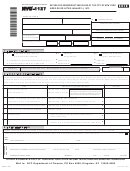

Form Nyc-1127 - For Nonresident Employees Of The City Of New York Hired On Or After January 4, 1973 - 2006 Page 2

ADVERTISEMENT

Form NYC-1127 - 2006

Page 2

COLUMN B

COLUMN A

NEW YORK ADJUSTED GROSS INCOME

1127

SECTION

EMPLOYEE

FEDERAL AMOUNT

(

)

SEE INSTRUCTIONS

NEW YORK ADDITIONS

19.

(line 18, page 1)

FEDERAL ADJUSTED GROSS INCOME

................................................ 19a. _______________________________

19b. ______________________________

20. Interest income on state and local bonds other than NYS and its localities

........

20a. _______________________________

20b. ______________________________

21. Public employee 414(h) retirement contributions

.....................................................

21a. _______________________________

21b. ______________________________

22. Other (attach list)

.............................................................................................................

22a. _______________________________

22b. ______________________________

23. Add lines 19 through 22

.................................................................................................

23a. _______________________________

23b. ______________________________

NEW YORK SUBTRACTIONS

24. Taxable refunds of New York State and local income taxes

(from page1, line 4) ......

24a. _______________________________

24b. ______________________________

25. Pensions of NYS and local governments and the federal government..............

25a. _______________________________

25b. ______________________________

26. Taxable social security benefits

(from page 1, line 14) ................................................

26a. _______________________________

26b. ______________________________

27. Interest income on United States government bonds

..............................................

27a. _______________________________

27b. ______________________________

28. Pension and annuity income exclusion

.......................................................................

28a. _______________________________

28b. ______________________________

29. Other (attach list)

..............................................................................................................

29a. _______________________________

29b. ______________________________

30. Total subtractions (add lines 24 through 29)

..............................................................

30a. _______________________________

30b. ______________________________

31.

(line 23 less line 30)

TOTAL NEW YORK INCOME

(transfer amount from column B to line 32

) (for line 31b, see instructions) ...............

31a. _______________________________

31b. ______________________________

32. Amount from line 31, column B, (total New York City income)

..................................................................................................

32. ______________________________

33.

Part-year employees must prorate

:

(See Instructions)

NEW YORK CITY DEDUCTION

standard deduction and dependent

line 31, column B

$

exemption amounts based on num-

%

........................................ =

a.

Compute limitation percentage:

---------------------------------

33a.____________________________

ber of months employed by NYC.

line 31, column A

$

________________________________

}

Standard deduction (enter amount from instructions) .....................................................

b.

Check only one box:

%

Itemized deduction - $________________________ X _______________________

=

33b.________________________________

amount from line p below

% from line 33a

34. Line 32 less line 33b

34. ________________________________

...........................................................................................................................................................................

35.

No exemption is allowed for employee or spouse.

NEW YORK DEPENDENT EXEMPTION FROM NYS RETURN

(If married filing separately for Section 1127 purposes, apply the limitation percentage from line 33a.)

(see instructions)

(

)

_____________ X 1000

____________ % = ...............................................................................................................

35. ________________________________

X

# of exemptions

% from line 33a

36. New York City income subject to Section 1127 (line 34 less line 35)

.......................................................................................

36. ________________________________

OR

STANDARD DEDUCTION

ITEMIZED DEDUCTIONS

a.

Medical and dental expenses

...........................................................

a. ________________________________

Choose the standard deduction

b.

Taxes

......................................................................................................

b. ________________________________

amount appropriate to your Section

c.

Interest expense

c. ________________________________

..................................................................................

1127 filing status.

d.

Gifts to charity

......................................................................................

d. ________________________________

The Standard Deduction allowable is:

e.

Casualty and theft losses

e. ________________________________

..................................................................

$3,000 - if single for the entire year

f.

Job expenses and most other miscellaneous deductions

and you can be claimed as a

(see instructions and attach detailed schedule)

dependent on another taxpayer’s

............................

f. ________________________________

federal return

g.

Other miscellaneous deductions (attach detailed schedule)

g. ________________________________

.....

$7,500 - if single for the entire year

h.

(from federal Schedule A, line 28)

TOTAL ITEMIZED DEDUCTIONS

.

h. ________________________________

and you cannot be claimed as a

i.

State, local and foreign income taxes on line b

dependent on another taxpayer’s

and Sect. 1127 liability if deducted elsewhere

federal return

..............................

i. ________________________________

j.

Subtract line i from line h

j. ________________________________

..................................................................

$10,500 - if head of household for

the entire year

k.

Other adjustments

..............................................................................

k. ________________________________

l.

lines j and k

l. ________________________________

Total of

.............................................................................

$14,600 - if married and filing jointly

for the entire year

m. New York State itemized deduction adjustment (if line 31 is

$100,000 or less, enter "0") (otherwise see instructions)

............

m. ________________________________

$14,600 - if qualifying widow(er)

with dependent child for the entire

n.

New York State itemized deduction before limitation percentage

year

(line l less line m)

n. ________________________________

................................................................................

o.

College tuition itemized deduction.........................................................

$6,500 - if married, filing separately

o. ________________________________

for the entire year

p.

Add lines n and o...................................................................................

80020690

p. ________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3