Form Il-700-H - Illinois Household Employer'S Tax Return For Calendar Year 2000

ADVERTISEMENT

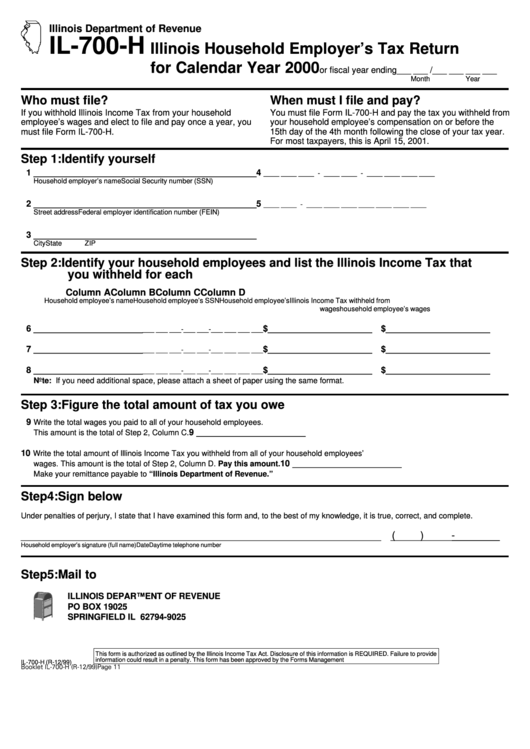

Illinois Department of Revenue

IL-700-H

Illinois Household Employer’s Tax Return

for Calendar Year 2000

or fiscal year ending ___ ___ /___ ___ ___ ___

Month

Year

Who must file?

When must I file and pay?

If you withhold Illinois Income Tax from your household

You must file Form IL-700-H and pay the tax you withheld from

employee’s wages and elect to file and pay once a year, you

your household employee’s compensation on or before the

must file Form IL-700-H.

15th day of the 4th month following the close of your tax year.

For most taxpayers, this is April 15, 2001.

Step 1: Identify yourself

1 _______________________________________________ 4

____ ____ ____ - ____ ____ - ____ ____ ____ ____

Household employer’s name

Social Security number (SSN)

2 _______________________________________________ 5

____ ____ - ____ ____ ____ ____ ____ ____ ____

Street address

Federal employer identification number (FEIN)

3 _______________________________________________

City

State

ZIP

Step 2: Identify your household employees and list the Illinois Income Tax that

you withheld for each

Column A

Column B

Column C

Column D

Household employee’s name

Household employee’s SSN

Household employee’s

Illinois Income Tax withheld from

wages

household employee’s wages

6 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

7 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

8 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

Note: If you need additional space, please attach a sheet of paper using the same format.

Step 3: Figure the total amount of tax you owe

9

Write the total wages you paid to all of your household employees.

9 _______________________

This amount is the total of Step 2, Column C.

10

Write the total amount of Illinois Income Tax you withheld from all of your household employees’

10 _______________________

wages. This amount is the total of Step 2, Column D. Pay this amount.

Make your remittance payable to “Illinois Department of Revenue.”

Step 4: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

(

)

-

_____________________________________________________________________

_______________________

Household employer’s signature (full name)

Date

Daytime telephone number

Step 5: Mail to

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19025

SPRINGFIELD IL 62794-9025

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3745

IL-700-H (R-12/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1