Form Rct-127a - Public Utility Realty Tax Report For 1999 Pursuant To Act 4 0f 1999 Page 2

ADVERTISEMENT

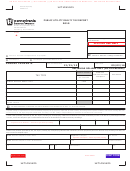

RCT-127A

SCHEDULE 1

Page 2

)

(PART 1

PENNSYLVANIA

DEPARTMENT OF

evenue

1999 COUNTY SUMMARIES

PURTA UTILITY REALTY TAX REPORT

UTILITY NAME

BOX # (ID)

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

PURTA – REAL ESTATE

COMMON LEVEL RATIO

EQUALIZED TAXABLE VALUE

APPEALED ASSESSMENTS

COUNTY

COUNTY

STATE TAXABLE VALUE

COUNTY ASSESSED VALUE

(CLR) FACTOR*

COLUMN 1 X COLUMN 2

STIPULATED

COLUMN 3 + COLUMN 4

CODE

NAME

DO NOT INCLUDE PENDING

(EFFECTIVE 7-1-99)

(ALSO COMPLETE

MARKET VALUE

APPEAL PARCEL VALUES

SCHEDULE 2)

01

ADAMS

2.53

02

ALLEGHENY

5.05

03

ARMSTRONG

2.04

04

BEAVER

2.57

05

BEDFORD

10.87

06

BERKS

1.04

07

BLAIR

9.01

08

BRADFORD

2.00

09

BUCKS

21.74

10

BUTLER

7.63

11

CAMBRIA

5.62

12

CAMERON

2.49

13

CARBON

11.91

14

CENTRE

2.22

15

CHESTER

1.07

16

CLARION

4.22

17

CLEARFIELD

4.55

18

CLINTON

3.08

19

COLUMBIA

2.70

20

CRAWFORD

2.43

21

CUMBERLAND

15.15

22

DAUPHIN

1.84

23

DELAWARE

1.00

24

ELK

5.81

25

ERIE

11.77

26

FAYETTE

9.43

27

FOREST

3.37

28

FRANKLIN

13.70

29

FULTON

5.68

30

GREENE

3.61

31

HUNTINGDON

4.88

32

INDIANA

5.99

33

JEFFERSON

4.90

34

JUNIATA

7.09

01-34

SUBTOTAL

*The real estate valuation factors are based on sales data complied by the PA State Tax Equalization Board. These factors are the mathematical recipro-

cals of the actual common level ratios.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8