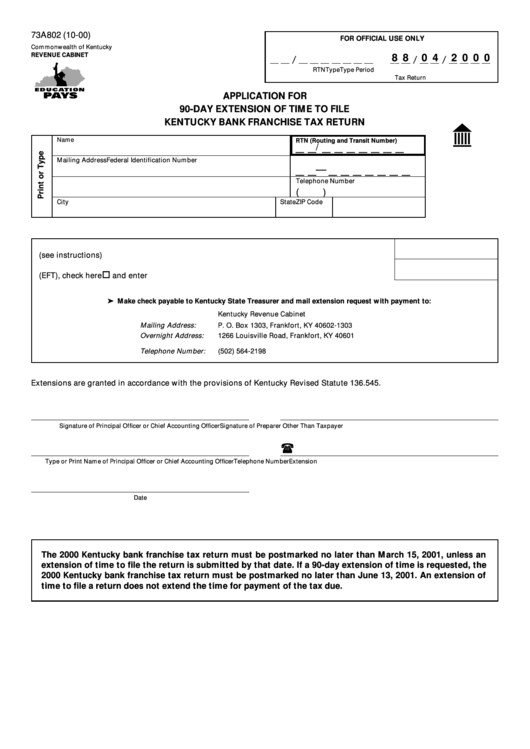

Form 73a802 - Application For 90-Day Extension Of Time To File Kentucky Bank Franchise Tax Return - 2000

ADVERTISEMENT

73A802 (10-00)

FOR OFFICIAL USE ONLY

Commonwealth of Kentucky

__ __ / __ __ __ __ __ __ __

__ __ / __ __ / __ __ __ __

REVENUE CABINET

8 8

0 4

2 0 0 0

RTN

Type

Type

Period

Tax

Return

APPLICATION FOR

90-DAY EXTENSION OF TIME TO FILE

KENTUCKY BANK FRANCHISE TAX RETURN

Name

RTN (Routing and Transit Number)

_ _

_ _ _ _ _ _ _

/

Mailing Address

Federal Identification Number

_ _

_ _ _ _ _ _ _

—

Telephone Number

(

)

City

State

ZIP Code

1. Tentative payment of bank franchise tax due (see instructions) .................................................

2. If remitting payment by electronic funds transfer (EFT), check here

and enter amount ......

Make check payable to Kentucky State Treasurer and mail extension request with payment to:

Kentucky Revenue Cabinet

Mailing Address:

P. O. Box 1303, Frankfort, KY 40602-1303

Overnight Address:

1266 Louisville Road, Frankfort, KY 40601

Telephone Number:

(502) 564-2198

Extensions are granted in accordance with the provisions of Kentucky Revised Statute 136.545.

Signature of Principal Officer or Chief Accounting Officer

Signature of Preparer Other Than Taxpayer

Type or Print Name of Principal Officer or Chief Accounting Officer

Telephone Number

Extension

Date

The 2000 Kentucky bank franchise tax return must be postmarked no later than March 15, 2001, unless an

extension of time to file the return is submitted by that date. If a 90-day extension of time is requested, the

2000 Kentucky bank franchise tax return must be postmarked no later than June 13, 2001. An extension of

time to file a return does not extend the time for payment of the tax due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1