Instructions For Form 8839 Draft - 2009 Page 4

ADVERTISEMENT

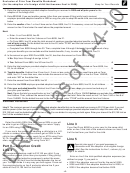

Exclusion of Prior Year Benefits Worksheet

(for the adoption of a foreign child that became final in 2009)

Keep for Your Records

1. Enter the total employer-provided adoption benefits you received in 2009 and all prior years for the

adoption of the foreign child . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Enter $12,150. If you and another person (other than your spouse if filing jointly) each received

employer-provided adoption benefits in 2009 or any prior year to adopt the same child, see instructions

below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Enter the smaller of line 1 or line 2 here and on Form 8839, line 19. If necessary, cross out the preprinted

amount on line 19 and enter the result above the preprinted amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Next:

•

Enter -0- on Form 8839, line 20.

•

Enter the amount from line 3 above on Form 8839, line 21.

•

On Form 8839, line 22, enter the total amount of employer-provided adoption benefits received in 2009

and all prior years. On the dotted line next to line 22, enter “PYAB” and the total amount of benefits you

received before 2009.

•

Complete Form 8839 through line 30. Then, complete lines 4 through 9 below to figure the amount of any

prior year benefits you can exclude and the taxable benefits, if any, to enter on Form 8839, line 31.

4. Is the amount on your 2009 Form 8839, line 30, less than the amount on Form 8839, line 23?

❏ No. Skip lines 4 through 6 and go to line 7.

❏ Yes. Subtract Form 8839, line 30 from line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Enter the total employer-provided adoption benefits you received before 2009 included on Form 8839, line

22, for all children . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Taxable benefits. Subtract line 5 from line 4. If zero or less, enter -0-. Enter the result here and on Form

8839, line 31. If more than zero, also include this amount on line 7 of Form 1040 or line 8 of Form 1040NR,

and enter “AB” on the dotted line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Enter the amount from Form 8839, line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Enter the total 2009 employer-provided adoption benefits included on Form 8839, line 22, for all children . . .

8.

9. Prior year excluded benefits. Subtract line 8 from line 7. If zero or less, stop; you cannot exclude any of

your prior year benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Next. Figure the total you would enter on line 7 of Form 1040 or line 8 of Form 1040NR before you exclude the amount from

line 9 above. Then, subtract the amount from line 9 above from that total. Enter the result on line 7 of Form 1040 or line 8 of

Form 1040NR. On the dotted line next to the line for wages, enter “PYAB” and the amount from line 9 above.

Worksheet Instructions

Line 2. The maximum amount of employer-provided adoption benefits that can be excluded from income is $12,150 per child. If you and

another person (other than your spouse if filing jointly) each received employer-provided adoption benefits to adopt the same child, the

$12,150 limit must be divided between the two of you. You can divide it in any way you both agree. Enter your share of the $12,150 limit on

line 2 of the worksheet above.

Enter the child’s SSN if the child has an SSN or you will

Line 3

be able to get an SSN in time to file your tax return. Apply

for an SSN using Form SS-5.

If you filed Form 8839 for a prior year for the same child,

enter on line 3 the total of the amounts shown on lines 3 and

If you are in the process of adopting a child who is a U.S.

6 of the last form you filed for the child.

citizen or resident alien but you cannot get an SSN for the

child in time to file your return, apply for an ATIN using Form

W-7A. However, if the child is not a U.S. citizen or resident

Line 5

alien, apply instead for an ITIN using Form W-7.

Special rules apply if you paid expenses in

Part II—Adoption Credit

!

connection with the adoption of an eligible foreign

child. See the instructions for line 1, column (e), on

CAUTION

Line 2

page 3 for details.

The maximum adoption credit is $12,150 per child. If you

and another person (other than your spouse if filing jointly)

Enter on line 5 the total qualified adoption expenses (as

each paid qualified adoption expenses to adopt the same

defined on page 1) you paid in:

child, the $12,150 limit must be divided between the two of

•

2008 if the adoption was not final by the end of 2009,

you. You can divide it in any way you both agree. Cross out

•

2008 and 2009 if the adoption became final in 2009, or

the preprinted entry on line 2 and enter above line 2 your

•

share of the $12,150 limit for that child.

2009 if the adoption became final before 2009.

-4-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6