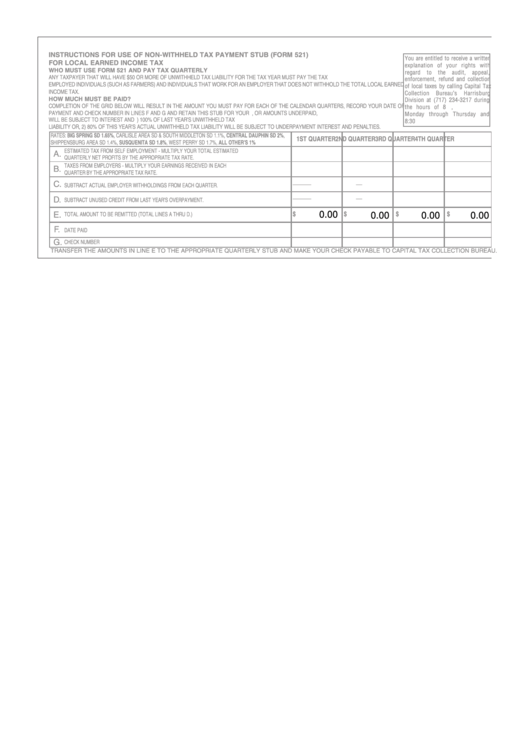

INSTRUCTIONS FOR USE OF NON-WITHHELD TAX PAYMENT STUB (FORM 521)

You are entitled to receive a written

FOR LOCAL EARNED INCOME TAX

explanation of your rights with

WHO MUST USE FORM 521 AND PAY TAX QUARTERLY

regard

to

the

audit,

appeal,

ANY TAXPAYER THAT WILL HAVE $50 OR MORE OF UNWITHHELD TAX LIABILITY FOR THE TAX YEAR MUST PAY THE TAX QUARTERLY. THIS INCLUDES SELF

enforcement, refund and collection

EMPLOYED INDIVIDUALS (SUCH AS FARMERS) AND INDIVIDUALS THAT WORK FOR AN EMPLOYER THAT DOES NOT WITHHOLD THE TOTAL LOCAL EARNED

of local taxes by calling Capital Tax

INCOME TAX.

Collection

Bureau’s

Harrisburg

HOW MUCH MUST BE PAID?

Division at (717) 234-3217 during

COMPLETION OF THE GRID BELOW WILL RESULT IN THE AMOUNT YOU MUST PAY FOR EACH OF THE CALENDAR QUARTERS, RECORD YOUR DATE OF

the hours of 8 a.m. - 4 p.m.,

PAYMENT AND CHECK NUMBER IN LINES F AND G AND RETAIN THIS STUB FOR YOUR RECORDS. AMOUNTS PAID UNTIMELY, OR AMOUNTS UNDERPAID,

Monday through Thursday and

WILL BE SUBJECT TO INTEREST AND PENALTIES. PAYMENTS THAT DO NOT AT LEAST EQUAL THE LESSER OF 1) 100% OF LAST YEAR’S UNWITHHELD TAX

8:30 a.m. - 4 p.m. Friday.

LIABILITY OR, 2) 80% OF THIS YEAR’S ACTUAL UNWITHHELD TAX LIABILITY WILL BE SUBJECT TO UNDERPAYMENT INTEREST AND PENALTIES.

RATES: BIG SPRING SD 1.65%, CARLISLE AREA SD & SOUTH MIDDLETON SD 1.1%, CENTRAL DAUPHIN SD 2%,

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

SHIPPENSBURG AREA SD 1.4%, SUSQUENITA SD 1.8%, WEST PERRY SD 1.7%, ALL OTHER’S 1%

ESTIMATED TAX FROM SELF EMPLOYMENT - MULTIPLY YOUR TOTAL ESTIMATED

A.

QUARTERLY NET PROFITS BY THE APPROPRIATE TAX RATE.

TAXES FROM EMPLOYERS - MULTIPLY YOUR EARNINGS RECEIVED IN EACH

B.

QUARTER BY THE APPROPRIATE TAX RATE.

__

__

__

__

C.

SUBTRACT ACTUAL EMPLOYER WITHHOLDINGS FROM EACH QUARTER.

__

__

__

__

D.

SUBTRACT UNUSED CREDIT FROM LAST YEAR’S OVERPAYMENT.

0.00

0.00

0.00

0.00

E.

$

$

$

$

TOTAL AMOUNT TO BE REMITTED (TOTAL LINES A THRU D.)

F.

DATE PAID

G.

CHECK NUMBER

TRANSFER THE AMOUNTS IN LINE E TO THE APPROPRIATE QUARTERLY STUB AND MAKE YOUR CHECK PAYABLE TO CAPITAL TAX COLLECTION BUREAU.

1

1 2

2