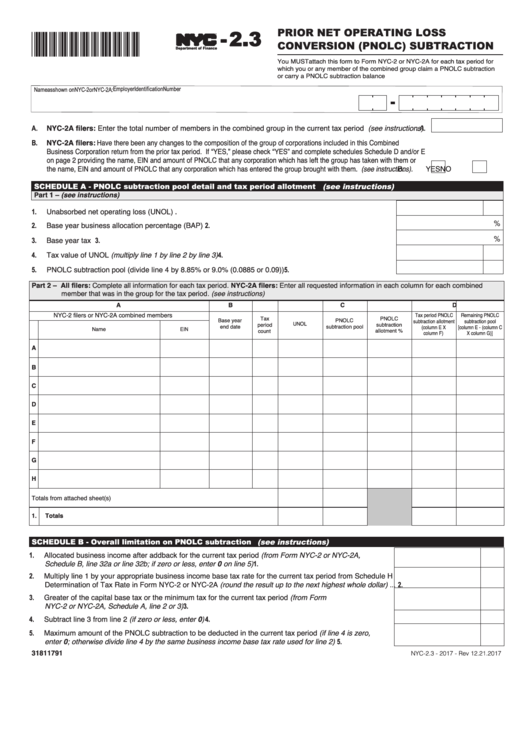

Form Nyc-2.3 - Prior Net Operating Loss Conversion (Pnolc) Subtraction

ADVERTISEMENT

- 2.3

PRIOR NET OPERATING LOSS

CONVERSION (PNOLC) SUBTRACTION

31811791

TM

Department of Finance

You MUST attach this form to Form NYC-2 or NYC-2A for each tax period for

which you or any member of the combined group claim a PNOLC subtraction

or carry a PNOLC subtraction balance

NYC-2A filers: Enter the total number of members in the combined group in the current tax period (see instructions)..A.

A.

NYC-2A filers: Have there been any changes to the composition of the group of corporations included in this Combined

B.

Business Corporation return from the prior tax period. If “YES,” please check “YES” and complete schedules Schedule D and/or E

on page 2 providing the name, EIN and amount of PNOLC that any corporation which has left the group has taken with them or

the name, EIN and amount of PNOLC that any corporation which has entered the group brought with them. (see instructions)............B.

YES

NO

SCHEDULE A - PNOLC subtraction pool detail and tax period allotment (see instructions)

Part 1 – (see instructions)

1.

Unabsorbed net operating loss (UNOL)........................................................................................................1.

2.

Base year business allocation percentage (BAP) ........................................................................................ 2.

%

3.

Base year tax rate ........................................................................................................................................ 3.

%

Tax value of UNOL (multiply line 1 by line 2 by line 3) ......................................................................................... 4.

4.

PNOLC subtraction pool (divide line 4 by 8.85% or 9.0% (0.0885 or 0.09)).................................................................... 5.

5.

Part 2 – All filers: Complete all information for each tax period. NYC-2A filers: Enter all requested information in each column for each combined

member that was in the group for the tax period. (see instructions)

A

B

C

D

E

F

G

H

NYC-2 filers or NYC-2A combined members

Tax period PNOLC

Remaining PNOLC

Tax

PNOLC

Base year

PNOLC

subtraction allotment

subtraction pool

UNOL

period

subtraction

end date

subtraction pool

(column E X

[column E - (column C

Name

EIN

count

allotment %

column F)

X column G)]

A

B

C

D

E

F

G

H

Totals from attached sheet(s)...............................................................................................

1.

Totals...........................................................................................................................

SCHEDULE B - Overall limitation on PNOLC subtraction (see instructions)

Allocated business income after addback for the current tax period (from Form NYC-2 or NYC-2A,

1.

Schedule B, line 32a or line 32b; if zero or less, enter 0 on line 5) ............................................................. 1.

2.

Multiply line 1 by your appropriate business income base tax rate for the current tax period from Schedule H

Determination of Tax Rate in Form NYC-2 or NYC-2A (round the result up to the next highest whole dollar) ... 2.

Greater of the capital base tax or the minimum tax for the current tax period (from Form

3.

NYC-2 or NYC-2A, Schedule A, line 2 or 3)................................................................................................. 3.

Subtract line 3 from line 2 (if zero or less, enter 0) ...................................................................................... 4.

4.

5.

Maximum amount of the PNOLC subtraction to be deducted in the current tax period (if line 4 is zero,

enter 0; otherwise divide line 4 by the same business income base tax rate used for line 2) .................... 5.

31811791

NYC-2.3 - 2017 - Rev 12.21.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2