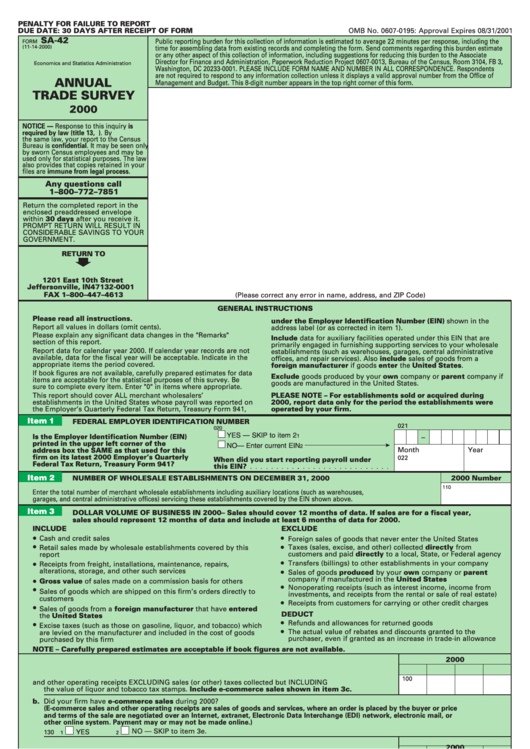

Form Sa-42 - Annual Trade Survey - 2000

ADVERTISEMENT

PENALTY FOR FAILURE TO REPORT

DUE DATE: 30 DAYS AFTER RECEIPT OF FORM

OMB No. 0607-0195: Approval Expires 08/31/2001

SA-42

Public reporting burden for this collection of information is estimated to average 22 minutes per response, including the

FORM

(11-14-2000)

time for assembling data from existing records and completing the form. Send comments regarding this burden estimate

or any other aspect of this collection of information, including suggestions for reducing this burden to the Associate

U.S. DEPARTMENT OF COMMERCE

Director for Finance and Administration, Paperwork Reduction Project 0607-0013, Bureau of the Census, Room 3104, FB 3,

Economics and Statistics Administration

Washington, DC 20233-0001. PLEASE INCLUDE FORM NAME AND NUMBER IN ALL CORRESPONDENCE. Respondents

U.S. CENSUS BUREAU

are not required to respond to any information collection unless it displays a valid approval number from the Office of

ANNUAL

Management and Budget. This 8-digit number appears in the top right corner of this form.

TRADE SURVEY

2000

NOTICE — Response to this inquiry is

required by law (title 13, U.S. Code). By

the same law, your report to the Census

Bureau is confidential. It may be seen only

by sworn Census employees and may be

used only for statistical purposes. The law

also provides that copies retained in your

files are immune from legal process.

Any questions call

1–800–772–7851

Return the completed report in the

enclosed preaddressed envelope

within 30 days after you receive it.

PROMPT RETURN WILL RESULT IN

CONSIDERABLE SAVINGS TO YOUR

GOVERNMENT.

RETURN TO

U.S. CENSUS BUREAU

1201 East 10th Street

Jeffersonville, IN 47132-0001

FAX 1–800–447–4613

(Please correct any error in name, address, and ZIP Code)

GENERAL INSTRUCTIONS

Please read all instructions.

under the Employer Identification Number (EIN) shown in the

Report all values in dollars (omit cents).

address label (or as corrected in item 1).

Please explain any significant data changes in the "Remarks"

Include data for auxiliary facilities operated under this EIN that are

section of this report.

primarily engaged in furnishing supporting services to your wholesale

Report data for calendar year 2000. If calendar year records are not

establishments (such as warehouses, garages, central administrative

available, data for the fiscal year will be acceptable. Indicate in the

offices, and repair services). Also include sales of goods from a

appropriate items the period covered.

foreign manufacturer if goods enter the United States.

If book figures are not available, carefully prepared estimates for data

Exclude goods produced by your own company or parent company if

items are acceptable for the statistical purposes of this survey. Be

goods are manufactured in the United States.

sure to complete every item. Enter "0" in items where appropriate.

This report should cover ALL merchant wholesalers’

PLEASE NOTE – For establishments sold or acquired during

establishments in the United States whose payroll was reported on

2000, report data only for the period the establishments were

the Employer’s Quarterly Federal Tax Return, Treasury Form 941,

operated by your firm.

Item 1

FEDERAL EMPLOYER IDENTIFICATION NUMBER

021

020

YES — SKIP to item 2

Is the Employer Identification Number (EIN)

1

–

printed in the upper left corner of the

NO— Enter current EIN

2

Month

Year

address box the SAME as that used for this

firm on its latest 2000 Employer’s Quarterly

022

When did you start reporting payroll under

Federal Tax Return, Treasury Form 941?

this EIN?

Item 2

NUMBER OF WHOLESALE ESTABLISHMENTS ON DECEMBER 31, 2000

2000 Number

110

Enter the total number of merchant wholesale establishments including auxiliary locations (such as warehouses,

garages, and central administrative offices) servicing these establishments covered by the EIN shown above.

Item 3

DOLLAR VOLUME OF BUSINESS IN 2000 – Sales should cover 12 months of data. If sales are for a fiscal year,

sales should represent 12 months of data and include at least 6 months of data for 2000.

INCLUDE

EXCLUDE

•

•

Cash and credit sales

Foreign sales of goods that never enter the United States

•

•

Taxes (sales, excise, and other) collected directly from

Retail sales made by wholesale establishments covered by this

customers and paid directly to a local, State, or Federal agency

report

•

•

Transfers (billings) to other establishments in your company

Receipts from freight, installations, maintenance, repairs,

•

alterations, storage, and other such services

Sales of goods produced by your own company or parent

•

company if manufactured in the United States

Gross value of sales made on a commission basis for others

•

•

Nonoperating receipts (such as interest income, income from

Sales of goods which are shipped on this firm’s orders directly to

investments, and receipts from the rental or sale of real estate)

customers

•

Receipts from customers for carrying or other credit charges

•

Sales of goods from a foreign manufacturer that have entered

DEDUCT

the United States

•

•

Refunds and allowances for returned goods

Excise taxes (such as those on gasoline, liquor, and tobacco) which

•

The actual value of rebates and discounts granted to the

are levied on the manufacturer and included in the cost of goods

purchaser, even if granted as an increase in trade-in allowance

purchased by this firm

NOTE – Carefully prepared estimates are acceptable if book figures are not available.

2000

Bil.

Mil.

Thou.

Dol.

100

a. Sales and other operating receipts EXCLUDING sales (or other) taxes collected but INCLUDING

the value of liquor and tobacco tax stamps. Include e-commerce sales shown in item 3c.

b.

Did your firm have e-commerce sales during 2000?

(E-commerce sales and other operating receipts are sales of goods and services, where an order is placed by the buyer or price

and terms of the sale are negotiated over an Internet, extranet, Electronic Data Interchange (EDI) network, electronic mail, or

other online system. Payment may or may not be made online.)

NO — SKIP to item 3e.

YES

130

1

2

2000

Bil.

Mil.

Thou.

Dol.

c. E-commerce sales and other operating receipts by your firm for 2000 (Include e-commerce

113

sales in item 3a. Exclude sales taxes. Include EDI sales shown in item 3d. If a book figure is

not available, a carefully prepared estimate of e-commerce sales is acceptable)

Bil.

Mil.

Thou.

Dol.

114

d. Sales and other operating receipts over an EDI network (Include this amount in item 3c. If a book

figure is not available, a carefully prepared estimate of EDI sales is acceptable.)

104

Month

Day

Year

From

e. If the sales reported on line 3a are for a period other than January 1 through December 31,

105

please enter the beginning and ending dates.

To

CONTINUE ON REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2