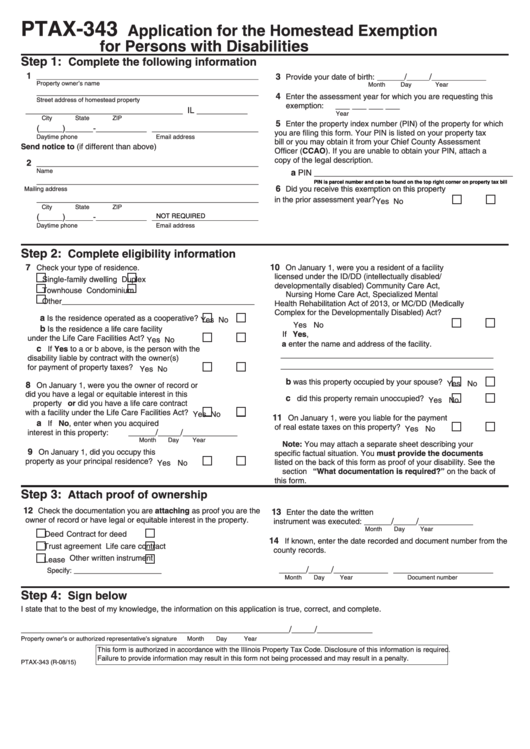

PTAX-343

Application for the Homestead Exemption

for Persons with Disabilities

Step 1:

Complete the following information

1

________________________________________________

3

______/_____/____________

Provide your date of birth:

Property owner’s name

Month

Day

Year

________________________________________________

4

Enter the assessment year for which you are requesting this

Street address of homestead property

___ ___ ___ ___

exemption:

__________________________________ IL ___________

Year

City

State

ZIP

5

Enter the property index number (PIN) of the property for which

(_____)______-___________

_______________________

you are filing this form. Your PIN is listed on your property tax

Daytime phone

Email address

bill or you may obtain it from your Chief County Assessment

Send notice to (if different than above)

Officer (CCAO). If you are unable to obtain your PIN, attach a

copy of the legal description.

2

________________________________________________

a

Name

PIN ___________________________________________

________________________________________________

PIN is parcel number and can be found on the top right corner on property tax bill

6

Did you receive this exemption on this property

Mailing address

________________________________________________

in the prior assessment year?

Yes

No

City

State

ZIP

(_____)______-___________

_______________________

NOT REQUIRED

Daytime phone

Email address

Step 2:

Complete eligibility information

10

7

On January 1, were you a resident of a facility

Check your type of residence.

licensed under the ID/DD (intellectually disabled/

Single-family dwelling

Duplex

developmentally disabled) Community Care Act,

Townhouse

Condominium

Nursing Home Care Act, Specialized Mental

Other____________________________________________

Health Rehabilitation Act of 2013, or MC/DD (Medically

Complex for the Developmentally Disabled) Act?

a

Is the residence operated as a cooperative?

Yes

No

Yes

No

b

Is the residence a life care facility

If Yes,

under the Life Care Facilities Act?

Yes

No

a enter the name and address of the facility.

c

If Yes to a or b above, is the person with the

_________________________________________________

disability liable by contract with the owner(s)

_________________________________________________

for payment of property taxes?

Yes

No

b

was this property occupied by your spouse?

Yes

No

8

On January 1, were you the owner of record or

did you have a legal or equitable interest in this

c

did this property remain unoccupied?

Yes

No

property or did you have a life care contract

with a facility under the Life Care Facilities Act?

Yes

No

11

On January 1, were you liable for the payment

a

If No, enter when you acquired

of real estate taxes on this property?

Yes

No

______/_____/____________

interest in this property:

Month

Day

Year

Note: You may attach a separate sheet describing your

9

On January 1, did you occupy this

specific factual situation. You must provide the documents

property as your principal residence?

listed on the back of this form as proof of your disability. See the

Yes

No

section “What documentation is required?” on the back of

this form.

Step 3:

Attach proof of ownership

12

Check the documentation you are attaching as proof you are the

13

Enter the date the written

owner of record or have legal or equitable interest in the property.

______/_____/____________

instrument was executed:

Month

Day

Year

Deed

Contract for deed

14

If known, enter the date recorded and document number from the

Trust agreement

Life care contract

county records.

Other written instrument

Lease

______/_____/____________

______________________

____________________

Specify:

Month

Day

Year

Document number

Step 4:

Sign below

I state that to the best of my knowledge, the information on this application is true, correct, and complete.

____________________________________________________

______/_____/____________

Property owner’s or authorized representative’s signature

Month

Day

Year

This form is authorized in accordance with the Illinois Property Tax Code. Disclosure of this information is required.

Failure to provide information may result in this form not being processed and may result in a penalty.

PTAX-343 (R-08/15)

1

1 2

2