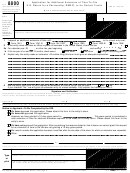

Annual Return For Companies, Partnerships, Trusts Or Estates Of Deceased Persons - Inland Revenue Department Page 2

ADVERTISEMENT

Page 2

SCHEDULE A

Reconciliation of Chargeable Income with Profit and Loss

1. Profit/Loss as per Profit and Loss Account

1.

OFFICIAL

2. Add/Deduct: Expenses not allowable

USE ONLY

a.

2a.

b.

2b.

c.

2c.

d.

2d.

?

Total

2e.

3. Deduct/Add: Allowable Deductions and Exempt

Income included in accounts

a.

3a.

b.

3b.

c.

3c.

d.

3d.

?

Total

3e.

4.

Deduct: (For Partnerships)

a. Salaries to Partners

4a.

b. Interest on Capital

4b.

?

Total

4c.

Chargeable Income (enter on Page 1 Line 101)

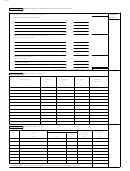

SCHEDULE B

Apportionment of Income

Name of Partners,

Share of

Salaries of

Interest on

Sum of

or Beneficiaries

Income

Partners

Capital

Columns

(2) to (4)

(1)

(2)

(3)

(4)

(5)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

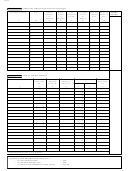

SCHEDULE C

Loss form Prior Year(s)

Year of

Amount of

Prior Set Offs

Balance of

Amount set off

Loss

Loss

Amount

Year of

Loss allowable

this Income

Income

for set off

Year

(1)

(2)

(3)

(4)

(5)

(6)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Total set off for this Income Year is 50% of Line 101 (enter here and page 1, line 102)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4