Instructions For Form 8839 Draft - 2009 Page 6

ADVERTISEMENT

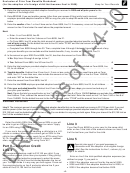

Modified Adjusted Gross Income (AGI) Worksheet—Line 26

Keep for Your Records

Before you begin:

If you file Form 1040, complete lines 8a through 21, 23 through 32, and 36 if they apply.

If you file Form 1040NR, complete lines 9a through 21, 24 through 31, and 34 if they apply.

1. Enter the amount you would enter on line 7 of Form 1040 or line 8 of Form 1040NR if you could exclude the total

amount on Form 8839, line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Enter the amount from Form 8839, line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Form 1040 filers, enter the total of lines 8a, 9a, 10 through 14, 15b, 16b, 17 through 19, 20b, and 21. Form

1040NR filers, enter the total of lines 9a, 10a, 11 through 15, 16b, 17b, and 18 through 21 . . . . . . . . . . . . . . . .

3.

4. Add lines 1, 2, and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Form 1040 filers, enter the total of lines 23 through 32, and any write-in adjustments entered on the dotted line

next to line 36. Form 1040NR filers, enter the total of lines 24 through 31 and any write-in adjustments entered on

the dotted line next to line 34. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Form 1040 filers, increase the amount on line 6 above by the total of the following amounts. Enter the total on

Form 8839, line 26.

•

Any amount from Form 2555, lines 45 and 50, Form 2555-EZ, line 18, and Form 4563, line 15, and

•

Any exclusion of income from Puerto Rico.

Form 1040NR filers, enter on Form 8839, line 26, the amount from line 6 above.

Special rules apply if the prior year benefits were

Line 16

!

received in connection with the adoption of a foreign

If you are claiming the child tax credit for 2009, include on

child and the adoption became final in 2009. See

CAUTION

this line the amount from line 12 of the Line 11 Worksheet in

Exclusion of prior year benefits on page 3.

Pub. 972.

Line 26

If you are not claiming the child tax credit for 2009,

TIP

you do not need Pub. 972.

Use the worksheet above to figure your modified adjusted

gross income.

Your modified adjusted gross income (AGI) for the

Line 18—Credit Carryforward to 2010

!

adoption credit may not be the same as the modified

If Form 8839, line 17, is smaller than line 14, you may have

AGI figured in the worksheet above. If you are taking

CAUTION

an unused credit to carry forward to the next 5 years or until

the credit, be sure to read the instructions for line 8 on page

used, whichever comes first. Use the worksheet on page 5

5 before you enter an amount on that line.

to figure the amount of your credit carryforward. If you have

any unused credit to carry forward to 2010, be sure you

Paperwork Reduction Act Notice. We ask for the

keep the worksheet. You will need it to figure your credit for

information on this form to carry out the Internal Revenue

2010.

laws of the United States. You are required to give us the

information. We need it to ensure that you are complying

Part III—Employer-Provided

with these laws and to allow us to figure and collect the right

Adoption Benefits

amount of tax.

You are not required to provide the information requested

Line 19

on a form that is subject to the Paperwork Reduction Act

The maximum amount that can be excluded from income for

unless the form displays a valid OMB control number. Books

employer-provided adoption benefits is $12,150 per child. If

or records relating to a form or its instructions must be

you and another person (other than your spouse if filing

retained as long as their contents may become material in

jointly) each received employer-provided adoption benefits

the administration of any Internal Revenue law. Generally,

in connection with the adoption of the same eligible child,

tax returns and return information are confidential, as

the $12,150 limit must be divided between the two of you.

required by Internal Revenue Code section 6103.

You can divide it in any way you both agree. Cross out the

The average time and expenses required to complete

preprinted entry on line 19 and enter above line 19 your

and file this form will vary depending on individual

share of the $12,150 limit for that child.

circumstances. For the estimated averages, see the

instructions for your income tax return.

Line 20

If you have suggestions for making this form simpler, we

If you received employer-provided adoption benefits in a

would be happy to hear from you. See the instructions for

prior year for the same child, enter on line 20 the total of the

your income tax return.

amounts shown on lines 20 and 24 of the last Form 8839

you filed for the child.

-6-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6