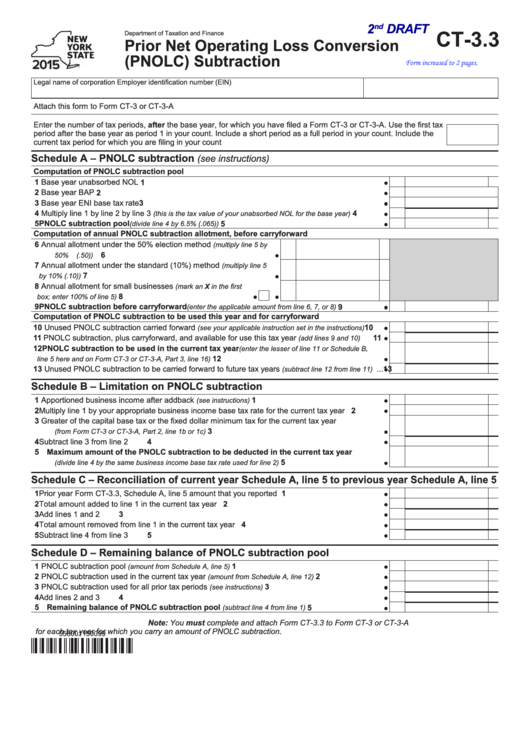

Form Ct-3.3 Draft - Prior Net Operating Loss Conversion (Pnolc) Subtraction - 2015

ADVERTISEMENT

2

DRAFT

nd

CT-3.3

Department of Taxation and Finance

Prior Net Operating Loss Conversion

(PNOLC) Subtraction

Form increased to 2 pages.

Legal name of corporation

Employer identification number (EIN)

Attach this form to Form CT-3 or CT-3-A

Enter the number of tax periods, after the base year, for which you have filed a Form CT-3 or CT-3-A. Use the first tax

period after the base year as period 1 in your count. Include a short period as a full period in your count. Include the

current tax period for which you are filing in your count .....................................................................................................

Schedule A – PNOLC subtraction

(see instructions)

Computation of PNOLC subtraction pool

1 Base year unabsorbed NOL .............................................................................................................

1

2 Base year BAP .................................................................................................................................

2

3 Base year ENI base tax rate ............................................................................................................

3

4 Multiply line 1 by line 2 by line 3

............

4

(this is the tax value of your unabsorbed NOL for the base year)

5 PNOLC subtraction pool

......................................................................

5

(divide line 4 by 6.5% (.065))

Computation of annual PNOLC subtraction allotment, before carryforward

6 Annual allotment under the 50% election method

(multiply line 5 by

6

.....................................................................................

50% (.50))

7 Annual allotment under the standard (10%) method

(multiply line 5

................................................................................

7

by 10% (.10))

8 Annual allotment for small businesses

(mark an X in the first

......................................................

8

box; enter 100% of line 5)

9 PNOLC subtraction before carryforward

................

9

(enter the applicable amount from line 6, 7, or 8)

Computation of PNOLC subtraction to be used this year and for carryforward

10 Unused PNOLC subtraction carried forward

........

10

(see your applicable instruction set in the instructions)

11 PNOLC subtraction, plus carryforward, and available for use this tax year

........

11

(add lines 9 and 10)

12 PNOLC subtraction to be used in the current tax year

(enter the lesser of line 11 or Schedule B,

.......................................................................

12

line 5 here and on Form CT-3 or CT-3-A, Part 3, line 16)

13 Unused PNOLC subtraction to be carried forward to future tax years

13

...

(subtract line 12 from line 11)

Schedule B – Limitation on PNOLC subtraction

1 Apportioned business income after addback

..........................................................

1

(see instructions)

2 Multiply line 1 by your appropriate business income base tax rate for the current tax year .............

2

3 Greater of the capital base tax or the fixed dollar minimum tax for the current tax year

3

.................................................................................

(from Form CT-3 or CT-3-A, Part 2, line 1b or 1c)

4 Subtract line 3 from line 2 .................................................................................................................

4

5 Maximum amount of the PNOLC subtraction to be deducted in the current tax year

...............................................

5

(divide line 4 by the same business income base tax rate used for line 2)

Schedule C – Reconciliation of current year Schedule A, line 5 to previous year Schedule A, line 5

1 Prior year Form CT-3.3, Schedule A, line 5 amount that you reported .............................................

1

2 Total amount added to line 1 in the current tax year ........................................................................

2

3 Add lines 1 and 2 ..............................................................................................................................

3

4 Total amount removed from line 1 in the current tax year ................................................................

4

5 Subtract line 4 from line 3 .................................................................................................................

5

Schedule D – Remaining balance of PNOLC subtraction pool

1 PNOLC subtraction pool

...................................................................

1

(amount from Schedule A, line 5)

2 PNOLC subtraction used in the current tax year

............................

2

(amount from Schedule A, line 12)

3 PNOLC subtraction used for all prior tax periods

....................................................

3

(see instructions)

4 Add lines 2 and 3 ..............................................................................................................................

4

5 Remaining balance of PNOLC subtraction pool

...................................

5

(subtract line 4 from line 1)

Note: You must complete and attach Form CT-3.3 to Form CT-3 or CT-3-A

for each tax year for which you carry an amount of PNOLC subtraction.

558001150099

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2