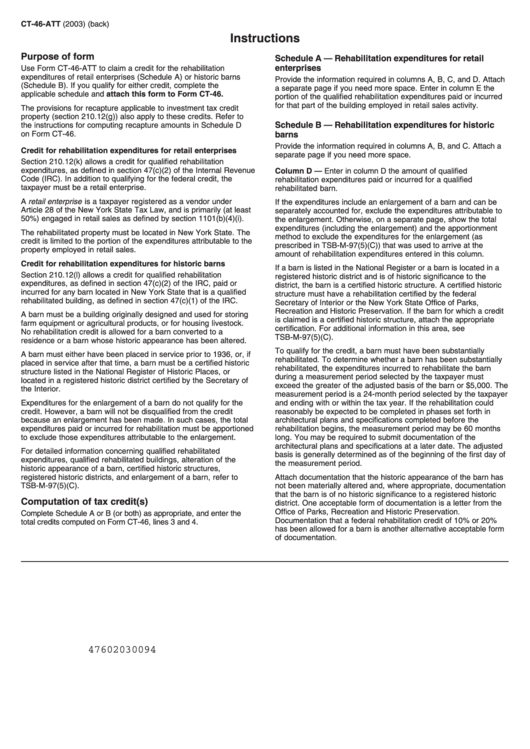

Instructions For Form Ct-46-Att - Credit For Rehabilitation Expenses For Retail Enterprises And Historic Barns - New York State - 2003

ADVERTISEMENT

CT-46-ATT (2003) (back)

Instructions

Purpose of form

Schedule A — Rehabilitation expenditures for retail

enterprises

Use Form CT-46-ATT to claim a credit for the rehabilitation

expenditures of retail enterprises (Schedule A) or historic barns

Provide the information required in columns A, B, C, and D. Attach

(Schedule B). If you qualify for either credit, complete the

a separate page if you need more space. Enter in column E the

applicable schedule and attach this form to Form CT-46.

portion of the qualified rehabilitation expenditures paid or incurred

for that part of the building employed in retail sales activity.

The provisions for recapture applicable to investment tax credit

property (section 210.12(g)) also apply to these credits. Refer to

Schedule B — Rehabilitation expenditures for historic

the instructions for computing recapture amounts in Schedule D

on Form CT-46.

barns

Provide the information required in columns A, B, and C. Attach a

Credit for rehabilitation expenditures for retail enterprises

separate page if you need more space.

Section 210.12(k) allows a credit for qualified rehabilitation

expenditures, as defined in section 47(c)(2) of the Internal Revenue

Column D — Enter in column D the amount of qualified

Code (IRC). In addition to qualifying for the federal credit, the

rehabilitation expenditures paid or incurred for a qualified

taxpayer must be a retail enterprise.

rehabilitated barn.

A retail enterprise is a taxpayer registered as a vendor under

If the expenditures include an enlargement of a barn and can be

Article 28 of the New York State Tax Law, and is primarily (at least

separately accounted for, exclude the expenditures attributable to

50%) engaged in retail sales as defined by section 1101(b)(4)(i).

the enlargement. Otherwise, on a separate page, show the total

expenditures (including the enlargement) and the apportionment

The rehabilitated property must be located in New York State. The

method to exclude the expenditures for the enlargement (as

credit is limited to the portion of the expenditures attributable to the

prescribed in TSB-M-97(5)(C)) that was used to arrive at the

property employed in retail sales.

amount of rehabilitation expenditures entered in this column.

Credit for rehabilitation expenditures for historic barns

If a barn is listed in the National Register or a barn is located in a

Section 210.12(l) allows a credit for qualified rehabilitation

registered historic district and is of historic significance to the

expenditures, as defined in section 47(c)(2) of the IRC, paid or

district, the barn is a certified historic structure. A certified historic

incurred for any barn located in New York State that is a qualified

structure must have a rehabilitation certified by the federal

rehabilitated building, as defined in section 47(c)(1) of the IRC.

Secretary of Interior or the New York State Office of Parks,

Recreation and Historic Preservation. If the barn for which a credit

A barn must be a building originally designed and used for storing

is claimed is a certified historic structure, attach the appropriate

farm equipment or agricultural products, or for housing livestock.

certification. For additional information in this area, see

No rehabilitation credit is allowed for a barn converted to a

TSB-M-97(5)(C).

residence or a barn whose historic appearance has been altered.

To qualify for the credit, a barn must have been substantially

A barn must either have been placed in service prior to 1936, or, if

rehabilitated. To determine whether a barn has been substantially

placed in service after that time, a barn must be a certified historic

rehabilitated, the expenditures incurred to rehabilitate the barn

structure listed in the National Register of Historic Places, or

during a measurement period selected by the taxpayer must

located in a registered historic district certified by the Secretary of

exceed the greater of the adjusted basis of the barn or $5,000. The

the Interior.

measurement period is a 24-month period selected by the taxpayer

Expenditures for the enlargement of a barn do not qualify for the

and ending with or within the tax year. If the rehabilitation could

credit. However, a barn will not be disqualified from the credit

reasonably be expected to be completed in phases set forth in

because an enlargement has been made. In such cases, the total

architectural plans and specifications completed before the

expenditures paid or incurred for rehabilitation must be apportioned

rehabilitation begins, the measurement period may be 60 months

to exclude those expenditures attributable to the enlargement.

long. You may be required to submit documentation of the

architectural plans and specifications at a later date. The adjusted

For detailed information concerning qualified rehabilitated

basis is generally determined as of the beginning of the first day of

expenditures, qualified rehabilitated buildings, alteration of the

the measurement period.

historic appearance of a barn, certified historic structures,

registered historic districts, and enlargement of a barn, refer to

Attach documentation that the historic appearance of the barn has

TSB-M-97(5)(C).

not been materially altered and, where appropriate, documentation

that the barn is of no historic significance to a registered historic

Computation of tax credit(s)

district. One acceptable form of documentation is a letter from the

Office of Parks, Recreation and Historic Preservation.

Complete Schedule A or B (or both) as appropriate, and enter the

Documentation that a federal rehabilitation credit of 10% or 20%

total credits computed on Form CT-46, lines 3 and 4.

has been allowed for a barn is another alternative acceptable form

of documentation.

47602030094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1