Form 910 Instructions - Idaho State Tax Commission

ADVERTISEMENT

RO02640

FORM 910 INSTRUCTIONS

12-30-03

Payment Requirements. If your account filing cycle is

Payment Made by Check. Make your check or money order

monthly, split-monthly or quarterly, you must pay the withheld

payable to the Idaho State Tax Commission. Payment must

Idaho income taxes electronically or with a Form 910, Idaho

be accompanied by a Form 910 postmarked on or before the

Withholding Payment Voucher. All payments are due on or

due date. Mail your Form 910 and payment to: Idaho State

before the due date as shown in the due date table below.

Tax Commission, PO Box 76, Boise, Idaho 83707-0076.

Please include the Form 910 with your check or money order

Change of Mailing Address. If the address on your form is

to ensure your account is properly credited. If you did not

incorrect, check the "Mailing Address Change" box on the

withhold income taxes, you must file a "zero" payment.

Form 910 and provide your new address.

Zero Payments. You can file zero payments in one of the

New Owner. If you are a new owner of a business, do not

following ways:

use a form that has been addressed to the former owner.

Accounts are not transferable. Contact the Idaho State Tax

1. Through the withholding web filing system. File your zero

Commission at 334-7660 or 1-800-972-7660 toll free to

payment through our Web site at www2.state.id.us/tax .

obtain an application for a new number, or visit our Web site

Click on the "Electronic Filing" button.

at www2.state.id.us/tax . Click on the "Forms" button.

2. By Electronic Funds Transfer (EFT). Zero payments are

allowed through the EFT system. (See below)

Cancel Account. If you want to cancel your account, check

3. By using a Form 910 payment and entering a "0" in the

the "Cancel Account" box on your Form 910.

"Payment Amount" box. Mail it to: Idaho State Tax

Commission, PO Box 76, Boise, Idaho 83707-0076.

Signature. You must sign your Form 910.

Payments Made by Electronic Funds Transfer (EFT). You

Penalty. Late payments are subject to penalty. Penalty is

can use EFT to make all your payments to the state of Idaho.

5% of the tax due for each month or portion of a month the

Whenever the amount due is $100,000 or greater, the law

payment is late. The maximum penalty is 25% and the

requires you to use EFT. For more information on how to

minimum penalty amount is $10.00.

make payments electronically, call 334-7515 or toll free at

1-800-972-7660, ext 7515, or visit our Web site at

Interest. Interest accrues on late payments from the due

www2.state.id.us/tax . Do not file a Form 910 when paying

date until paid. Rates are as follows:

by EFT.

1/1/2004 - 12/31/2004, 6% per year

Payment Made by Credit Card. Use MasterCard or Visa to

1/1/2003 - 12/31/2003, 5% per year

make payments under $100,000 to the state of Idaho. You

1/1/2002 - 12/31/2002, 7% per year

can pay through our Web site at www2.state.id.us/tax by

1/1/2001 - 12/31/2001, 8% per year

clicking the "Electronic Payments" button, or by calling 334-

7660 or 1-800-972-7660 toll free. You can only make debit

Rounding Amounts. Round the amounts on the Form 910

card payments at your local Idaho State Tax Commission

to the nearest whole dollar. Reduce amounts of less than 50

office. Do not file a Form 910 when paying by credit card.

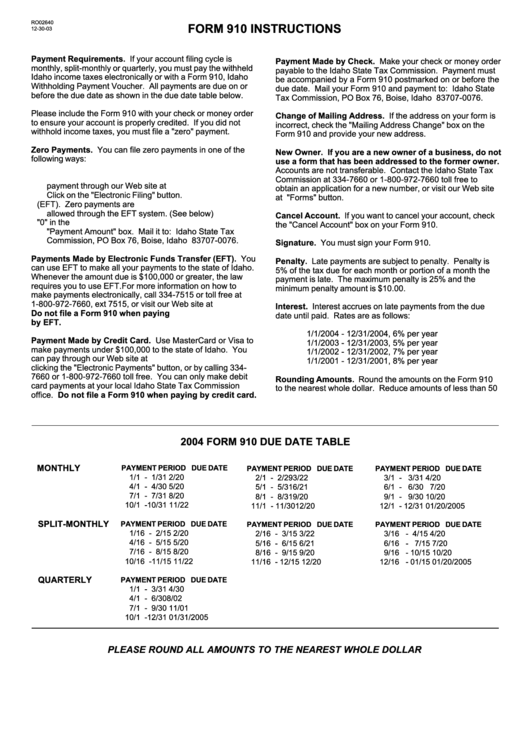

2004 FORM 910 DUE DATE TABLE

MONTHLY

PAYMENT PERIOD DUE DATE

PAYMENT PERIOD DUE DATE

PAYMENT PERIOD DUE DATE

1/1 - 1/31

2/20

2/1 - 2/29

3/22

3/1 - 3/31

4/20

4/1 - 4/30

5/20

5/1 - 5/31

6/21

6/1 - 6/30

7/20

7/1 - 7/31

8/20

8/1 - 8/31

9/20

9/1 - 9/30

10/20

10/1 -10/31

11/22

11/1 - 11/30

12/20

12/1 - 12/31

01/20/2005

SPLIT-MONTHLY

PAYMENT PERIOD DUE DATE

PAYMENT PERIOD DUE DATE

PAYMENT PERIOD DUE DATE

1/16 - 2/15

2/20

2/16 - 3/15

3/22

3/16 - 4/15

4/20

4/16 - 5/15

5/20

5/16 - 6/15

6/21

6/16 - 7/15

7/20

7/16 - 8/15

8/20

8/16 - 9/15

9/20

9/16 - 10/15

10/20

10/16 -11/15

11/22

11/16 - 12/15

12/20

12/16 - 01/15

01/20/2005

QUARTERLY

PAYMENT PERIOD DUE DATE

1/1 - 3/31

4/30

4/1 - 6/30

8/02

7/1 - 9/30

11/01

10/1 -12/31

01/31/2005

PLEASE ROUND ALL AMOUNTS TO THE NEAREST WHOLE DOLLAR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3