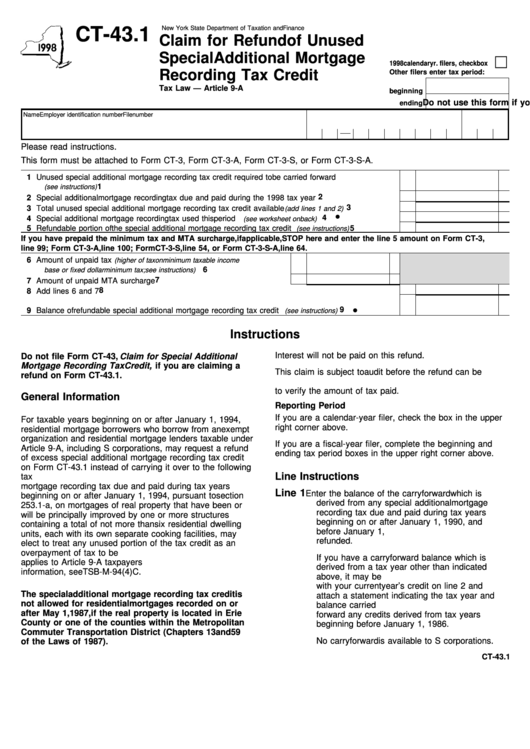

Form Ct-43.1 - Claim For Refund Of Unused Special Additional Mortgage Recording Tax Credit - 1998

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-43.1

Claim for Refund of Unused

Special Additional Mortgage

□

1998 calendar yr. filers, check box

Recording Tax Credit

Other filers enter tax period:

Tax Law — Article 9-A

beginning

Do not use this form if you file Form CT-43.

ending

Name

Employer identification number

File number

Please read instructions.

This form must be attached to Form CT-3, Form CT-3-A, Form CT-3-S, or Form CT-3-S-A.

1 Unused special additional mortgage recording tax credit required to be carried forward

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

(see instructions)

2

2 Special additional mortgage recording tax due and paid during the 1998 tax year . . . . . . . . . . . . . . . . . . . . . .

3

3 Total unused special additional mortgage recording tax credit available

. . . . . . . . . . . . . . .

(add lines 1 and 2)

●

4

4 Special additional mortgage recording tax used this period

. . . . . . . . . . . . . . . . . . . . . .

(see worksheet on back)

5 Refundable portion of the special additional mortgage recording tax credit

. . . . . . . . . . . . . .

5

(see instructions)

If you have prepaid the minimum tax and MTA surcharge, if applicable, STOP here and enter the line 5 amount on Form CT-3,

line 99; Form CT-3-A, line 100; Form CT-3-S, line 54, or Form CT-3-S-A, line 64.

6 Amount of unpaid tax

(higher of tax on minimum taxable income

. . . . . . . . . . . . . . . . . . . . . . . . .

6

base or fixed dollar minimum tax; see instructions )

7

7 Amount of unpaid MTA surcharge. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

●

. . . . . . . . . . . . . . . . . 9

9 Balance of refundable special additional mortgage recording tax credit

(see instructions)

Instructions

Interest will not be paid on this refund.

Do not file Form CT-43, Claim for Special Additional

Mortgage Recording Tax Credit, if you are claiming a

This claim is subject to audit before the refund can be

refund on Form CT-43.1.

issued. You will be asked to provide additional information

to verify the amount of tax paid.

General Information

Reporting Period

If you are a calendar-year filer, check the box in the upper

For taxable years beginning on or after January 1, 1994,

right corner above.

residential mortgage borrowers who borrow from an exempt

organization and residential mortgage lenders taxable under

If you are a fiscal-year filer, complete the beginning and

Article 9-A, including S corporations, may request a refund

ending tax period boxes in the upper right corner above.

of excess special additional mortgage recording tax credit

on Form CT-43.1 instead of carrying it over to the following

Line Instructions

tax year. Taxpayers claiming a credit for special additional

mortgage recording tax due and paid during tax years

Line 1

Enter the balance of the carryforward which is

beginning on or after January 1, 1994, pursuant to section

derived from any special additional mortgage

253.1-a, on mortgages of real property that have been or

recording tax due and paid during tax years

will be principally improved by one or more structures

beginning on or after January 1, 1990, and

containing a total of not more than six residential dwelling

before January 1, 1994. This amount may not be

units, each with its own separate cooking facilities, may

refunded.

elect to treat any unused portion of the tax credit as an

overpayment of tax to be refunded. This refund provision

If you have a carryforward balance which is

applies to Article 9-A taxpayers only. For additional

derived from a tax year other than indicated

information, see TSB-M-94(4)C.

above, it may be refunded. Include such amount

with your current year’s credit on line 2 and

The special additional mortgage recording tax credit is

attach a statement indicating the tax year and

not allowed for residential mortgages recorded on or

balance carried forward. You may not carry

after May 1, 1987, if the real property is located in Erie

forward any credits derived from tax years

County or one of the counties within the Metropolitan

beginning before January 1, 1986.

Commuter Transportation District (Chapters 13 and 59

No carryforward is available to S corporations.

of the Laws of 1987).

CT-43.1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2