Form Nc-478d - Tax Credit Worker Training - 2001

ADVERTISEMENT

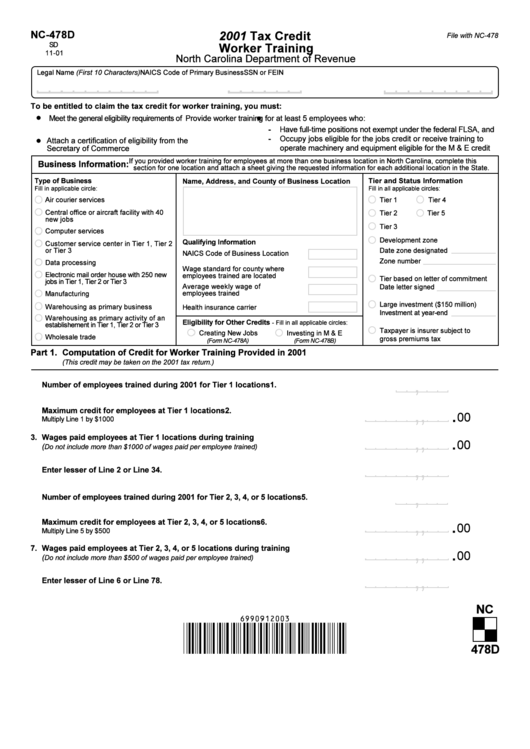

NC-478D

2001 Tax Credit

File with NC-478

Worker Training

North Carolina Department of Revenue

(First 10 Characters)

To be entitled to claim the tax credit for worker training, you must:

-

-

Business Information:

Type of Business

Tier and Status Information

Name, Address, and County of Business Location

Fill in applicable circle:

Fill in all applicable circles:

Qualifying Information

Eligibility for Other Credits

- Fill in all applicable circles:

(Form NC-478A)

(Form NC-478B)

Part 1.

Computation of Credit for Worker Training Provided in 2001

(This credit may be taken on the 2001 tax return.)

,

1.

Number of employees trained during 2001 for Tier 1 locations

,

,

.

2.

Maximum credit for employees at Tier 1 locations

00

,

,

.

3.

Wages paid employees at Tier 1 locations during training

00

(

Do not include more than $1000 of wages paid per employee trained)

,

,

.

4.

Enter lesser of Line 2 or Line 3

00

,

5.

Number of employees trained during 2001 for Tier 2, 3, 4, or 5 locations

,

,

.

6.

Maximum credit for employees at Tier 2, 3, 4, or 5 locations

00

,

,

.

7.

Wages paid employees at Tier 2, 3, 4, or 5 locations during training

00

(

Do not include more than $500 of wages paid per employee trained)

,

,

.

8.

Enter lesser of Line 6 or Line 7

00

NC

478D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2