Instructions For Maryland Income Tax Return Form 515 - 2002

ADVERTISEMENT

-aA ----..

tt:sL pt31r1y.

--_--_ --__.- -_- ---__-..

Thnrn care cavclraa Mnalt& for failing to

,11”1U

“I_

.z~.II” p

D pay any tax when

nn+

Ition. The penalties

VuI IID I Iv& paid.

lnn-iA

+-yes, the Comptroller

i against the salary,

--t----- --

-I--,

-.-.

dence in Maryland during the taxable year,

EmI

additions

34,49-54,56 and 58.

If,Maryland

mation at the top of the form through the

widow(er)

Form 505.

widow(er),

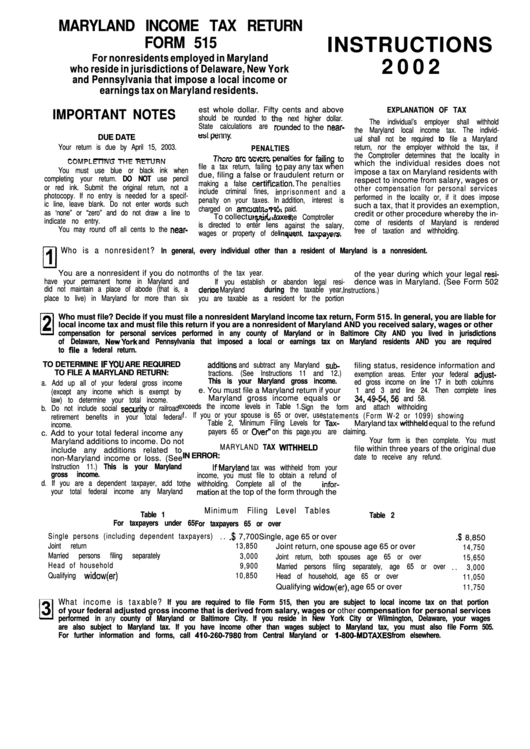

MARYLAND INCOME TAX RETURN

FORM 515

INSTRUCTIONS

For nonresidents employed in Maryland

2 0 0 2

who reside in jurisdictions of Delaware, New York

and Pennsylvania that impose a local income or

earnings tax on Maryland residents.

est whole dollar. Fifty cents and above

EXPLANATION OF TAX

IMPORTANT NOTES

should be rounded to thl e next higher dollar.

The individual’s employer shall withhold

State calculations are r( lunded to the near-

the Maryland local income tax. The individ-

DUE DATE

ual shall not be required to file a Maryland

Your return is due by April 15, 2003.

return, nor the employer withhold the tax, if

PENALTIES

the Comptroller determines that the locality in

COMPLETING THE RETURN

which the individual resides does not

file a tax return, failing b

You must use blue or black ink when

impose a tax on Maryland residents with

due, filing a false or fr

audulent return or

completing your return. DO NOT use pencil

respect to income from salary, wages or

making a false certifica

or red ink. Submit the original return, not a

other compensation for personal services

include criminal fines, ir

nprisonment and a

photocopy. If no entry is needed for a specif-

performed in the locality or, if it does impose

penalty on your taxes. In

addition, interest is

ic line, leave blank. Do not enter words such

such a tax, that it provides an exemption,

charged on amcl*n+e

as ‘none” or “zero” and do not draw a line to

credit or other procedure whereby the in-

To collect t + , I+.,pIU Lcl l

indicate no entry.

come of residents of Maryland is rendered

is directed to enter liens

You may round off all cents to the near-

free of taxation and withholding.

wages or property of del..

inauent taxnaver~

Who is a nonresident?

In general, every individual other than a resident of Maryland is a nonresident.

You are a nonresident if you do not

months of the tax year.

of the year during which your legal resi-

have your permanent home in Maryland and

If you establish or abandon legal resi-

dence was in Maryland. (See Form 502

did not maintain a place of abode (that is, a

Instructions.)

place to live) in Maryland for more than six

you are taxable as a resident for the portion

Who must file? Decide if you must file a nonresident Maryland income tax return, Form 515. In general, you are liable for

local income tax and must file this return if you are a nonresident of Maryland AND you received salary, wages or other

compensation for personal services performed in any county of Maryland or in Baltimore City AND you lived in jurisdictions

of Delaware, NewYork

and Pennsylvania that imposed a local or earnings tax on Maryland residents AND you are required

to file a federal return.

TO DETERMINE IFYOU ARE REQUIRED

and subtract any Maryland sub-

filing status, residence information and

TO FILE A MARYLAND RETURN:

tractions. (See Instructions 11 and 12.)

exemption areas. Enter your federal adjust-

This is your Maryland gross income.

ed gross income on line 17 in both columns

a. Add up all of your federal gross income

e. You must file a Maryland return if your

1 and 3 and line 24. Then complete lines

(except any income which is exempt by

Maryland gross income equals or

law) to determine your total income.

exceeds the income levels in Table 1.

Sign the form and attach withholding

b. Do not include social security

or railroad

f . If you or your spouse is 65 or over, use

statements (Form W-2 or 1099) showing

retirement benefits in your total federal

Table 2, ‘Minimum Filing Levels for Tax-

Maryland tax withheld equal to the refund

income.

payers 65 or Over” on this page.

you are claiming.

c. Add to your total federal income any

Your form is then complete. You must

Maryland additions to income. Do not

MARYLAND TAX WtTHHELD

file within three years of the original due

include any additions related to

IN ERROR:

date to receive any refund.

non-Maryland income or loss. (See

Instruction 11.) This is your Maryland

tax was withheld from your

gross

income.

income, you must file to obtain a refund of

d. If you are a dependent taxpayer, add to

the withholding. Complete all of the infor-

your total federal income any Maryland

Minimum Filing Level Tables

Table 1

Table 2

For taxpayers under 65

For taxpayers 65 or over

Single persons (including dependent taxpayers) . . .$ 7,700

Single, age 65 or over . . . . . . . . . . . . . . . . . . . . .$ 8,850

Joint

return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13,850

Joint return, one spouse age 65 or over . . . . . . . . . 14,750

Married

persons

filing

separately . . . . . . . . . . . . . .

3,000

Joint return, both spouses age 65 or over . . . . . . . 15,650

Head of household . . . . . . . . . . . . . . . . . . . . . . . .

9,900

Married persons filing separately, age 65 or over . .

3,000

Qualifying

10,850

. . . . . . . . . . . . . . . . . . . . . . .

Head of household, age 65 or over . . . . . . . . . . . . 11,050

Qualifying

age 65 or over . . . . . . . . . . . 11,750

What income is taxable?

If you are required to file Form 515, then you are subject to local income tax on that portion

of your federal adjusted gross income that is derived from salary, wages or other compensation for personal services

performed in any county of Maryland or Baltimore City. If you reside in New York City or Wilmington, Delaware, your wages

are also subject to Maryland tax. If you have income other than wages subject to Maryland tax, you must also file

For further information and forms, call 416-260-7980

from Central Maryland or l-809-MDTAXES

from elsewhere.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8