Consumers Use Tax Return Form - Alabama Department Of Revenue

ADVERTISEMENT

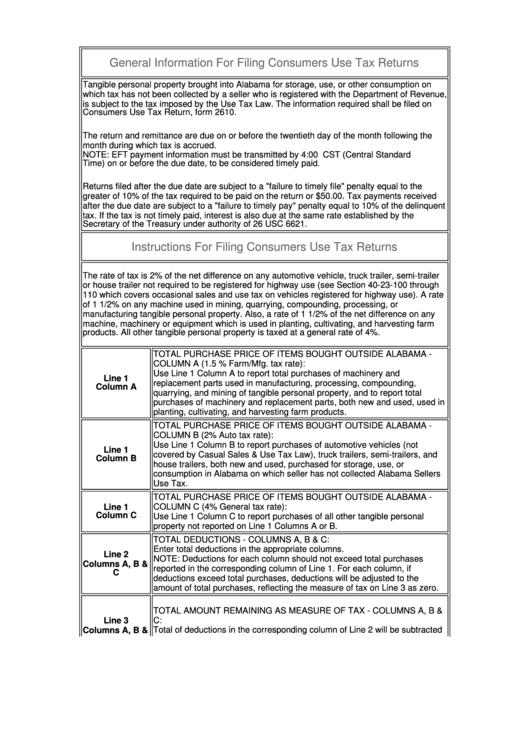

General Information For Filing Consumers Use Tax Returns

Tangible personal property brought into Alabama for storage, use, or other consumption on

which tax has not been collected by a seller who is registered with the Department of Revenue,

is subject to the tax imposed by the Use Tax Law. The information required shall be filed on

Consumers Use Tax Return, form 2610.

The return and remittance are due on or before the twentieth day of the month following the

month during which tax is accrued.

NOTE: EFT payment information must be transmitted by 4:00 p.m. CST (Central Standard

Time) on or before the due date, to be considered timely paid.

Returns filed after the due date are subject to a "failure to timely file" penalty equal to the

greater of 10% of the tax required to be paid on the return or $50.00. Tax payments received

after the due date are subject to a "failure to timely pay" penalty equal to 10% of the delinquent

tax. If the tax is not timely paid, interest is also due at the same rate established by the

Secretary of the Treasury under authority of 26 USC 6621.

Instructions For Filing Consumers Use Tax Returns

The rate of tax is 2% of the net difference on any automotive vehicle, truck trailer, semi-trailer

or house trailer not required to be registered for highway use (see Section 40-23-100 through

110 which covers occasional sales and use tax on vehicles registered for highway use). A rate

of 1 1/2% on any machine used in mining, quarrying, compounding, processing, or

manufacturing tangible personal property. Also, a rate of 1 1/2% of the net difference on any

machine, machinery or equipment which is used in planting, cultivating, and harvesting farm

products. All other tangible personal property is taxed at a general rate of 4%.

TOTAL PURCHASE PRICE OF ITEMS BOUGHT OUTSIDE ALABAMA -

COLUMN A (1.5 % Farm/Mfg. tax rate):

Use Line 1 Column A to report total purchases of machinery and

Line 1

replacement parts used in manufacturing, processing, compounding,

Column A

quarrying, and mining of tangible personal property, and to report total

purchases of machinery and replacement parts, both new and used, used in

planting, cultivating, and harvesting farm products.

TOTAL PURCHASE PRICE OF ITEMS BOUGHT OUTSIDE ALABAMA -

COLUMN B (2% Auto tax rate):

Use Line 1 Column B to report purchases of automotive vehicles (not

Line 1

covered by Casual Sales & Use Tax Law), truck trailers, semi-trailers, and

Column B

house trailers, both new and used, purchased for storage, use, or

consumption in Alabama on which seller has not collected Alabama Sellers

Use Tax.

TOTAL PURCHASE PRICE OF ITEMS BOUGHT OUTSIDE ALABAMA -

Line 1

COLUMN C (4% General tax rate):

Use Line 1 Column C to report purchases of all other tangible personal

Column C

property not reported on Line 1 Columns A or B.

TOTAL DEDUCTIONS - COLUMNS A, B & C:

Enter total deductions in the appropriate columns.

Line 2

NOTE: Deductions for each column should not exceed total purchases

Columns A, B &

reported in the corresponding column of Line 1. For each column, if

C

deductions exceed total purchases, deductions will be adjusted to the

amount of total purchases, reflecting the measure of tax on Line 3 as zero.

TOTAL AMOUNT REMAINING AS MEASURE OF TAX - COLUMNS A, B &

C:

Line 3

Total of deductions in the corresponding column of Line 2 will be subtracted

Columns A, B &

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5