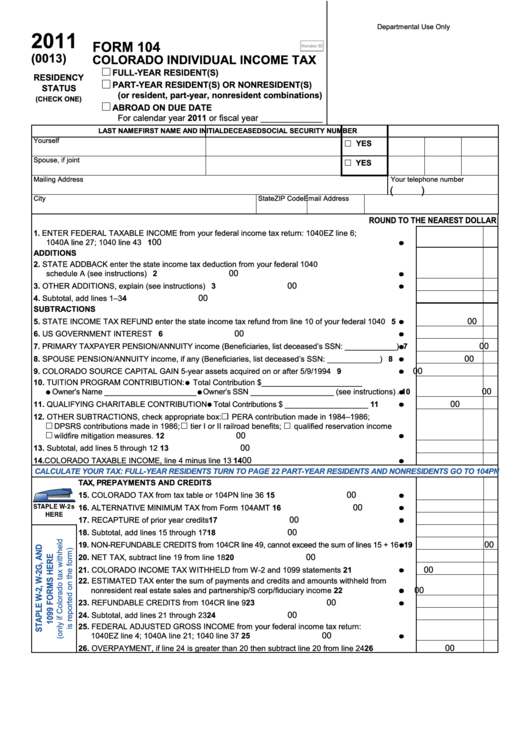

Form 104 - Colorado Individual Income Tax - 2011

ADVERTISEMENT

Departmental Use Only

2011

FORM 104

Vendor ID

(0013)

COLORADO INDIVIDUAL INCOME TAX

FULL-YEAR RESIDENT(S)

RESIDENCY

PART-YEAR RESIDENT(S) OR NONRESIDENT(S)

STATUS

(or resident, part-year, nonresident combinations)

(CHECK ONE)

ABROAD ON DUE DATE

For calendar year 2011 or fiscal year _____________

LAST NAME

FIRST NAME AND INITIAL

DECEASED

SOCIAL SECURITY NUMBER

Yourself

YES

Spouse, if joint

YES

Mailing Address

Your telephone number

(

)

City

State

ZIP Code

Email Address

ROUND TO THE NEAREST DOLLAR

1. EntEr FEDErAL tAXABLE InCOME from your federal income tax return: 1040EZ line 6;

00

1040A line 27; 1040 line 43 .......................................................................................................................

1

ADDITIONS

2. StAtE ADDBACK enter the state income tax deduction from your federal 1040

00

schedule A (see instructions) ....................................................................................................................

2

00

3. OtHEr ADDItIOnS, explain (see instructions) ........................................................................................

3

00

4. Subtotal, add lines 1–3 ................................................................................................................................ 4

SUBTRACTIONS

00

5. StAtE InCOME tAX rEFUnD enter the state income tax refund from line 10 of your federal 1040 ......

5

00

6. US GOVErnMEnt IntErESt ................................................................................................................

6

00

7. PrIMArY tAXPAYEr PEnSIOn/AnnUItY income (Beneficiaries, list deceased’s SSn: ____________)

7

00

8. SPOUSE PEnSIOn/AnnUItY income, if any (Beneficiaries, list deceased’s SSn: ____________) ......

8

00

9. COLOrADO SOUrCE CAPItAL GAIn 5-year assets acquired on or after 5/9/1994 ..............................

9

10. tUItIOn PrOGrAM COntrIBUtIOn:

total Contribution $_______________________

00

Owner’s name _____________________

Owner’s SSn ___________________ (see instructions) . 10

00

11. QUALIFYInG CHArItABLE COntrIBUtIOn

total Contributions $ ___________________ ............... 11

12. OtHEr SUBtrACtIOnS, check appropriate box:

PErA contribution made in 1984–1986;

DPSrS contributions made in 1986;

tier I or II railroad benefits;

qualified reservation income

00

wildfire mitigation measures. ................................................................................................................. 12

00

13. Subtotal, add lines 5 through 12 .................................................................................................................. 13

00

14. COLOrADO tAXABLE InCOME, line 4 minus line 13 ............................................................................. 14

CALCULATE YOUR TAX: FULL-YEAR RESIDENTS TURN TO PAGE 22 PART-YEAR RESIDENTS AND NONRESIDENTS GO TO 104PN

TAX, PREPAYMENTS AND CREDITS

00

15. COLOrADO tAX from tax table or 104Pn line 36 ............................................................... 15

00

16. ALtErnAtIVE MInIMUM tAX from Form 104AMt ............................................................ 16

00

17. rECAPtUrE of prior year credits........................................................................................ 17

00

18. Subtotal, add lines 15 through 17 ............................................................................................18

00

19. nOn-rEFUnDABLE CrEDItS from 104Cr line 49, cannot exceed the sum of lines 15 + 16 . 19

00

20. nEt tAX, subtract line 19 from line 18....................................................................................20

00

21. COLOrADO InCOME tAX WItHHELD from W-2 and 1099 statements ............................ 21

22. EStIMAtED tAX enter the sum of payments and credits and amounts withheld from

00

nonresident real estate sales and partnership/S corp/fiduciary income ............................... 22

00

23. rEFUnDABLE CrEDItS from 104Cr line 9....................................................................... 23

00

24. Subtotal, add lines 21 through 23 ............................................................................................24

25. FEDErAL ADJUStED GrOSS InCOME from your federal income tax return:

00

1040EZ line 4; 1040A line 21; 1040 line 37 .......................................................................... 25

00

26. OVErPAYMEnt, if line 24 is greater than 20 then subtract line 20 from line 24 ....................26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2