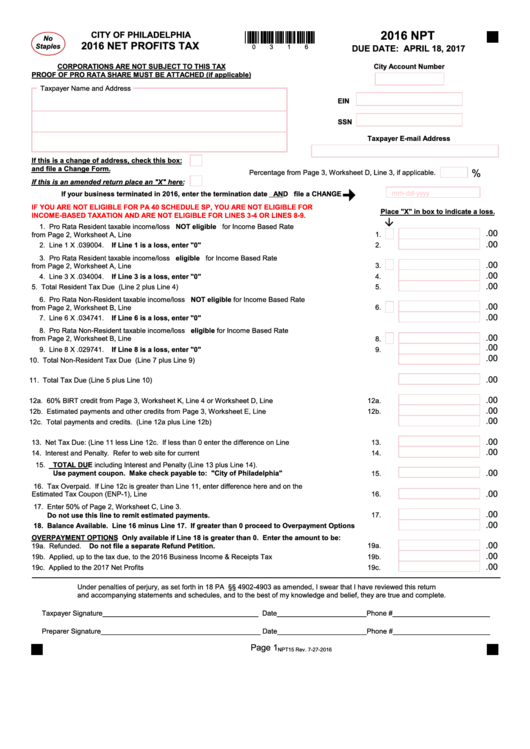

2016 NPT

CITY OF PHILADELPHIA

No

2016 NET PROFITS TAX

Staples

DUE DATE: APRIL 18, 2017

0

3

1

6

CORPORATIONS ARE NOT SUBJECT TO THIS TAX

City Account Number

PROOF OF PRO RATA SHARE MUST BE ATTACHED (if applicable)

Taxpayer Name and Address

EIN

SSN

Taxpayer E-mail Address

If this is a change of address, check this box:

%

and file a Change Form.

Percentage from Page 3, Worksheet D, Line 3, if applicable.

¢

If this is an amended return place an "X" here:

mm-dd-yyyy

If your business terminated in 2016, enter the termination date AND file a CHANGE

IF YOU ARE NOT ELIGIBLE FOR PA 40 SCHEDULE SP, YOU ARE NOT ELIGIBLE FOR

Place "X" in box to indicate a loss.

INCOME-BASED TAXATION AND ARE NOT ELIGIBLE FOR LINES 3-4 OR LINES 8-9.

â

1. Pro Rata Resident taxable income/loss NOT eligible for Income Based Rate

.00

from Page 2, Worksheet A, Line 5.........................................................................................................

1.

.00

2. Line 1 X .039004. If Line 1 is a loss, enter "0"...................................................................................

2.

3. Pro Rata Resident taxable income/loss eligible for Income Based Rate

.00

3.

from Page 2, Worksheet A, Line 6.........................................................................................................

.00

4. Line 3 X .034004. If Line 3 is a loss, enter "0"...................................................................................

4.

.00

5. Total Resident Tax Due (Line 2 plus Line 4).........................................................................................

5.

6. Pro Rata Non-Resident taxable income/loss NOT eligible for Income Based Rate

.00

6.

from Page 2, Worksheet B, Line 7.........................................................................................................

.00

7. Line 6 X .034741. If Line 6 is a loss, enter "0"...................................................................................

7.

8. Pro Rata Non-Resident taxable income/loss eligible for Income Based Rate

.00

from Page 2, Worksheet B, Line 8.........................................................................................................

8.

.00

9. Line 8 X .029741. If Line 8 is a loss, enter "0"...................................................................................

9.

.00

10. Total Non-Resident Tax Due (Line 7 plus Line 9)..................................................................................

10.

.00

11. Total Tax Due (Line 5 plus Line 10).......................................................................................................

11.

.00

12a. 60% BIRT credit from Page 3, Worksheet K, Line 4 or Worksheet D, Line 8.........................................

12a.

.00

12b. Estimated payments and other credits from Page 3, Worksheet E, Line 4.............................................

12b.

.00

12c. Total payments and credits. (Line 12a plus Line 12b)........................................................................... 12c.

.00

13. Net Tax Due: (Line 11 less Line 12c. If less than 0 enter the difference on Line 16..............................

13.

.00

14. Interest and Penalty. Refer to web site for current percentage..............................................................

14.

15. TOTAL DUE including Interest and Penalty (Line 13 plus Line 14).

.00

Use payment coupon. Make check payable to: "City of Philadelphia"...........................................

15.

16. Tax Overpaid. If Line 12c is greater than Line 11, enter difference here and on the

.00

Estimated Tax Coupon (ENP-1), Line 2.................................................................................................

16.

17. Enter 50% of Page 2, Worksheet C, Line 3.

.00

17.

Do not use this line to remit estimated payments..............................................................................

.00

18. Balance Available. Line 16 minus Line 17. If greater than 0 proceed to Overpayment Options....

18.

OVERPAYMENT OPTIONS Only available if Line 18 is greater than 0. Enter the amount to be:

.00

19a. Refunded. Do not file a separate Refund Petition.............................................................................

19a.

.00

19b. Applied, up to the tax due, to the 2016 Business Income & Receipts Tax

19b.

.00

19c. Applied to the 2017 Net Profits

19c.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

Page 1

NPT15 Rev. 7-27-2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1