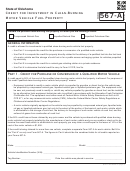

Form 567-A Draft - Credit For Investment In Clean-Burning Motor Vehicle Fuel Property - 2015 Page 2

ADVERTISEMENT

Barcode

Placeholder

2015 Form 567A - Page 2

Credit for Investment in Clean-Burning Motor Vehicle Fuel Property

Name as Shown on Return

Social Security Number or Federal Employer Identification Number

Part 1 - Credit for Purchase or Conversion of a Qualified Motor Vehicle

(continued)

Complete Section A to compute the credit based on the cost of the qualified clean-burning motor vehicle fuel property.

Provide documentation to substantiate the cost entered on line 1. If your vehicle was originally equipped to be

propelled by a clean-burning motor fuel, provide detail for how the portion of the basis on which the credit is

based was determined.

OR

Complete Section B if the vehicle is purchased with qualified clean-burning motor vehicle fuel property installed by

the manufacturer of such motor vehicle and you are unable or elect not to determine the exact basis which is attribut-

able to such property. If your vehicle is not tagged in Oklahoma, provide a copy of the invoice or other docu-

mentation showing the purchase price of the vehicle.

Section A

$

1. Enter the cost of the qualified clean-burning motor vehicle property .................................

45%

2. Rate ..................................................................................................................................

$

3. Total - Multiply line 1 by line 2 (Enter here and on Form 511CR, line 3a) .........................

Any credit allowed but not used will have a five-year carryover provision.

OR

Section B

$

1. Enter the cost of the motor vehicle ....................................................................................

Draft

10%

2. Rate ...................................................................................................................................

7/31/15

$

3. Multiply line 1 by line 2 .......................................................................................................

1,500

$

4. Limitation ............................................................................................................................

$

5. Total - Enter the lesser of line 3 or line 4 (Enter here and on Part 4, line 1) .....................

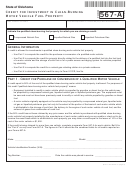

Part 2 - Credit for Property Directly Related to the Delivery of a Qualified

Fuel into the Fuel Tank of a Motor Vehicle and the Storage of such Fuel or

for a Public Access Recharging System for Vehicles Propelled by Electricity

A per-location credit of 75% of the cost of the qualified clean-burning motor vehicle fuel property is allowed. For pur-

poses of this credit “qualified clean-burning motor vehicle fuel property” means property, not including a building and

its structural components, which is:

• directly related to the delivery of compressed natural gas, liquefied natural gas or liquefied petroleum gas, for

commercial purposes or for a fee or charge, into the fuel tank of a motor vehicle propelled by such fuel including

compression equipment and storage tanks for such fuel at the point where such fuel is so delivered but only if

such property is not used to deliver such fuel into any other type of storage tank or receptacle and such fuel is

not used for any purpose other than to propel a motor vehicle, or

• a metered-for-fee, public access recharging system for motor vehicles propelled in whole or in part by electricity.

The property must be new, and must not have been previously installed or used to refuel vehicles powered by com-

pressed natural gas, liquefied natural gas or liquefied petroleum gas, hydrogen or electricity.

Provide documentation to substantiate the cost entered on line 1.

$

1. Enter the cost of the qualified clean-burning motor vehicle fuel property ..........................

75%

2. Rate ...................................................................................................................................

3. Total - Multiply line 1 by line 2 (Enter here and on Part 4, line 2) ......................................

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3