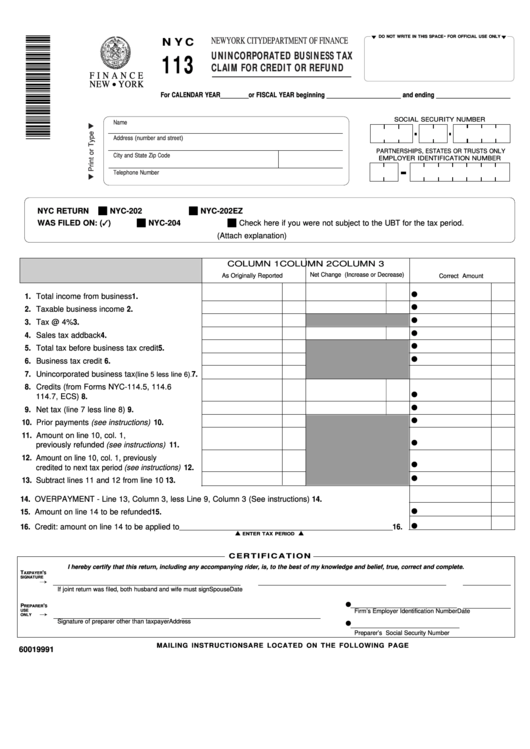

Form Nyc-113 - Unincorporated Business Tax Claim For Credit Or Refund - 1999

ADVERTISEMENT

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

UNINCORPORATED BUSINESS TAX

113

CLAIM FOR CREDIT OR REFUND

F I N A N C E

NEW YORK

For CALENDAR YEAR ________or FISCAL YEAR beginning _____________________ and ending _____________________

SOCIAL SECURITY NUMBER

Name

Address (number and street)

PARTNERSHIPS, ESTATES OR TRUSTS ONLY

City and State

Zip Code

EMPLOYER IDENTIFICATION NUMBER

Telephone Number

NYC RETURN

NYC-202

NYC-202EZ

WAS FILED ON: ( )

NYC-204

Check here if you were not subject to the UBT for the tax period.

(Attach explanation)

COLUMN 1

COLUMN 2

COLUMN 3

Net Change (Increase or Decrease)

As Originally Reported

Correct Amount

1. Total income from business

1.

.........................................

2. Taxable business income

2.

...............................................

3. Tax @ 4%

3.

..................................................................................

4. Sales tax addback

4.

...............................................................

5. Total tax before business tax credit

5.

.......................

6. Business tax credit

6.

..............................................................

7. Unincorporated business tax

7.

(line 5 less line 6)

.

8. Credits (from Forms NYC-114.5, 114.6

8.

114.7, ECS)

..............................................................................

9. Net tax (line 7 less line 8)

9.

..............................................

10. Prior payments (see instructions)

10.

.........................

11. Amount on line 10, col. 1,

previously refunded (see instructions)

11.

..............

12. Amount on line 10, col. 1, previously

credited to next tax period (see instructions)

12.

....

13. Subtract lines 11 and 12 from line 10

13.

.................

14. OVERPAYMENT - Line 13, Column 3, less Line 9, Column 3 (See instructions)

14.

......................................................

15. Amount on line 14 to be refunded

15.

...................................................................................................................................................................

16. Credit: amount on line 14 to be applied to

16.

_________________________________________________________________________

ENTER TAX PERIOD

C E R T I F I C AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

T

'

AXPAYER

S

SIGNATURE

If joint return was filed, both husband and wife must sign

Spouse

Date

P

'

REPARER

S

Firm’s Employer Identification Number

Date

USE

ONLY

Signature of preparer other than taxpayer

Address

Preparer’s Social Security Number

MAILING INSTRUCTIONS ARE LOCATED ON THE FOLLOWING PAGE

60019991

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4