Form Ct-2210 - Underpayment Of Estimated Income Tax By Individuals, Trusts, And Estates - 2015

ADVERTISEMENT

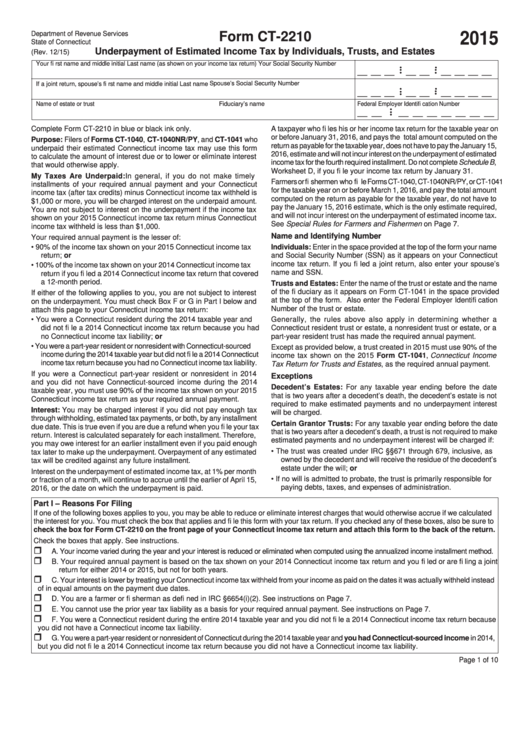

Department of Revenue Services

Form CT-2210

2015

State of Connecticut

Underpayment of Estimated Income Tax by Individuals, Trusts, and Estates

(Rev. 12/15)

Your fi rst name and middle initial

Last name (as shown on your income tax return)

Your Social Security Number

__ __ __ __ __ __ __ __ __

• •

• •

•

•

Spouse’s Social Security Number

If a joint return, spouse’s fi rst name and middle initial

Last name

__ __ __ __ __ __ __ __ __

• •

• •

•

•

Name of estate or trust

Fiduciary’s name

Federal Employer Identifi cation Number

__ __

__ __ __ __ __ __ __

• •

•

Complete Form CT-2210 in blue or black ink only.

A taxpayer who fi les his or her income tax return for the taxable year on

or before January 31, 2016, and pays the total amount computed on the

Purpose: Filers of Forms CT-1040, CT-1040NR/PY, and CT-1041 who

return as payable for the taxable year, does not have to pay the January 15,

underpaid their estimated Connecticut income tax may use this form

2016, estimate and will not incur interest on the underpayment of estimated

to calculate the amount of interest due or to lower or eliminate interest

income tax for the fourth required installment. Do not complete Schedule B,

that would otherwise apply.

Worksheet D, if you fi le your income tax return by January 31.

My Taxes Are Underpaid: In general, if you do not make timely

Farmers or fi shermen who fi le Forms CT-1040, CT-1040NR/PY, or CT-1041

installments of your required annual payment and your Connecticut

for the taxable year on or before March 1, 2016, and pay the total amount

income tax (after tax credits) minus Connecticut income tax withheld is

computed on the return as payable for the taxable year, do not have to

$1,000 or more, you will be charged interest on the underpaid amount.

pay the January 15, 2016 estimate, which is the only estimate required,

You are not subject to interest on the underpayment if the income tax

and will not incur interest on the underpayment of estimated income tax.

shown on your 2015 Connecticut income tax return minus Connecticut

See Special Rules for Farmers and Fishermen on Page 7.

income tax withheld is less than $1,000.

Name and Identifying Number

Your required annual payment is the lesser of:

• 90% of the income tax shown on your 2015 Connecticut income tax

Individuals: Enter in the space provided at the top of the form your name

return; or

and Social Security Number (SSN) as it appears on your Connecticut

income tax return. If you fi led a joint return, also enter your spouse’s

• 100% of the income tax shown on your 2014 Connecticut income tax

name and SSN.

return if you fi led a 2014 Connecticut income tax return that covered

a 12-month period.

Trusts and Estates: Enter the name of the trust or estate and the name

of the fi duciary as it appears on Form CT-1041 in the space provided

If either of the following applies to you, you are not subject to interest

at the top of the form. Also enter the Federal Employer Identifi cation

on the underpayment. You must check Box F or G in Part I below and

Number of the trust or estate.

attach this page to your Connecticut income tax return:

• You were a Connecticut resident during the 2014 taxable year and

Generally, the rules above also apply in determining whether a

did not fi le a 2014 Connecticut income tax return because you had

Connecticut resident trust or estate, a nonresident trust or estate, or a

no Connecticut income tax liability; or

part-year resident trust has made the required annual payment.

• You were a part-year resident or nonresident with Connecticut-sourced

Except as provided below, a trust created in 2015 must use 90% of the

income during the 2014 taxable year but did not fi le a 2014 Connecticut

income tax shown on the 2015 Form CT-1041, Connecticut Income

income tax return because you had no Connecticut income tax liability.

Tax Return for Trusts and Estates, as the required annual payment.

If you were a Connecticut part-year resident or nonresident in 2014

Exceptions

and you did not have Connecticut-sourced income during the 2014

Decedent’s Estates: For any taxable year ending before the date

taxable year, you must use 90% of the income tax shown on your 2015

that is two years after a decedent’s death, the decedent’s estate is not

Connecticut income tax return as your required annual payment.

required to make estimated payments and no underpayment interest

Interest: You may be charged interest if you did not pay enough tax

will be charged.

through withholding, estimated tax payments, or both, by any installment

Certain Grantor Trusts: For any taxable year ending before the date

due date. This is true even if you are due a refund when you fi le your tax

that is two years after a decedent’s death, a trust is not required to make

return. Interest is calculated separately for each installment. Therefore,

estimated payments and no underpayment interest will be charged if:

you may owe interest for an earlier installment even if you paid enough

• The trust was created under IRC §§671 through 679, inclusive, as

tax later to make up the underpayment. Overpayment of any estimated

owned by the decedent and will receive the residue of the decedent’s

tax will be credited against any future installment.

estate under the will; or

Interest on the underpayment of estimated income tax, at 1% per month

• If no will is admitted to probate, the trust is primarily responsible for

or fraction of a month, will continue to accrue until the earlier of April 15,

paying debts, taxes, and expenses of administration.

2016, or the date on which the underpayment is paid.

Part I – Reasons For Filing

If one of the following boxes applies to you, you may be able to reduce or eliminate interest charges that would otherwise accrue if we calculated

the interest for you. You must check the box that applies and fi le this form with your tax return. If you checked any of these boxes, also be sure to

check the box for Form CT-2210 on the front page of your Connecticut income tax return and attach this form to the back of the return.

Check the boxes that apply. See instructions.

A. Your income varied during the year and your interest is reduced or eliminated when computed using the annualized income installment method.

B. Your required annual payment is based on the tax shown on your 2014 Connecticut income tax return and you fi led or are fi ling a joint

return for either 2014 or 2015, but not for both years.

C. Your interest is lower by treating your Connecticut income tax withheld from your income as paid on the dates it was actually withheld instead

of in equal amounts on the payment due dates.

D. You are a farmer or fi sherman as defi ned in IRC §6654(i)(2). See instructions on Page 7.

E. You cannot use the prior year tax liability as a basis for your required annual payment. See instructions on Page 7.

F. You were a Connecticut resident during the entire 2014 taxable year and you did not fi le a 2014 Connecticut income tax return because

you did not have a Connecticut income tax liability.

G. You were a part-year resident or nonresident of Connecticut during the 2014 taxable year and you had Connecticut-sourced income in 2014,

but you did not fi le a 2014 Connecticut income tax return because you did not have a Connecticut income tax liability.

Page 1 of 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10