Annual Return For Companies, Partnerships, Trusts Or Estates Of Deceased Persons - Inland Revenue Department

ADVERTISEMENT

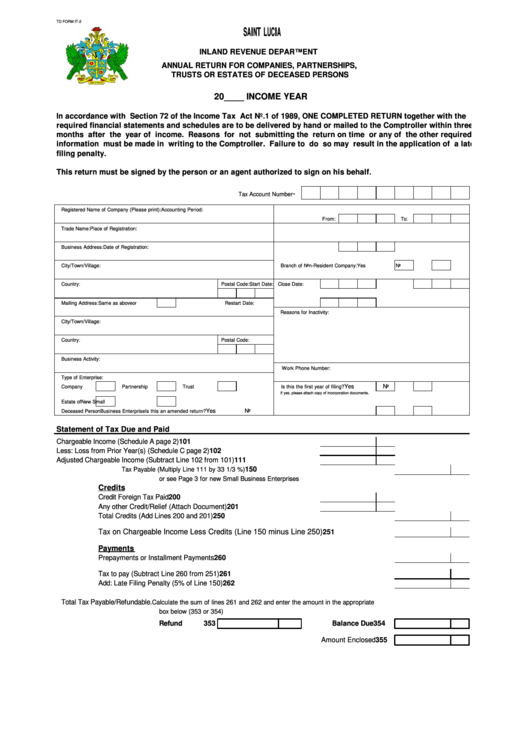

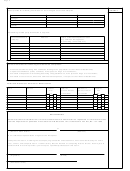

TD FORM IT-2

SAINT LUCIA

INLAND REVENUE DEPARTMENT

ANNUAL RETURN FOR COMPANIES, PARTNERSHIPS,

TRUSTS OR ESTATES OF DECEASED PERSONS

20____ INCOME YEAR

In accordance with Section 72 of the Income Tax Act No.1 of 1989, ONE COMPLETED RETURN together with the

required financial statements and schedules are to be delivered by hand or mailed to the Comptroller within three

months after the year of income. Reasons for not submitting the return on time or any of the other required

information must be made in writing to the Comptroller. Failure to do so may result in the application of a late

filing penalty.

This return must be signed by the person or an agent authorized to sign on his behalf.

-

Tax Account Number

Registered Name of Company (Please print):

Accounting Period:

From:

To:

Trade Name:

Place of Registration:

Business Address:

Date of Registration:

City/Town/Village:

Branch of Non-Resident Company:

Yes

No

Country:

Postal Code:

Start Date:

Close Date:

Mailing Address:

Same as above

or

Restart Date:

Reasons for Inactivity:

City/Town/Village:

Country:

Postal Code:

Business Activity:

Work Phone Number:

Type of Enterprise:

Yes

No

Company

Partnership

Trust

Is this the first year of filing?

If yes, please attach copy of incorporation documents.

Estate of

New Small

Yes

No

Deceased Person

Business Enterprise

Is this an amended return?

Statement of Tax Due and Paid

Chargeable Income (Schedule A page 2)

101

Less: Loss from Prior Year(s) (Schedule C page 2)

102

Adjusted Chargeable Income (Subtract Line 102 from 101)

111

150

Tax Payable (Multiply Line 111 by 33 1/3 %)

or see Page 3 for new Small Business Enterprises

Credits

Credit Foreign Tax Paid

200

Any other Credit/Relief (Attach Document)

201

Total Credits (Add Lines 200 and 201)

250

Tax on Chargeable Income Less Credits (Line 150 minus Line 250)

251

Payments

Prepayments or Installment Payments

260

Tax to pay (Subtract Line 260 from 251)

261

Add: Late Filing Penalty (5% of Line 150)

262

Total Tax Payable/Refundable.

Calculate the sum of lines 261 and 262 and enter the amount in the appropriate

box below (353 or 354)

Refund

353

Balance Due 354

Amount Enclosed 355

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4