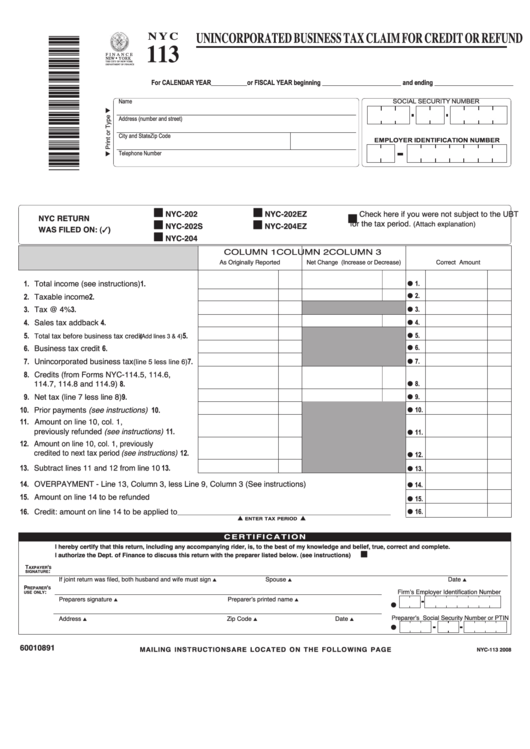

Form Nyc-113 - Unincorporated Business Tax Claim For Credit Or Refund - 2008

ADVERTISEMENT

113

UNINCORPORATED BUSINESS TAX CLAIM FOR CREDIT OR REFUND

N Y C

F I N A N C E

NEW

YORK

G

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

For CALENDAR YEAR ___________or FISCAL YEAR beginning ________________________ and ending ________________________

Name

SOCIAL SECURITY NUMBER

Address (number and street)

City and State

Zip Code

EMPLOYER IDENTIFICATION NUMBER

Telephone Number

I I

I I

NYC-202

NYC-202EZ

Check here if you were not subject to the UBT

NYC RETURN

I I

for the tax period.

I I

NYC-202S

I I

NYC-204EZ

(Attach explanation)

WAS FILED ON: ()

I I

NYC-204

COLUMN 1

COLUMN 2

COLUMN 3

As Originally Reported

Net Change (Increase or Decrease)

Correct Amount

1. Total income (see instructions)

1.

G 1.

.................................

2. Taxable income

2.

G 2.

....................................................................

3. Tax @ 4%

3.

G 3.

.................................................................................

4. Sales tax addback

4.

G 4.

..............................................................

Total tax before business tax credit

5.

(Add lines 3 & 4)

5.

G 5.

.....

6. Business tax credit

6.

G 6.

.............................................................

7. Unincorporated business tax

(line 5 less line 6)

7.

G 7.

....

8. Credits (from Forms NYC-114.5, 114.6,

114.7, 114.8 and 114.9)

8.

G 8.

..................................................

9. Net tax (line 7 less line 8)

9.

G 9.

..............................................

10. Prior payments (see instructions)

10.

G 10.

........................

11. Amount on line 10, col. 1,

previously refunded (see instructions)

11.

..............

G 11.

12. Amount on line 10, col. 1, previously

credited to next tax period (see instructions)

12.

....

G 12.

13. Subtract lines 11 and 12 from line 10

13.

.................

G 13.

14. OVERPAYMENT - Line 13, Column 3, less Line 9, Column 3 (See instructions)

..................................................................

G 14.

15. Amount on line 14 to be refunded

..............................................................................................................................................................................

G 15.

16. Credit: amount on line 14 to be applied to

.......

G 16.

_________________________________________________________________________

ENTER TAX PERIOD

L

L

C E R T I F I C AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES

I I

T

'

AXPAYER

S

:

SIGNATURE

If joint return was filed, both husband and wife must sign

Spouse

Date

L

L

L

P

'

REPARER

S

Firmʼs Employer Identification Number

:

USE ONLY

Preparers signature

Preparerʼs printed name

L

L

G

Preparerʼs Social Security Number or PTIN

Address

Zip Code

Date

L

L

L

G

60010891

MAILING INSTRUCTIONS ARE LOCATED ON THE FOLLOWING PAGE

NYC-113 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4