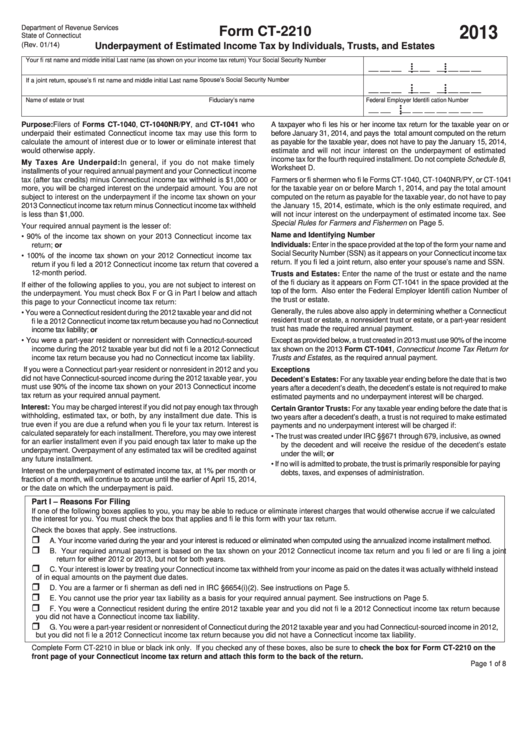

Department of Revenue Services

2013

Form CT-2210

State of Connecticut

(Rev. 01/14)

Underpayment of Estimated Income Tax by Individuals, Trusts, and Estates

Your fi rst name and middle initial

Last name (as shown on your income tax return)

Your Social Security Number

__ __ __ __ __ __ __ __ __

• •

• •

• •

• •

Spouse’s Social Security Number

If a joint return, spouse’s fi rst name and middle initial

Last name

__ __ __ __ __ __ __ __ __

• •

• •

• •

• •

Name of estate or trust

Fiduciary’s name

Federal Employer Identifi cation Number

__ __ __ __ __ __ __ __ __

• •

• •

Purpose: Filers of Forms CT-1040, CT-1040NR/PY, and CT-1041 who

A taxpayer who fi les his or her income tax return for the taxable year on or

underpaid their estimated Connecticut income tax may use this form to

before January 31, 2014, and pays the total amount computed on the return

calculate the amount of interest due or to lower or eliminate interest that

as payable for the taxable year, does not have to pay the January 15, 2014,

would otherwise apply.

estimate and will not incur interest on the underpayment of estimated

income tax for the fourth required installment. Do not complete Schedule B,

My Taxes Are Underpaid: In general, if you do not make timely

Worksheet D.

installments of your required annual payment and your Connecticut income

tax (after tax credits) minus Connecticut income tax withheld is $1,000 or

Farmers or fi shermen who fi le Forms CT-1040, CT-1040NR/PY, or CT-1041

more, you will be charged interest on the underpaid amount. You are not

for the taxable year on or before March 1, 2014, and pay the total amount

subject to interest on the underpayment if the income tax shown on your

computed on the return as payable for the taxable year, do not have to pay

2013 Connecticut income tax return minus Connecticut income tax withheld

the January 15, 2014, estimate, which is the only estimate required, and

is less than $1,000.

will not incur interest on the underpayment of estimated income tax. See

Special Rules for Farmers and Fishermen on Page 5.

Your required annual payment is the lesser of:

Name and Identifying Number

• 90% of the income tax shown on your 2013 Connecticut income tax

Individuals: Enter in the space provided at the top of the form your name and

return; or

Social Security Number (SSN) as it appears on your Connecticut income tax

• 100% of the income tax shown on your 2012 Connecticut income tax

return. If you fi led a joint return, also enter your spouse’s name and SSN.

return if you fi led a 2012 Connecticut income tax return that covered a

12-month period.

Trusts and Estates: Enter the name of the trust or estate and the name

of the fi duciary as it appears on Form CT-1041 in the space provided at the

If either of the following applies to you, you are not subject to interest on

top of the form. Also enter the Federal Employer Identifi cation Number of

the underpayment. You must check Box F or G in Part I below and attach

the trust or estate.

this page to your Connecticut income tax return:

Generally, the rules above also apply in determining whether a Connecticut

• You were a Connecticut resident during the 2012 taxable year and did not

resident trust or estate, a nonresident trust or estate, or a part-year resident

fi le a 2012 Connecticut income tax return because you had no Connecticut

trust has made the required annual payment.

income tax liability; or

• You were a part-year resident or nonresident with Connecticut-sourced

Except as provided below, a trust created in 2013 must use 90% of the income

income during the 2012 taxable year but did not fi le a 2012 Connecticut

tax shown on the 2013 Form CT-1041, Connecticut Income Tax Return for

income tax return because you had no Connecticut income tax liability.

Trusts and Estates, as the required annual payment.

If you were a Connecticut part-year resident or nonresident in 2012 and you

Exceptions

did not have Connecticut-sourced income during the 2012 taxable year, you

Decedent’s Estates: For any taxable year ending before the date that is two

must use 90% of the income tax shown on your 2013 Connecticut income

years after a decedent’s death, the decedent’s estate is not required to make

tax return as your required annual payment.

estimated payments and no underpayment interest will be charged.

Interest: You may be charged interest if you did not pay enough tax through

Certain Grantor Trusts: For any taxable year ending before the date that is

withholding, estimated tax, or both, by any installment due date. This is

two years after a decedent’s death, a trust is not required to make estimated

true even if you are due a refund when you fi le your tax return. Interest is

payments and no underpayment interest will be charged if:

calculated separately for each installment. Therefore, you may owe interest

• The trust was created under IRC §§671 through 679, inclusive, as owned

for an earlier installment even if you paid enough tax later to make up the

by the decedent and will receive the residue of the decedent’s estate

underpayment. Overpayment of any estimated tax will be credited against

under the will; or

any future installment.

• If no will is admitted to probate, the trust is primarily responsible for paying

Interest on the underpayment of estimated income tax, at 1% per month or

debts, taxes, and expenses of administration.

fraction of a month, will continue to accrue until the earlier of April 15, 2014,

or the date on which the underpayment is paid.

Part I – Reasons For Filing

If one of the following boxes applies to you, you may be able to reduce or eliminate interest charges that would otherwise accrue if we calculated

the interest for you. You must check the box that applies and fi le this form with your tax return.

Check the boxes that apply. See instructions.

A. Your income varied during the year and your interest is reduced or eliminated when computed using the annualized income installment method.

B. Your required annual payment is based on the tax shown on your 2012 Connecticut income tax return and you fi led or are fi ling a joint

return for either 2012 or 2013, but not for both years.

C. Your interest is lower by treating your Connecticut income tax withheld from your income as paid on the dates it was actually withheld instead

of in equal amounts on the payment due dates.

D. You are a farmer or fi sherman as defi ned in IRC §6654(i)(2). See instructions on Page 5.

E. You cannot use the prior year tax liability as a basis for your required annual payment. See instructions on Page 5.

F. You were a Connecticut resident during the entire 2012 taxable year and you did not fi le a 2012 Connecticut income tax return because

you did not have a Connecticut income tax liability.

G. You were a part-year resident or nonresident of Connecticut during the 2012 taxable year and you had Connecticut-sourced income in 2012,

but you did not fi le a 2012 Connecticut income tax return because you did not have a Connecticut income tax liability.

Complete Form CT-2210 in blue or black ink only. If you checked any of these boxes, also be sure to check the box for Form CT-2210 on the

front page of your Connecticut income tax return and attach this form to the back of the return.

Page 1 of 8

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8