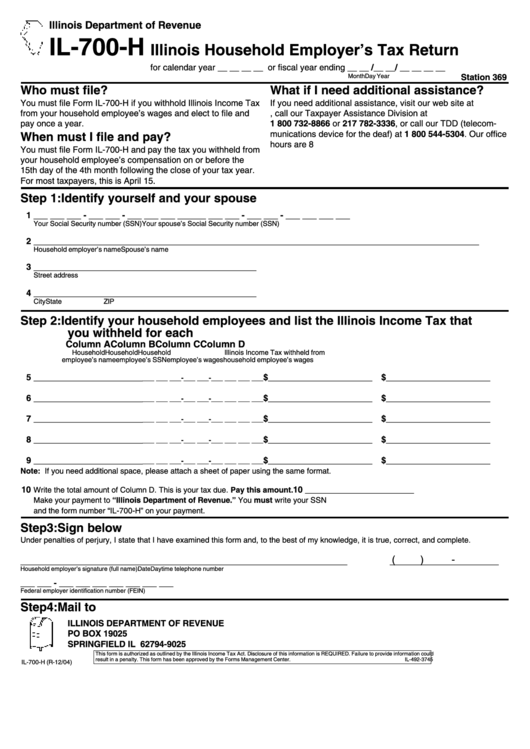

Form Il-700-H - Illinois Household Employer'S Tax Return

ADVERTISEMENT

Illinois Department of Revenue

IL-700-H

Illinois Household Employer’s Tax Return

for calendar year __ __ __ __ or fiscal year ending __ __ /__ __/ __ __ __ __

Month

Day

Year

Station 369

Who must file?

What if I need additional assistance?

You must file Form IL-700-H if you withhold Illinois Income Tax

If you need additional assistance, visit our web site at

from your household employee’s wages and elect to file and

, call our Taxpayer Assistance Division at

pay once a year.

1 800 732-8866 or 217 782-3336, or call our TDD (telecom-

munications device for the deaf) at 1 800 544-5304. Our office

When must I file and pay?

hours are 8 a.m. to 5 p.m.

You must file Form IL-700-H and pay the tax you withheld from

your household employee’s compensation on or before the

15th day of the 4th month following the close of your tax year.

For most taxpayers, this is April 15.

Step 1: Identify yourself and your spouse

1 ___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ ___ - ___ ___ - ___ ___ ___ ___

Your Social Security number (SSN)

Your spouse’s Social Security number (SSN)

2 _______________________________________________

_______________________________________________

Household employer’s name

Spouse’s name

3 _______________________________________________

Street address

4 _______________________________________________

City

State

ZIP

Step 2: Identify your household employees and list the Illinois Income Tax that

you withheld for each

Column A

Column B

Column C

Column D

Household

Household

Household

Illinois Income Tax withheld from

employee’s name

employee’s SSN

employee’s wages

household employee’s wages

5 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

6 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

7 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

8 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

9 _______________________

$______________________ $______________________

___ ___ ___-___ ___-___ ___ ___ ___

Note: If you need additional space, please attach a sheet of paper using the same format.

10

10 _______________________

Write the total amount of Column D. This is your tax due. Pay this amount.

Make your payment to “Illinois Department of Revenue.” You must write your SSN

and the form number “IL-700-H” on your payment.

Step 3: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

(

)

-

_____________________________________________________________________

_______________________

Household employer’s signature (full name)

Date

Daytime telephone number

___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identification number (FEIN)

Step 4: Mail to

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19025

SPRINGFIELD IL 62794-9025

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3745

IL-700-H (R-12/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1