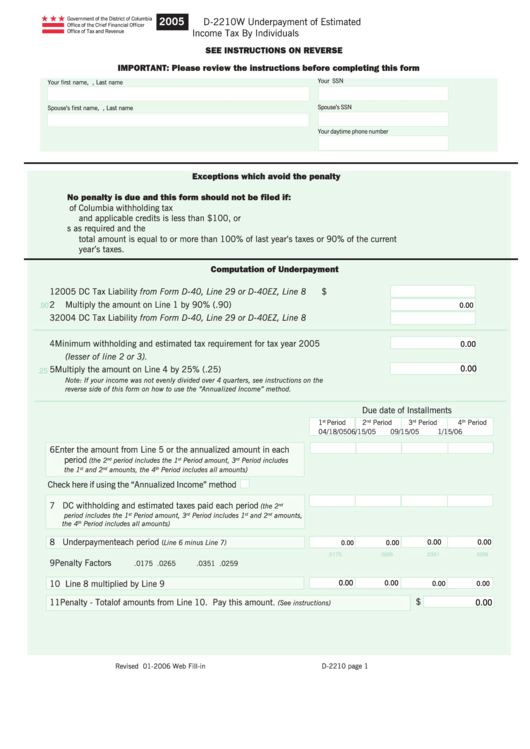

Government of the District of Columbia

D-2210W Underpayment of Estimated

2005

Office of the Chief Financial Officer

Income Tax By Individuals

Office of Tax and Revenue

SEE INSTRUCTIONS ON REVERSE

IMPORTANT: Please review the instructions before completing this form

Your SSN

Your first name, M.I., Last name

Spouse’s SSN

Spouse’s first name, M.I., Last name

Your daytime phone number

Exceptions which avoid the penalty

No penalty is due and this form should not be filed if:

A. Your tax liability on taxable income after deducting District of Columbia withholding tax

and applicable credits is less than $100, or

B. You have made quarterly estimated tax and withholding payments as required and the

total amount is equal to or more than 100% of last year’s taxes or 90% of the current

year’s taxes.

Computation of Underpayment

1

2005 DC Tax Liability from Form D-40, Line 29 or D-40EZ, Line 8

$

2

Multiply the amount on Line 1 by 90% (.90)

.90

0.00

3

2004 DC Tax Liability from Form D-40, Line 29 or D-40EZ, Line 8

4

Minimum withholding and estimated tax requirement for tax year 2005

0.00

(lesser of line 2 or 3)

.

5

Multiply the amount on Line 4 by 25% (.25)

0.00

.25

Note: If your income was not evenly divided over 4 quarters, see instructions on the

reverse side of this form on how to use the “Annualized Income” method.

Due date of Installments

1

st

Period

2

nd

Period

3

rd

Period

4

th

Period

04/18/05

06/15/05

09/15/05

1/15/06

6 Enter the amount from Line 5 or the annualized amount in each

period

(the 2

nd

period includes the 1

st

Period amount, 3

rd

Period includes

the 1

st

and 2

nd

amounts, the 4

th

Period includes all amounts)

Check here if using the “Annualized Income” method

7 DC withholding and estimated taxes paid each period

nd

(the 2

period includes the 1

st

Period amount, 3

rd

Period includes 1

st

and 2

nd

amounts,

the 4

th

Period includes all amounts)

8 Underpayment each period

(Line 6 minus Line 7)

0.00

0.00

0.00

0.00

.0175

.0265

.0351

.0259

9

Penalty Factors

.0175

.0265

.0351

.0259

10 Line 8 multiplied by Line 9

0.00

0.00

0.00

0.00

$

11 Penalty - Total of amounts from Line 10. Pay this amount.

0.00

(See instructions)

Revised 01-2006 Web Fill-in

D-2210 page 1

1

1