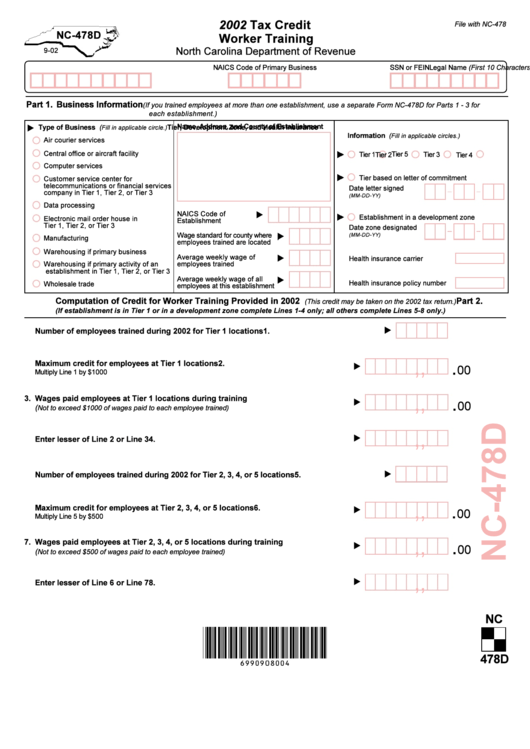

Form Nc 478d - Tax Credit Worker Training - 2002

ADVERTISEMENT

2002 Tax Credit

File with NC-478

NC-478D

Worker Training

North Carolina Department of Revenue

9-02

Legal Name (First 10 Characters)

NAICS Code of Primary Business

SSN or FEIN

Part 1.

Business Information

(If you trained employees at more than one establishment, use a separate Form NC-478D for Parts 1 - 3 for

each establishment.)

Name, Address, and County of Establishment

Type of Business (

Tier, Development Zone, and Health Insurance

Fill in applicable circle.)

Information (

Fill in applicable circles.)

Air courier services

Central office or aircraft facility

Tier 5

Tier 1

Tier 3

Tier 2

Tier 4

Computer services

Tier based on letter of commitment

Customer service center for

telecommunications or financial services

Date letter signed

company in Tier 1, Tier 2, or Tier 3

(MM-DD-YY)

Data processing

NAICS Code of

Establishment in a development zone

Electronic mail order house in

Establishment

Tier 1, Tier 2, or Tier 3

Date zone designated

Wage standard for county where

(MM-DD-YY)

Manufacturing

employees trained are located

Warehousing if primary business

Average weekly wage of

Health insurance carrier

Warehousing if primary activity of an

employees trained

establishment in Tier 1, Tier 2, or Tier 3

Average weekly wage of all

Health insurance policy number

Wholesale trade

employees at this establishment

Part 2.

Computation of Credit for Worker Training Provided in 2002

(This credit may be taken on the 2002 tax return.)

(If establishment is in Tier 1 or in a development zone complete Lines 1-4 only; all others complete Lines 5-8 only.)

,

1.

Number of employees trained during 2002 for Tier 1 locations

,

,

.

2.

Maximum credit for employees at Tier 1 locations

00

Multiply Line 1 by $1000

,

,

.

3.

Wages paid employees at Tier 1 locations during training

00

(

Not to exceed $1000 of wages paid to each employee trained)

,

,

.

4.

Enter lesser of Line 2 or Line 3

00

,

5.

Number of employees trained during 2002 for Tier 2, 3, 4, or 5 locations

,

,

.

6.

Maximum credit for employees at Tier 2, 3, 4, or 5 locations

00

Multiply Line 5 by $500

,

,

.

7.

Wages paid employees at Tier 2, 3, 4, or 5 locations during training

00

(

Not to exceed $500 of wages paid to each employee trained)

,

,

.

8.

Enter lesser of Line 6 or Line 7

00

NC

478D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2