ITW

3000401

000

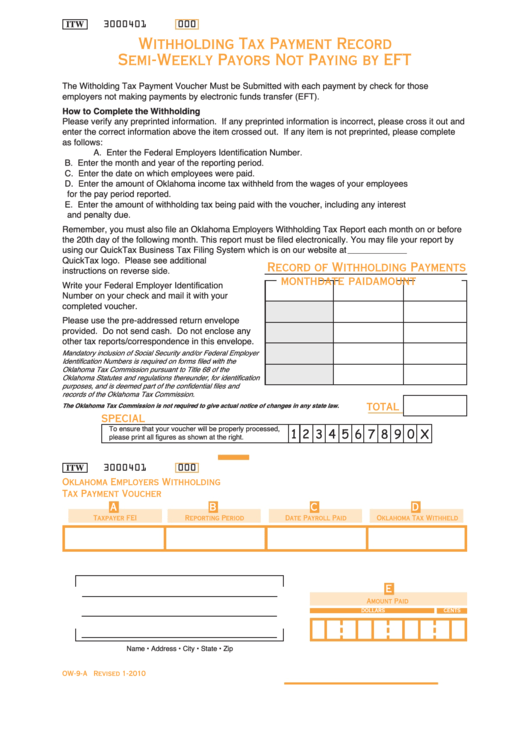

Withholding Tax Payment Record

Semi-Weekly Payors Not Paying by EFT

Instructions...

The Witholding Tax Payment Voucher Must be Submitted with each payment by check for those

employers not making payments by electronic funds transfer (EFT).

How to Complete the Withholding Voucher...

Please verify any preprinted information. If any preprinted information is incorrect, please cross it out and

enter the correct information above the item crossed out. If any item is not preprinted, please complete

as follows:

A. Enter the Federal Employers Identification Number.

B. Enter the month and year of the reporting period.

C. Enter the date on which employees were paid.

D. Enter the amount of Oklahoma income tax withheld from the wages of your employees

for the pay period reported.

E. Enter the amount of withholding tax being paid with the voucher, including any interest

and penalty due.

Remember, you must also file an Oklahoma Employers Withholding Tax Report each month on or before

the 20th day of the following month. This report must be filed electronically. You may file your report by

using our QuickTax Business Tax Filing System which is on our website at Click on the

QuickTax logo. Please see additional

Record of Withholding Payments

instructions on reverse side.

month

date paid

amount

Write your Federal Employer Identification

Number on your check and mail it with your

completed voucher.

Please use the pre-addressed return envelope

provided. Do not send cash. Do not enclose any

other tax reports/correspondence in this envelope.

Mandatory inclusion of Social Security and/or Federal Employer

Identification Numbers is required on forms filed with the

Oklahoma Tax Commission pursuant to Title 68 of the

Oklahoma Statutes and regulations thereunder, for identification

purposes, and is deemed part of the confidential files and

records of the Oklahoma Tax Commission.

total

The Oklahoma Tax Commission is not required to give actual notice of changes in any state law.

special note...

To ensure that your voucher will be properly processed,

1 2 3 4 5 6 7 8 9 0 X

please print all figures as shown at the right.

ITW

3000401

000

Oklahoma Employers Withholding

Tax Payment Voucher

A

B

C

D

Taxpayer FEI

Reporting Period

Date Payroll Paid

Oklahoma Tax Withheld

E

Amount Paid

dollars

cents

Name • Address • City • State • Zip

OW-9-A Revised 1-2010

1

1