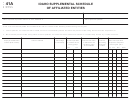

Form 39 (1998)

TC39981-2

10-9-98

Social Security Number

Name(s) as shown on return

PART II: For Form 43 filers.

PART II: For Form 43 filers.

PART II: For Form 43 filers.

PART II: For Form 43 filers.

PART II: For Form 43 filers. If you are filing Form 40, use PART I on the front of this form.

Column A

Column B

A. A. A. A. A. Other Subtractions

Other Subtractions

Other Subtractions. . . . . See instr

Other Subtractions

See instr

See instr

uctions

uctions, , , , , pages 21 and 22.

uctions

pages 21 and 22.

pages 21 and 22.

Other Subtractions

See instr

See instructions

uctions

pages 21 and 22.

pages 21 and 22.

Total

Idaho

1 .

Idaho resident - Active duty military pay earned outside of Idaho ...

1

2 .

Maintaining a home for the aged and/or developmentally disabled .

2

3 .

Idaho lottery winnings, less than $600 per prize .............................

3

4 .

Income earned on a reservation by a Native American ....................

4

5 .

Worker's compensation insurance .....................................................

5

6 .

Partner's and shareholder's pass-through subtractions ....................

6

7 .

Insulation of Idaho residence ..............................................................

7

8 .

Technological equipment donation .....................................................

8

9 .

Interest earned on a medical savings account ..................................

9

10.

Alternative energy device deduction

Year

Acquired

Type of Device

Total Cost

Percent

a. 1 9 9 8

$

X 4 0 % =

10a

b. 1 9 9 7

$

X 2 0 % =

10b

c. 1 9 9 6

$

X 2 0 % =

10c

d. 1 9 9 5

$

X 2 0 % =

10d

11.

Other subtractions. Identify. .............................................................

1 1

12.

Total other subtractions. Add lines 1 through 11.

Enter on line 42, Form 43.

1 2

B. B. B. B. B. Cr

Cr

Cr

Credit f

edit f

edit f

edit for Income

or Income

or Income

or Income T T T T T ax

ax

ax

axes P

es P

es P

es Paid to

aid to

aid to

aid to Another Sta

Another Sta

Another Sta

Another State b

te b

te b

te by P

y P

y Par ar ar ar art-Y

y P

t-Y

t-Y

t-Year Residents

ear Residents

ear Residents

ear Residents. . . . . See instr

See instr

See instr

See instructions

uctions

uctions

uctions, , , , , page 22.

page 22.

page 22.

page 22.

Cr

edit f

or Income

ax

es P

aid to

Another Sta

te b

y P

t-Y

ear Residents

See instr

uctions

page 22.

Nonresidents cannot claim this credit. Idaho residents on active military duty, complete Section C below.

1

1 .

Idaho adjusted income from line 44, Column B, Form 43 .................

Attach a copy of the

2

2 .

Other state's adjusted income ............................................................

income tax return and

a separate Form 39 for

3

3 .

Amount on lines 1 and 2 taxed by both states ..................................

each state for which a

4

4 .

Idaho tax, line 55, Form 43 ................................................................

credit is claimed.

%

5

5 .

Divide line 3 by line 1. Enter percentage here. .................................

6

6 .

Multiply line 4 by line 5. ...............................................................................................................

7 .

Other state's tax due from its tax table or rate schedule less

its income tax credits ..........................................................................

7

%

8 .

Divide line 3 by line 2. Enter percentage here. .................................

8

9 .

Multiply line 7 by line 8. ...............................................................................................................

9

10.

Enter the smaller of lines 6 or 9 here and on line 56, Form 43.

1 0

C.

C. C.

C. C. Cr

Cr

Cr

Credit f

Cr

edit f

edit f

edit f

edit for Income

or Income

or Income

or Income

or Income T T T T T ax

ax

ax

ax

axes P

es P

es P

es P

es Paid to

aid to

aid to

aid to

aid to Another Sta

Another Sta

Another Sta

Another Sta

Another State b

te b

te b

te b

te by Idaho Residents on

y Idaho Residents on

y Idaho Residents on

y Idaho Residents on

y Idaho Residents on Activ

Activ

Activ

Activ

Active Militar

e Militar

e Militar

e Militar

e Military Duty

y Duty

y Duty

y Duty

y Duty. . . . .

See instr

See instr

uctions

uctions

uctions, , , , , page 23.

page 23.

page 23.

See instr

See instr

See instructions

uctions

page 23.

page 23.

Attach a copy of the

1 .

Idaho tax, line 55, Form 43 ................................................................

1

income tax return and

2 .

Other state's adjusted income ............................................................

2

a separate Form 39 for

3 .

Idaho adjusted income from line 44, Column B, Form 43 .................

3

each state for which a

credit is claimed.

%

4 .

Divide line 2 by line 3. Enter percentage here. .................................

4

5

5 .

Multiply line 1 by line 4. Enter amount here. .............................................................................

6 .

Other state's tax due from its tax table or rate schedule less its income tax credits ..............

6

7

7 .

Enter the smaller of lines 5 or 6 here and on line 56, Form 43.

1

1 2

2