A Claim Form For Backdated Housing And Council Tax Reduction

ADVERTISEMENT

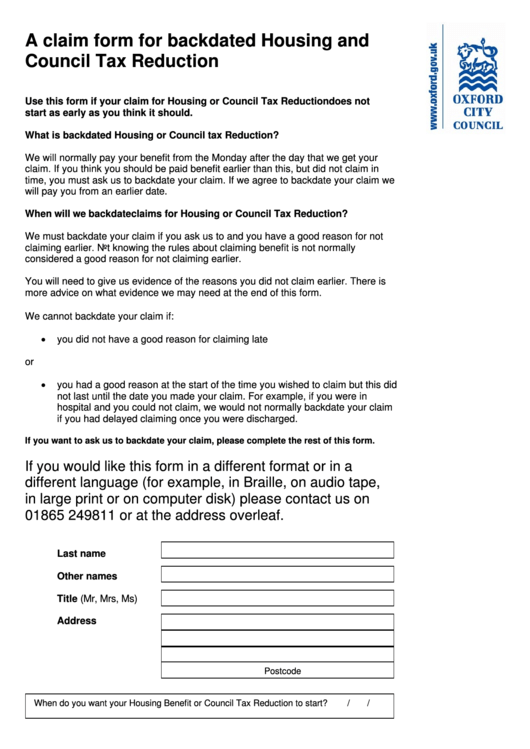

A claim form for backdated Housing and

Council Tax Reduction

Use this form if your claim for Housing or Council Tax Reduction does not

start as early as you think it should.

What is backdated Housing or Council tax Reduction?

We will normally pay your benefit from the Monday after the day that we get your

claim. If you think you should be paid benefit earlier than this, but did not claim in

time, you must ask us to backdate your claim. If we agree to backdate your claim we

will pay you from an earlier date.

When will we backdate claims for Housing or Council Tax Reduction?

We must backdate your claim if you ask us to and you have a good reason for not

claiming earlier. Not knowing the rules about claiming benefit is not normally

considered a good reason for not claiming earlier.

You will need to give us evidence of the reasons you did not claim earlier. There is

more advice on what evidence we may need at the end of this form.

We cannot backdate your claim if:

•

you did not have a good reason for claiming late

or

•

you had a good reason at the start of the time you wished to claim but this did

not last until the date you made your claim. For example, if you were in

hospital and you could not claim, we would not normally backdate your claim

if you had delayed claiming once you were discharged.

If you want to ask us to backdate your claim, please complete the rest of this form.

If you would like this form in a different format or in a

different language (for example, in Braille, on audio tape,

in large print or on computer disk) please contact us on

01865 249811 or at the address overleaf.

Last name

Other names

Title (Mr, Mrs, Ms)

Address

Postcode

When do you want your Housing Benefit or Council Tax Reduction to start?

/

/

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2