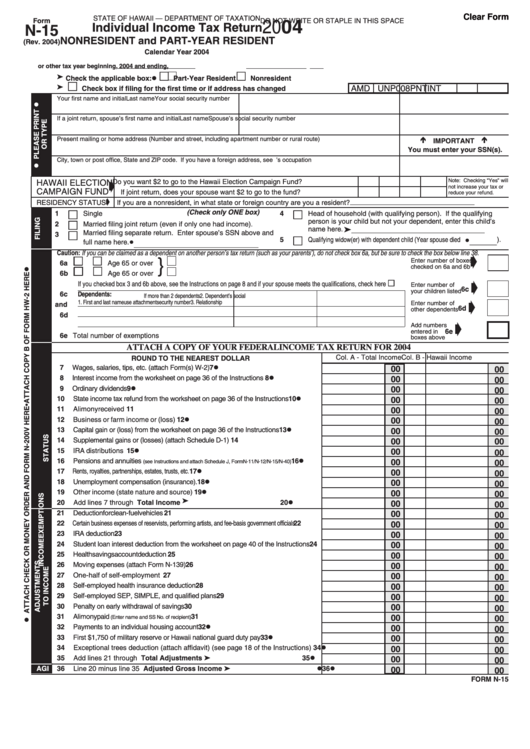

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

Form

DO NOT WRITE OR STAPLE IN THIS SPACE

2004

Individual Income Tax Return

N-15

NONRESIDENT and PART-YEAR RESIDENT

(Rev. 2004)

Calendar Year 2004

or other tax year beginning

, 2004 and ending

,

£

£

l

Check the applicable box:

Part-Year Resident

Nonresident

£

AMD UNP

008

PNT

INT

Check box if filing for the first time or if address has changed

Your first name and initial

Last name

Your social security number

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

é IMPORTANT é

Present mailing or home address (Number and street, including apartment number or rural route)

You must enter your SSN(s).

City, town or post office, State and ZIP code. If you have a foreign address, see Instructions.

Your occupation / Spouse’s occupation

Note: Checking “Yes” will

HAWAII ELECTION

Do you want $2 to go to the Hawaii Election Campaign Fund? ............

Yes

No

not increase your tax or

CAMPAIGN FUND

If joint return, does your spouse want $2 to go to the fund? .................

Yes

No

reduce your refund.

If you are a nonresident, in what state or foreign country are you a resident? ________________________________

RESIDENCY STATUS

£

£

(Check only ONE box)

1

Single

4

Head of household (with qualifying person). If the qualifying

£

person is your child but not your dependent, enter this child’s

2

Married filing joint return (even if only one had income).

name here. ä

£

Married filing separate return. Enter spouse’s SSN above and

3

£

—

5

Qualifying widow(er) with dependent child (Year spouse died

_______ ).

—

full name here.

________________________________

Caution: If you can be claimed as a dependent on another person’s tax return (such as your parents’), do not check box 6a, but be sure to check the box below line 38.

£

£

}

Enter number of boxes

6a

Yourself .........................

Age 65 or over ..............................................................................

£

£

checked on 6a and 6b

6b

Spouse ..........................

Age 65 or over ..............................................................................

£

If you checked box 3 and 6b above, see the Instructions on page 8 and if your spouse meets the qualifications, check here

Enter number of

6c

your children listed

6c

Dependents:

If more than 2 dependents

2. Dependent’s social

1. First and last name

use attachment

security number

3. Relationship

Enter number of

and

6d

other dependents

6d

Add numbers

6e

entered in

6e Total number of exemptions claimed.........................................................................................................

boxes above

ATTACH A COPY OF YOUR FEDERAL INCOME TAX RETURN FOR 2004

Col. A - Total Income

Col. B - Hawaii Income

ROUND TO THE NEAREST DOLLAR

7

Wages, salaries, tips, etc. (attach Form(s) W-2) ........................................................

7l

00

00

8

Interest income from the worksheet on page 36 of the Instructions ............................

8l

00

00

9

Ordinary dividends...................................................................................................

9l

00

00

10

State income tax refund from the worksheet on page 36 of the Instructions................

10l

00

00

11

Alimony received .....................................................................................................

00

11

00

12

Business or farm income or (loss).............................................................................

12l

00

00

13

Capital gain or (loss) from the worksheet on page 36 of the Instructions.....................

13l

00

00

14

Supplemental gains or (losses) (attach Schedule D-1) ..............................................

14

00

00

15

IRA distributions ......................................................................................................

15l

00

00

16

Pensions and annuities

..............

16l

00

(see Instructions and attach Schedule J, Form N-11/N-12/N-15/N-40)

00

17

Rents, royalties, partnerships, estates, trusts, etc. ...................................................................

17l

00

00

18

Unemployment compensation (insurance). ..............................................................

18l

00

00

19

Other income (state nature and source)....................................................................

00

19l

00

20

Add lines 7 through 19.................................................................Total Income

20l

00

00

21

Deduction for clean-fuel vehicles ..............................................................................

21

00

00

22

Certain business expenses of reservists, performing artists, and fee-basis government officials.............

22

00

00

23

IRA deduction..........................................................................................................

23

00

00

24

Student loan interest deduction from the worksheet on page 40 of the Instructions.....

24

00

00

25

Health savings account deduction ............................................................................

25

00

00

26

Moving expenses (attach Form N-139) .....................................................................

26

00

00

27

One-half of self-employment tax...............................................................................

27

00

00

28

Self-employed health insurance deduction ...............................................................

28

00

00

29

Self-employed SEP, SIMPLE, and qualified plans.....................................................

29

00

00

30

Penalty on early withdrawal of savings......................................................................

00

30

00

31

Alimony paid

..................................................................

31

00

(Enter name and SS No. of recipient)

00

32

Payments to an individual housing account...............................................................

32l

00

00

33

First $1,750 of military reserve or Hawaii national guard duty pay ..............................

33l

00

00

34

Exceptional trees deduction (attach affidavit) (see page 18 of the Instructions)....

34l

00

00

35

Add lines 21 through 34......................................................Total Adjustments

35l

00

00

l36l

AGI

36

Line 20 minus line 35 ................................................Adjusted Gross Income

00

00

FORM N-15

1

1 2

2