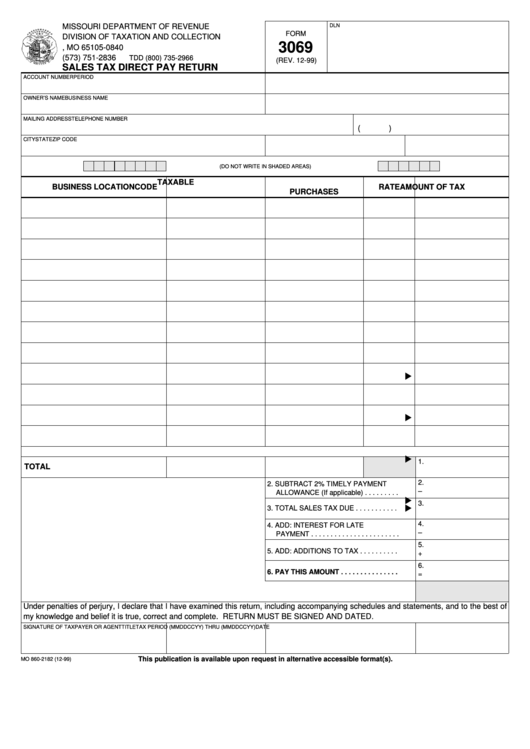

Form 3069 - Sales Tax Direct Pay Return

ADVERTISEMENT

DLN

MISSOURI DEPARTMENT OF REVENUE

FORM

DIVISION OF TAXATION AND COLLECTION

3069

P.O. BOX 840 JEFFERSON CITY, MO 65105-0840

(573) 751-2836

TDD (800) 735-2966

(REV. 12-99)

SALES TAX DIRECT PAY RETURN

ACCOUNT NUMBER

PERIOD

OWNER’S NAME

BUSINESS NAME

MAILING ADDRESS

TELEPHONE NUMBER

(

)

CITY

STATE

ZIP CODE

(DO NOT WRITE IN SHADED AREAS)

TAXABLE

BUSINESS LOCATION

CODE

RATE

AMOUNT OF TAX

PURCHASES

1.

TOTAL

2.

2. SUBTRACT 2% TIMELY PAYMENT

–

ALLOWANCE (If applicable) . . . . . . . . .

3.

3. TOTAL SALES TAX DUE . . . . . . . . . . .

4.

4. ADD: INTEREST FOR LATE

–

PAYMENT . . . . . . . . . . . . . . . . . . . . . . .

5.

5. ADD: ADDITIONS TO TAX . . . . . . . . . .

+

6.

6. PAY THIS AMOUNT . . . . . . . . . . . . . . .

=

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of

my knowledge and belief it is true, correct and complete. RETURN MUST BE SIGNED AND DATED.

SIGNATURE OF TAXPAYER OR AGENT

TITLE

TAX PERIOD (MMDDCCYY) THRU (MMDDCCYY)

DATE

This publication is available upon request in alternative accessible format(s).

MO 860-2182 (12-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1