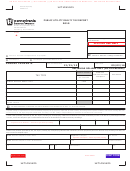

Form Rct-127a - Public Utility Realty Tax Report For 1999 Pursuant To Act 4 0f 1999 Page 3

ADVERTISEMENT

RCT-127A

SCHEDULE 1

Page 3

(PART 2)

PENNSYLVANIA

DEPARTMENT OF

evenue

1999 COUNTY SUMMARIES

PURTA UTILITY REALTY TAX REPORT

UTILITY NAME

BOX # (ID)

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

PURTA – REAL ESTATE

COMMON LEVEL RATIO

EQUALIZED TAXABLE VALUE

APPEALED ASSESSMENTS

STATE TAXABLE VALUE

COUNTY

COUNTY

COUNTY ASSESSED VALUE

(CLR) FACTOR*

COLUMN 1 X COLUMN 2

STIPULATED

COLUMN 3 + COLUMN 4

CODE

NAME

DO NOT INCLUDE PENDING

(EFFECTIVE 7-1-99)

(ALSO COMPLETE

MARKET VALUE

APPEAL PARCEL VALUES

SCHEDULE 2)

35

LACKAWANNA

4.72

36

LANCASTER

1.05

37

LAWRENCE

5.06

38

LEBANON

10.87

39

LEHIGH

2.03

40

LUZERNE

13.33

41

LYCOMING

1.43

42

MCKEAN

3.92

43

MERCER

9.35

44

MIFFLIN

2.00

45

MONROE

4.22

46

MONTGOMERY

1.04

47

MONTOUR

9.90

48

NORTHAMPTON

2.00

49

NORTHUMBERLAND

14.09

50

PERRY

7.63

51

PHILADELPHIA

3.33

52

PIKE

3.05

53

POTTER

7.81

54

SCHUYLKILL

2.20

55

SNYDER

5.24

56

SOMERSET

2.14

57

SULLIVAN

3.51

58

SUSQUEHANNA

2.03

59

TIOGA

2.87

60

UNION

5.41

61

VENANGO

5.08

62

WARREN

2.40

63

WASHINGTON

5.16

64

WAYNE

11.36

65

WESTMORELAND

3.85

66

WYOMING

3.53

67

YORK

1.06

35-67

SUBTOTAL

01-67

TOTAL

*The real estate valuation factors are based on sales data complied by the PA State Tax Equalization Board. These factors are the mathematical recipro-

cals of the actual common level ratios.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8