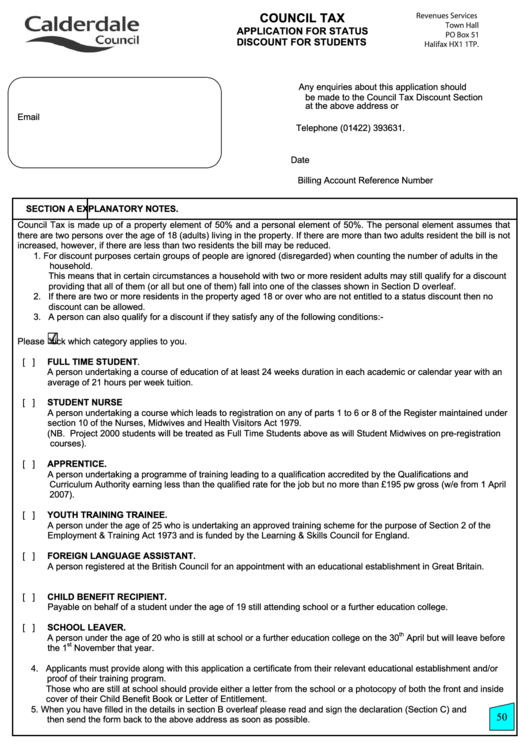

Council Tax - Application For Status Discount For Students

ADVERTISEMENT

COUNCIL TAX

Revenues Services

Town Hall

APPLICATION FOR STATUS

PO Box 51

DISCOUNT FOR STUDENTS

Halifax HX1 1TP.

Any enquiries about this application should

be made to the Council Tax Discount Section

at the above address or

Email central.services@calderdale.gov.uk

.

Telephone (01422) 393631

Date

Billing Account Reference Number

SECTION A

EXPLANATORY NOTES.

Council Tax is made up of a property element of 50% and a personal element of 50%. The personal element assumes that

there are two persons over the age of 18 (adults) living in the property. If there are more than two adults resident the bill is not

increased, however, if there are less than two residents the bill may be reduced.

1. For discount purposes certain groups of people are ignored (disregarded) when counting the number of adults in the

household.

This means that in certain circumstances a household with two or more resident adults may still qualify for a discount

providing that all of them (or all but one of them) fall into one of the classes shown in Section D overleaf.

2. If there are two or more residents in the property aged 18 or over who are not entitled to a status discount then no

discount can be allowed.

3. A person can also qualify for a discount if they satisfy any of the following conditions:-

Please

tick which category applies to you.

[ ]

FULL TIME STUDENT

.

A person undertaking a course of education of at least 24 weeks duration in each academic or calendar year with an

average of 21 hours per week tuition.

[ ]

STUDENT NURSE

A person undertaking a course which leads to registration on any of parts 1 to 6 or 8 of the Register maintained under

section 10 of the Nurses, Midwives and Health Visitors Act 1979.

(NB. Project 2000 students will be treated as Full Time Students above as will Student Midwives on pre-registration

courses).

[ ]

APPRENTICE.

A person undertaking a programme of training leading to a qualification accredited by the Qualifications and

Curriculum Authority earning less than the qualified rate for the job but no more than £195 pw gross (w/e from 1 April

2007).

[ ]

YOUTH TRAINING TRAINEE.

A person under the age of 25 who is undertaking an approved training scheme for the purpose of Section 2 of the

Employment & Training Act 1973 and is funded by the Learning & Skills Council for England.

[ ]

FOREIGN LANGUAGE ASSISTANT.

A person registered at the British Council for an appointment with an educational establishment in Great Britain.

[ ]

CHILD BENEFIT RECIPIENT.

Payable on behalf of a student under the age of 19 still attending school or a further education college.

SCHOOL LEAVER.

[ ]

th

A person under the age of 20 who is still at school or a further education college on the 30

April but will leave before

st

the 1

November that year.

4. Applicants must provide along with this application a certificate from their relevant educational establishment and/or

proof of their training program.

Those who are still at school should provide either a letter from the school or a photocopy of both the front and inside

cover of their Child Benefit Book or Letter of Entitlement.

5. When you have filled in the details in section B overleaf please read and sign the declaration (Section C) and

50

then send the form back to the above address as soon as possible.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2