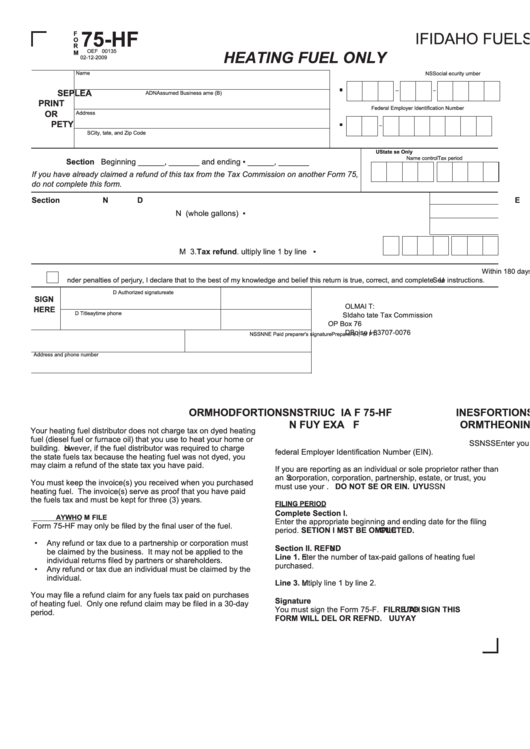

75-HF

Idaho Fuels Tax Re und Cla m

F

I

F

O

R

eF 00135

o

Heating Fuel Only

M

02-12-2009

name

social ecurity umber

s

n

PLEa

SE

assumed Business ame ( B )

n

d

a

PRINT

Federal Employer Identification Number

OR

address

Ty

PE

City, tate, and Zip Code

s

State se Only

u

name control

Tax period

Section I.

FILING PERIOD

Beginning ______, _______ and ending ▪ ______, _______

If you have already claimed a refund of this tax from the Tax Commission on another Form 75,

do not complete this form.

Section II.

R

EF

u

ND

Diesel

1.

n

ontaxable gallons (whole gallons) .............................................................................................................. ▪

2. Tax rate .........................................................................................................................................................

.25

3. Tax refund.

m

ultiply line 1 by line 2 ........................................................................................ ▪

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below.

u

nder penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct, and complete. ee instructions.

s

authorized signature

d

ate

SIGN

maI T :

l

o

HERE

Title

d

aytime phone

Idaho tate Tax Commission

s

P

o

Box 76

Boise I 83707-0076

d

Paid preparer's signature

Preparer's I ,

e

n

ssn

or PTI

n

address and phone number

I

NSTR

uc

TIONS

FOR

I a

D

HO

F

ORM

75-HF

S

PE

c

IFI

c I

NSTR

uc

TIONS

FOR

L

INES

N

OT

Fu

LL

y Ex

PL

a

INED

ON

THE

F

ORM

Your heating fuel distributor does not charge tax on dyed heating

fuel (diesel fuel or furnace oil) that you use to heat your home or

enter your name, address, and ocial ecurity number (

s

s

ssn

) or

building.

h

owever, if the fuel distributor was required to charge

federal Employer Identification Number (EIN).

the state fuels tax because the heating fuel was not dyed, you

may claim a refund of the state tax you have paid.

If you are reporting as an individual or sole proprietor rather than

an

s

corporation, corporation, partnership, estate, or trust, you

You must keep the invoice(s) you received when you purchased

must use your

ssn

. DO NOT SE O R EIN.

u

y

u

heating fuel. The invoice(s) serve as proof that you have paid

the fuels tax and must be kept for three (3) years.

FILING PERIOD

complete Section I.

WHO M

ay

FILE

Enter the appropriate beginning and ending date for the filing

Form 75-HF may only be filed by the final user of the fuel.

period. SE TION I M ST BE OMPLETED.

c

u

c

•

any refund or tax due to a partnership or corporation must

Section II. REF ND

u

be claimed by the business. It may not be applied to the

Line 1. nter the number of tax-paid gallons of heating fuel

e

individual returns filed by partners or shareholders.

purchased.

•

any refund or tax due an individual must be claimed by the

individual.

Line 3.

m

ultiply line 1 by line 2.

You may file a refund claim for any fuels tax paid on purchases

Signature

of heating fuel. Only one refund claim may be filed in a 30-day

You must sign the Form 75- F. F IL RE TO SIGN THIS

h

a

u

period.

FORM WILL DEL

ay

y

O R REF ND.

u

u

1

1