Trading Partner Agreement For Electronic Filing Of Withholding Tax Returns Form

ADVERTISEMENT

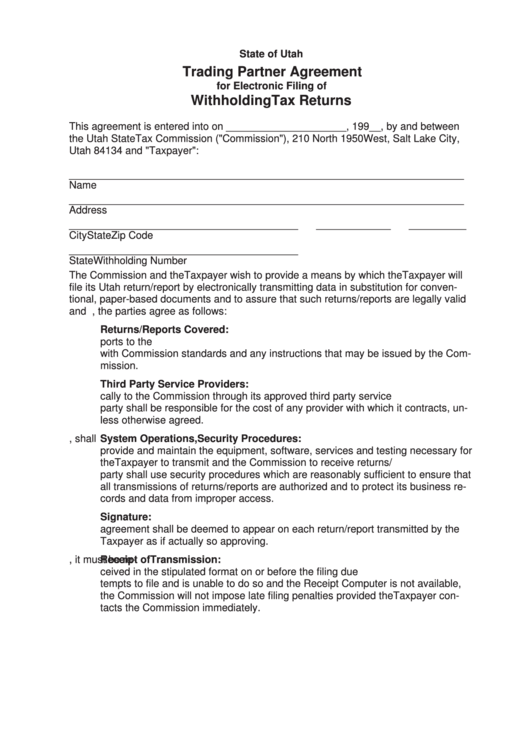

Trading Partner Agreement

State of Utah

Trading Partner Agreement

for Electronic Filing of

Withholding Tax Returns

This agreement is entered into on _____________________, 199__, by and between

the Utah State Tax Commission ("Commission"), 210 North 1950 West, Salt Lake City,

Utah 84134 and "Taxpayer":

_____________________________________________________________________

Name

_____________________________________________________________________

Address

________________________________________

_____________

__________

City

State

Zip Code

________________________________________

State Withholding Number

The Commission and the Taxpayer wish to provide a means by which the Taxpayer will

file its Utah return/report by electronically transmitting data in substitution for conven-

tional, paper-based documents and to assure that such returns/reports are legally valid

and enforceable. In order to achieve this goal, the parties agree as follows:

1.

Returns/Reports Covered:

The Taxpayer will electronically transmit returns/ re-

ports to the Commission. All returns/reports shall be transmitted in accordance

with Commission standards and any instructions that may be issued by the Com-

mission.

2.

Third Party Service Providers:

Returns/reports shall be transmitted electroni

cally to the Commission through its approved third party service provider. Each

party shall be responsible for the cost of any provider with which it contracts, un-

less otherwise agreed.

3.

System Operations, Security Procedures:

Each party at its own expense, shall

provide and maintain the equipment, software, services and testing necessary for

the Taxpayer to transmit and the Commission to receive returns/reports. Each

party shall use security procedures which are reasonably sufficient to ensure that

all transmissions of returns/reports are authorized and to protect its business re-

cords and data from improper access.

4.

Signature:

The signature of the Taxpayer or its authorized agent affixed to this

agreement shall be deemed to appear on each return/report transmitted by the

Taxpayer as if actually so approving.

5.

Receipt of Transmission:

For a return/report to be timely filed, it must be re-

ceived in the stipulated format on or before the filing due date. If the Taxpayer at-

tempts to file and is unable to do so and the Receipt Computer is not available,

the Commission will not impose late filing penalties provided the Taxpayer con-

tacts the Commission immediately.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2